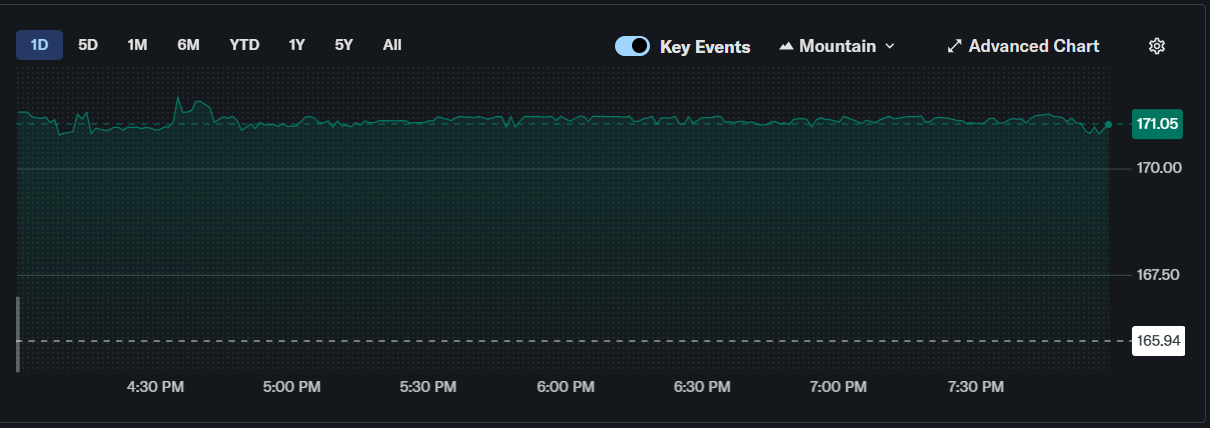

COIN Stock Price has seen a surge on Sunday, climbing 3.26% to close near $171.35. The gain of $5.41 offered brief relief after weeks of turbulence. Despite the uptick, shares remain far below their prior highs above $440. The stock continues to mirror sharp swings across the cryptocurrency market.

Coinbase remains one of the largest digital asset exchanges in the United States. Its performance is closely tied to Bitcoin and Ethereum price movements. Recently, Bitcoin price slipped below $70,000, pressuring crypto-linked equities. Ethereum price also traded under $2,000, adding to cautious sentiment. The broader crypto market declined 1.77% in 24 hours, standing near $2.3 trillion.

COIN Stock Price Outlook: Analysts See Significant Upside

Wall Street sentiment remains broadly constructive despite recent volatility. Twenty-seven analysts covering Coinbase currently hold a consensus Buy rating. The average 12-month price target stands at $314.94. That projection implies roughly 83% upside from current levels.

Targets vary widely, reflecting uncertainty around crypto cycles. The lowest published estimate sits near $148, while the highest reaches $510. Several analysts argue that Coinbase is positioned for strong operating leverage. They believe renewed crypto momentum could rapidly lift trading volumes.

The COIN stock price often reacts sharply to earnings and market sentiment shifts. Even after missing expectations in the fourth quarter of 2025, shares staged a short rally. Some investors viewed the post-earnings dip as an opportunity. Optimistic forecasts hinge on improving digital asset prices and stable regulations.

Institutional Confidence Supports COIN Stock Price

Institutional investors have also signaled renewed interest in Coinbase shares. Cathie Wood’s ARK Invest recently purchased 41,453 Coinbase shares. The move reversed a brief period of selling from the fund. It came as digital asset markets showed signs of stabilization.

ARK’s renewed buying highlights confidence in Coinbase’s long-term strategy. The company has expanded beyond simple trading commissions. Subscription services and blockchain infrastructure products now contribute to revenue. Diversification may reduce reliance on pure transaction activity.

🚨JUST IN: CATHIE WOOD’S ARK INVEST BUYS $6.9M IN COINBASE SHARES

Ark Invest has purchased $6.9 million worth of Coinbase shares, marking a sharp reversal from recent sales as the crypto exchange’s stock rebounds from multi-month lows.

The move represents a notable shift in… pic.twitter.com/AUqTUNmi29

— BSCN (@BSCNews) February 18, 2026

Higher trading volumes have also supported recent quarterly performance. Management continues to emphasize cost discipline and operational efficiency. If the future Bitcoin outlook rebounds, Coinbase could see amplified revenue growth. That dynamic historically fueled rapid gains in the COIN stock price.

Risks Remain if Crypto Weakness Persists

Despite positive signals, downside risks remain significant. Coinbase stock maintains strong correlation with crypto market performance. Prolonged declines in Bitcoin and Ethereum would likely pressure earnings. Regulatory scrutiny also remains an ongoing concern for the sector.

Recent quarterly results missed analyst expectations, adding short-term volatility. Some bearish analysts have trimmed price targets accordingly. If digital assets fall further, shares could retest lower support levels

The path forward for the COIN stock price depends largely on crypto sentiment. A sustained recovery could drive shares toward $250 or higher. Continued weakness, however, may limit rallies and renew selling pressure.

Source: https://coingape.com/markets/coin-stock-price-prediction-will-coinbase-crash-or-rally-in-feb-2026/