- Avalanche price today trades at $34.69, climbing after defending the $32 support zone.

- On-chain data shows $3.26M in net inflows as futures open interest steadily rises.

- Institutional backing, including AVAX One’s $550M treasury, fuels long-term optimism.

Avalanche price today is trading around $34.69, climbing more than 2% in the last 24 hours as buyers defended the $32 zone and pushed price toward the upper boundary of its rising channel. The next major resistance sits near $37, a level that coincides with the 0.5 Fibonacci retracement and could decide whether AVAX extends toward $50 in the coming weeks.

Avalanche Price Tests Mid-Fibonacci Resistance

The daily chart shows Avalanche steadily advancing within a rising channel, supported by the 20-day EMA at $30.43. Price has cleared the 50-day and 100-day EMAs, with the 200-day EMA at $24.66 now firmly below spot levels. This alignment reinforces a strong medium-term uptrend.

Immediate resistance stands at $37, the 0.5 Fibonacci retracement from the prior cycle high. A decisive breakout above this zone could expose higher targets at $40 and $47.15, while support rests at $32 and $30. A breakdown of the channel would risk a retracement toward $27.

Momentum indicators highlight ongoing strength. The RSI remains elevated but has not entered overbought territory, while On-Balance Volume shows a steady climb, reflecting consistent accumulation behind the rally.

Institutional Bets Add Fuel To Avalanche Rally

Avalanche’s fundamental narrative received a major boost after Anthony Scaramucci, founder of SkyBridge Capital, was announced as strategic advisor for AVAX One, a $550 million Avalanche-focused digital asset treasury. This follows his earlier $300 million tokenized hedge fund announcement, underlining growing institutional interest in AVAX.

Market analysts note that the creation of AVAX One could enhance liquidity and reinforce Avalanche’s role in the tokenization sector. The news has sparked renewed optimism among investors, with institutions signaling confidence in Avalanche’s ecosystem resilience and adoption potential.

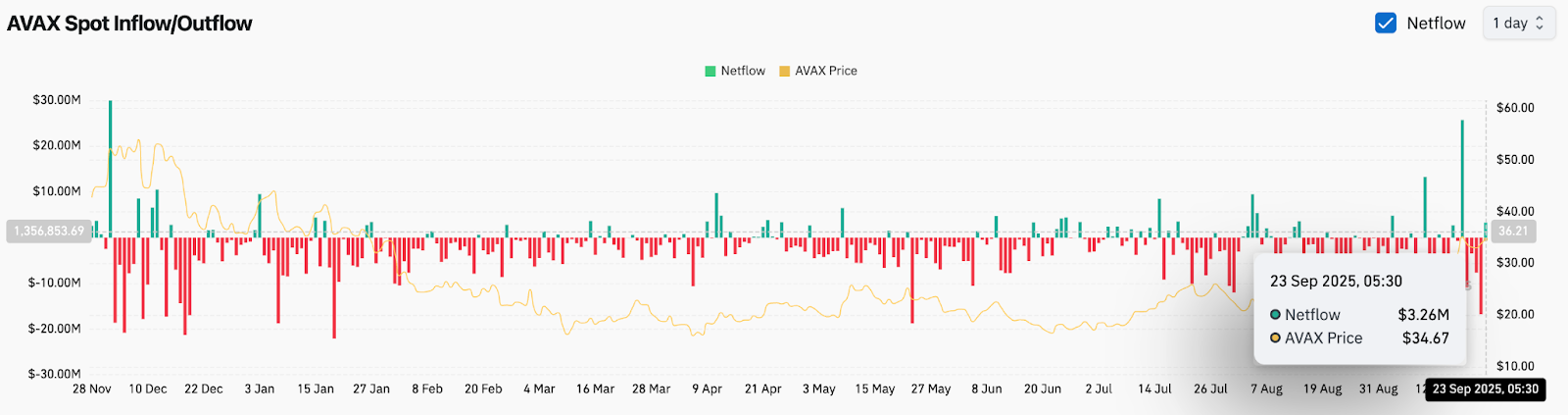

On-Chain Flows Show Net Inflows Returning

On-chain exchange data highlights a notable shift in flows. AVAX recorded $3.26 million in net inflows on September 23, marking one of the stronger daily positive readings in months. While recent weeks showed volatile flows with alternating inflows and outflows, the latest data suggests that traders are positioning for further upside.

Futures open interest has also grown steadily, reflecting rising leveraged demand. However, analysts caution that consistent inflows above $10 million per day would be needed to sustain a large breakout. Until then, the market remains sensitive to sudden liquidity shifts.

Smart Money Targets Higher Liquidity Zones

Smart Money Concepts (SMC) analysis indicates that AVAX has completed a liquidity sweep and is now building higher within a trendline base liquidity zone. The $37–$40 area marks the next key battleground, with confirmation of strength opening the door to $47–$50.

Liquidity maps highlight demand clusters at $32 and $30, with deeper liquidity support near $27. On the upside, the $47–$50 region is marked as the first confirmed supply zone where sellers may reemerge.

Technical Outlook For Avalanche Price

Avalanche price prediction in the short term depends on whether buyers can push beyond the $37 resistance level.

- Upside levels: $37, $40, and $47–$50

- Downside levels: $32, $30, and $27

- Trend support: $24.66 (200-day EMA)

Outlook: Will Avalanche Go Up?

The outlook for Avalanche remains constructive as long as price holds above the $32–$30 zone. Strong EMA alignment, rising on-chain inflows, and institutional endorsements all strengthen the bullish case. A breakout above $37 would confirm momentum toward the $47–$50 liquidity zone, aligning with the next Fibonacci retracement.

Failure to clear resistance, however, could trigger a retest of $30 before buyers attempt another push. For now, the balance of signals points toward continued accumulation, with the $50 target achievable if momentum and institutional flows persist through October.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source: https://coinedition.com/avalanche-avax-price-prediction-will-avax-hit-50-soon/