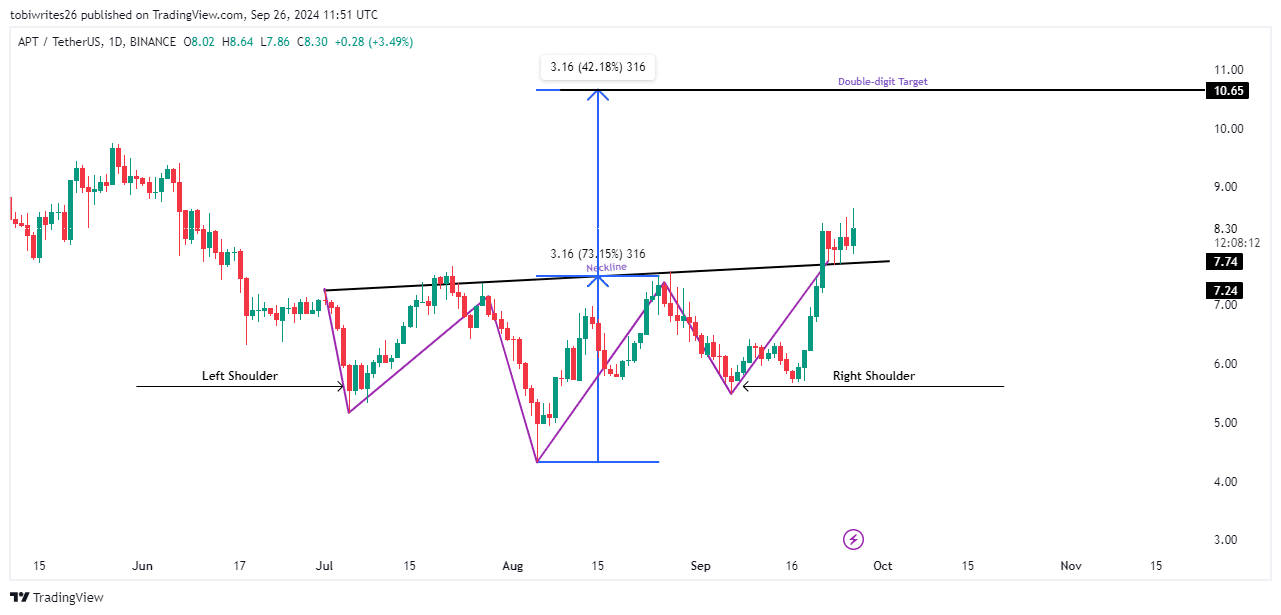

- The appearance of an inverse head-and-shoulders pattern on APT’s chart positions it well for potential gains.

- Initially, the market may see a period of accumulation, setting the stage for APT’s ascent into double-digit territory.

In the past week, Aptos [APT] has shown remarkable growth, surging by 29.98%. However, the pace has slowed in the last 24 hours, with an increase of just 1.59%.

Despite this slowdown, the chart analysis suggests this is likely a phase of accumulation and APT’s price could skyrocket again soon.

Why double-digit prices for Aptos is feasible

Prior to this, APT was trading within an ascending triangle, a bullish pattern that AMBCrypto identified as the initial phase of a potential rally—a prediction that has since materialized.

As of the latest updates, APT has introduced additional bullish signals with the formation of an inverse head and shoulders pattern, often seen as a precursor to a significant rally.

Typically, the rally mirrors the distance between the pattern’s head and its neckline. In APT’s case, this dynamic repeating itself will propel it to a trading price above $10.

Source: TradingView

Despite this upward trajectory, the price movement has been gradual, with market participants selling APT causing a decline.

However, AMBCrypto’s analysis offers a different perspective, and a continued bullish outlook is still in play.

APT’s short-term fall will benefit a rally

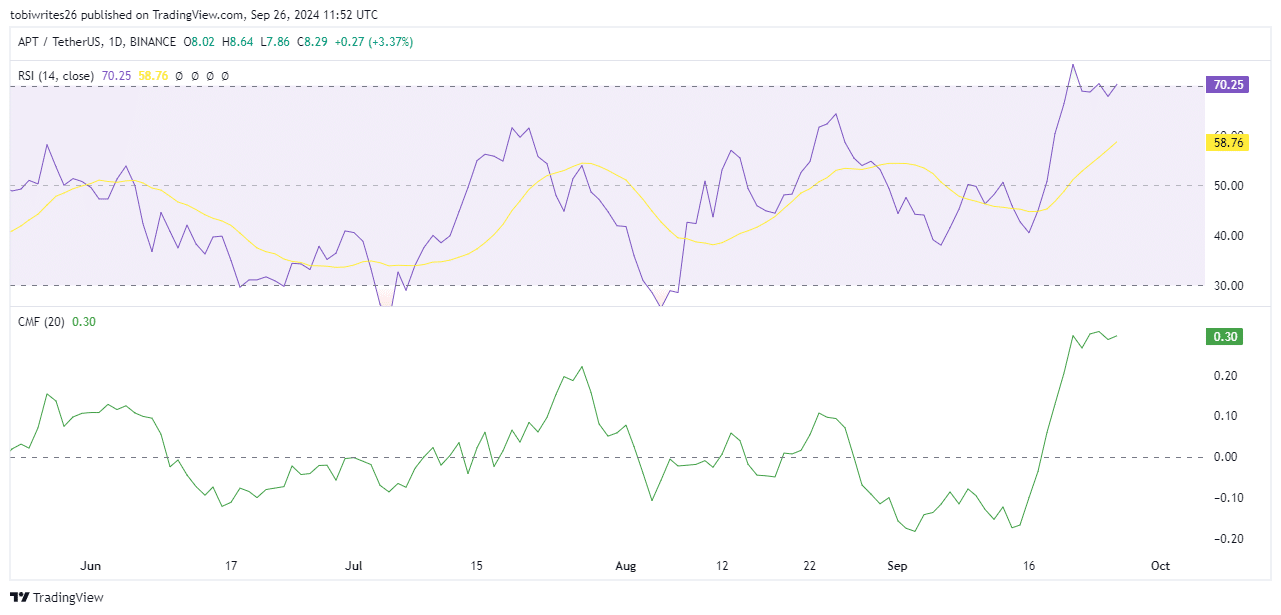

The Relative Strength Index (RSI) and the Chaikin Money Flow (CMF) indicators both signal a slowdown in APT’s momentum.

The RSI recently peaked at 74, indicating an overbought condition, but has since adjusted to 70.25.

This downturn, with the trendline facing up, suggests that the market is in a phase where participants are acquiring more APT units in anticipation of a future upward movement.

This accumulation phase is further confirmed by the Chaikin Money Flow. The CMF, which assesses the volume-weighted average of accumulation and distribution, shows a positive value of 0.30, indicating ongoing buying pressure.

Source: TradingView

As of now, the upward trend in the CMF suggests that the recent dip in price is a strategic moment for market participants to purchase APT at lower prices before initiating another rally.

Market participants seek lower prices for APT

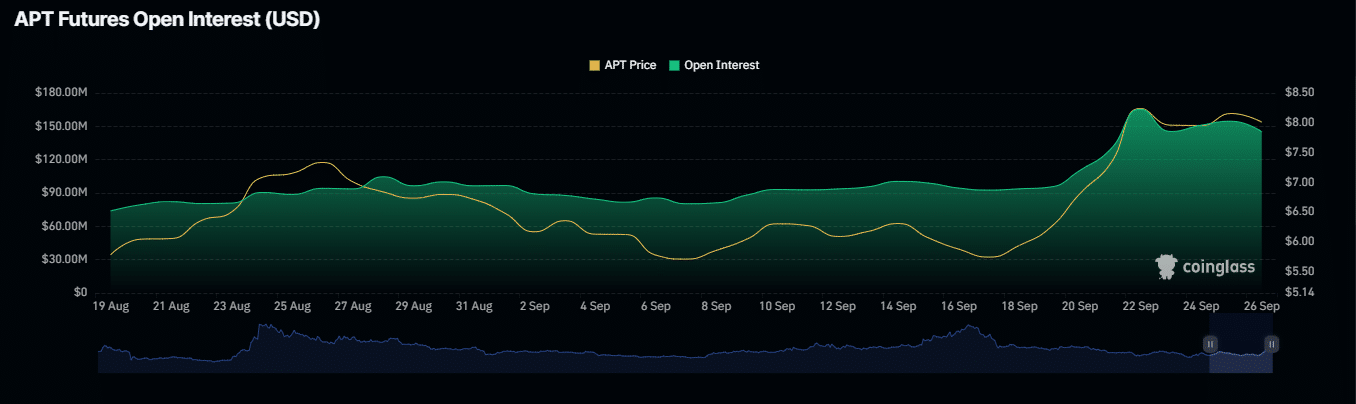

According to Coinglass, Open interest (OI) has decreased from its high on the 25th of September of $154.45 million to $145.02 million, indicating a concerted effort to drive APT’s price lower.

Read Aptos’ [APT] Price Prediction 2024–2025

Despite this decrease, OI has experienced a 1.66% increase, suggesting that bulls are gradually entering the market by opening more long positions.

Source: Coinglass

If this upward trend in open interest continues, it indicates that APT is set to exit its accumulation phase and embark on a rally toward double-digit values.

Source: https://ambcrypto.com/will-aptos-rally-above-10-key-levels-to-monitor/