- WIF may be mirroring DOGE’s early 2021 cycle, reigniting hopes for a breakout.

- An AMBCrypto strategy could help make that breakout a reality.

dogwifhat [WIF], dubbed Solana’s mascot, has seen a 14% surge over the past week, trading at $1.74 – double the gains of DOGE in the same period.

Despite pulling back from its March ATH of $4.60, WIF’s rising popularity has analysts speculating on a possible bullish cycle akin to DOGE’s meteoric rise in early 2021.

Uncovering the historic 2021 cycle

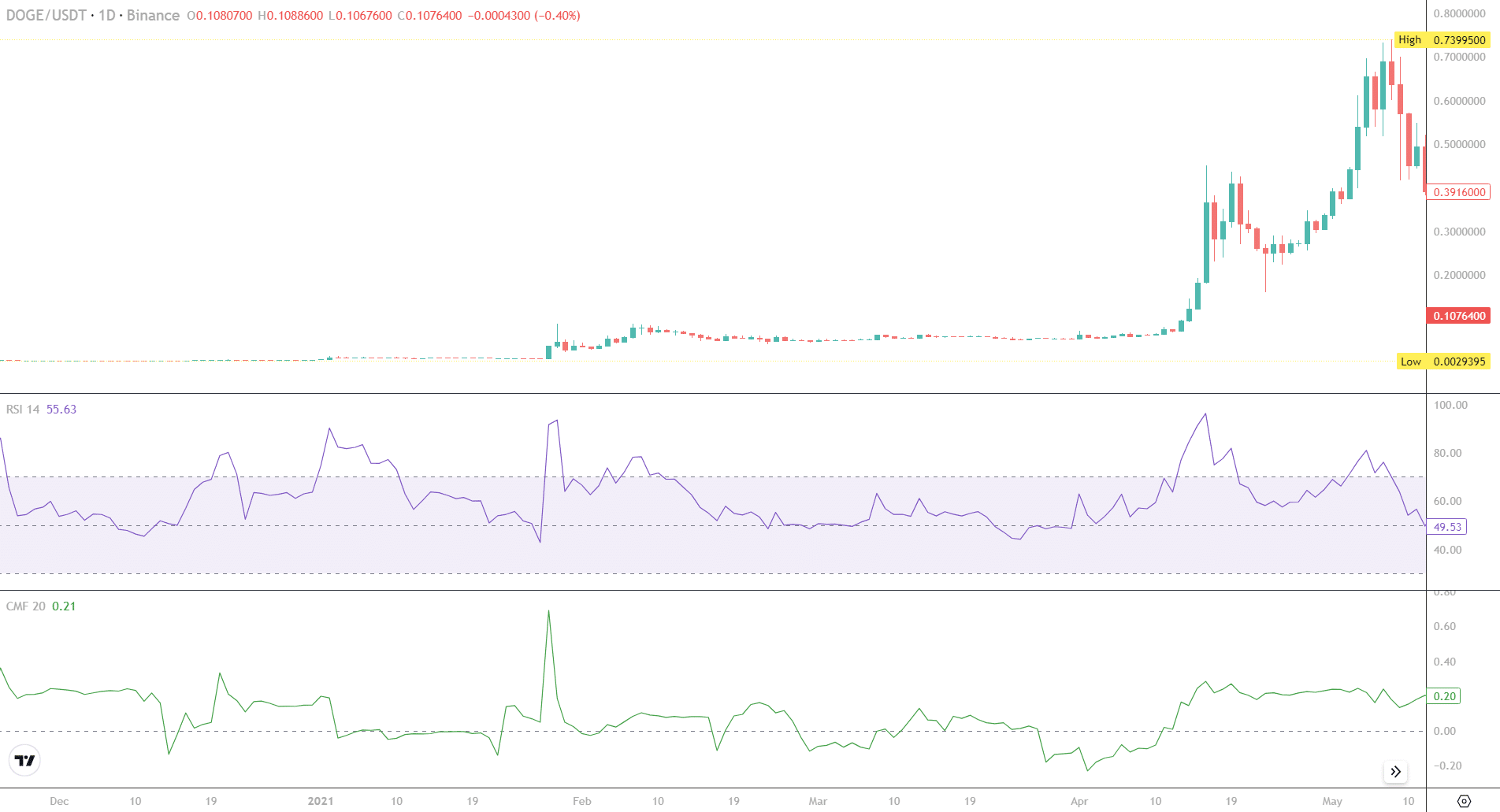

Source : Coinalyze

On the daily price chart, DOGE’s parabolic rally in early 2021 propelled it to prominence, surging 1,333% in just 2 days and closing at $0.0459054.

This was followed by a bullish move weeks later, where DOGE skyrocketed 10,351% over 100 days, reaching an ATH of $0.70. Put simply, that rally provided historic gains for profiteers; however, losses ensued after, with DOGE currently trading at $0.1075.

In contrast, WIF has not yet seen a parabolic rally but looks poised for one. If a similar trend develops, WIF could break its ATH by retesting its mid-July cycle, provided it holds support at $1.70.

Adding to the optimism are Bitcoin’s historic patterns, as October has often proven bullish. This could serve as an additional catalyst for the memecoin to break out from its month-long consolidation.

If the trend holds, WIF may be positioned for a significant correction during the first quarter of next year.

If specific conditions align

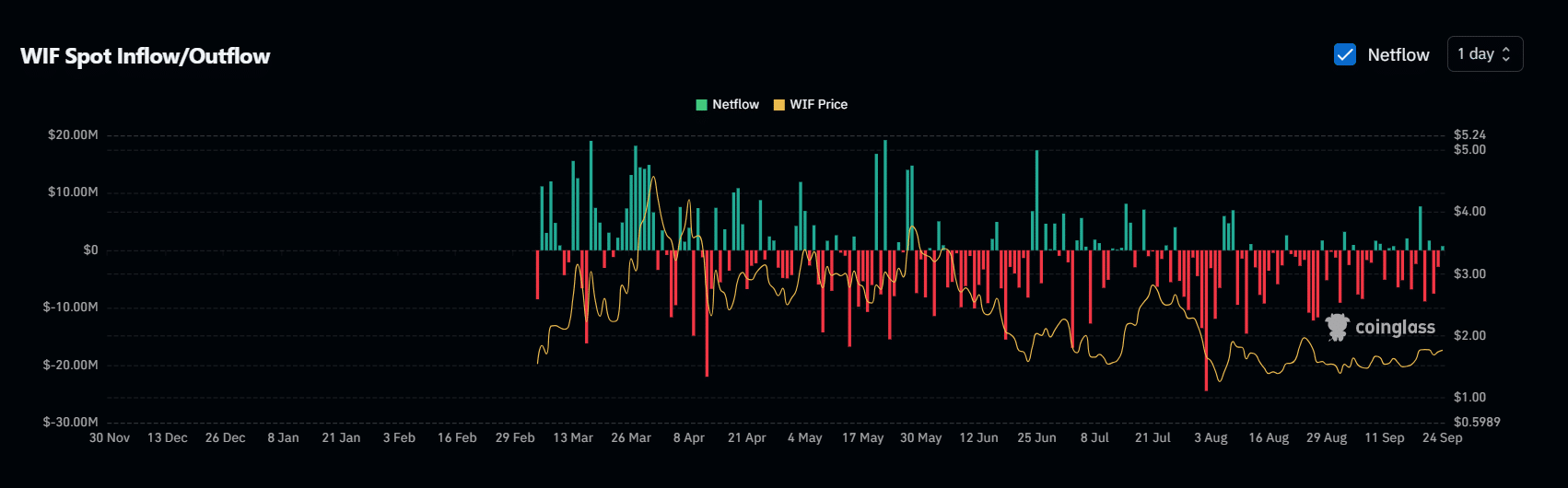

Typically, holders aim to identify a price bottom to begin accumulating before a surge drives prices higher. In the case of WIF, AMBCrypto observed a similar trend.

As previously mentioned, retesting mid-July resistance is crucial for reversing the trend. Supporting this idea are holders who have increased WIF withdrawals, highlighted by a spike in net outflows reaching $26 million on the day WIF hit its bottom at $1.664.

Source : Coinglass

In short, the necessary condition for a price correction is stakeholders refraining from entering the distribution phase. Keeping a watchful eye on that aspect is crucial.

Meanwhile, speculative trading has seen a sharp decline since early August, moving in tandem with WIF’ price. According to AMBCrypto, a reduction in OI could be a bullish sign, making the price less vulnerable to sudden swings.

As futures traders retreat, control may increasingly shift to the spot market. If holder interest remains strong, the chances of a reversal intensify. Therefore, capitalizing on this trend is crucial for anticipating a bullish move forward.

Spot traders must capitalize on this for a WIF reversal

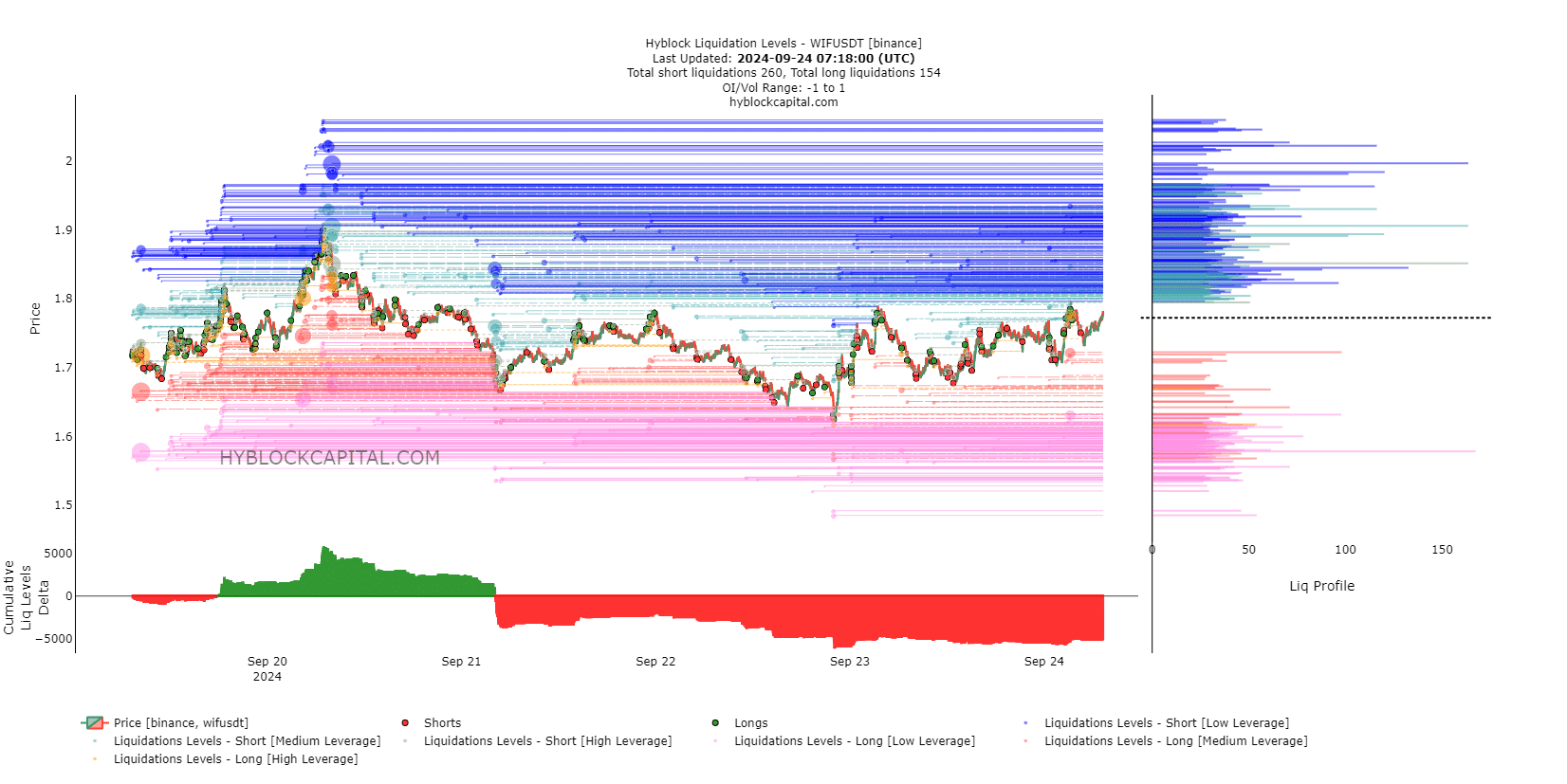

Three days ago, as bears thwarted another attempt to push WIF near its previous rejection at $1.90, longs retreated, resulting in a significant influx of short positions.

Source : HyblockCapital

While this may not seem bullish, a calculated strategy by spot traders could reset WIF for a breakout. Typically, a slight upward trend forces shorts to close their positions. Since shorts currently dominate, if spot traders continue accumulating, it could trigger massive liquidations.

Read dogwifhat’s [WIF] Price Prediction 2024–2025

In summary, if spot traders enter and bears retreat, a resurgence of crypto longs could push WIF toward the $1.90 range. If this trend holds, the next resistance could be expected near $2.

Overall, given the current market dynamics, the potential for a breakout is clearly present, contingent on traders capitalizing on this strategy.

Source: https://ambcrypto.com/wif-jumps-14-is-a-repeat-of-dogecoins-2021-bull-run-likely-now/