Key Takeaways

WLFI climbed 28% to $0.2398 as whales withdrew 13 million tokens, Futures inflows topped $113 million, and Open Interest surged. Yet, profit-taking inflows left traders eyeing $0.21 risk.

Since hitting $0.16 four days ago, World Liberty Financial [WLFI] traded within an ascending channel and reached a local high of $0.2446.

At press time, WLFI changed hands at $0.2398, up 28.18% in the last 24 hours. Its market cap stood at $5.91 billion, reflecting renewed inflows.

Is this a sustained uptrend or a speculative bounce?

Whale scoops up 13 million WLFI

Interestingly, as the market signaled recovery, investors, especially whales, jumped into the market to accumulate.

According to Lookonchain, a whale bought 13 million WLFI tokens worth $2.84 million from Binance.

Source: Lookonchain/X

Whale accumulation often suggests conviction.

This purchase followed the WLFI team’s recent blocklisting of Justin Sun’s and 272 wallets tied to manipulation claims. It signaled restored confidence among traders.

Futures remain more optimistic

As prices recovered, most investors jumped into the Futures market for strategic positioning.

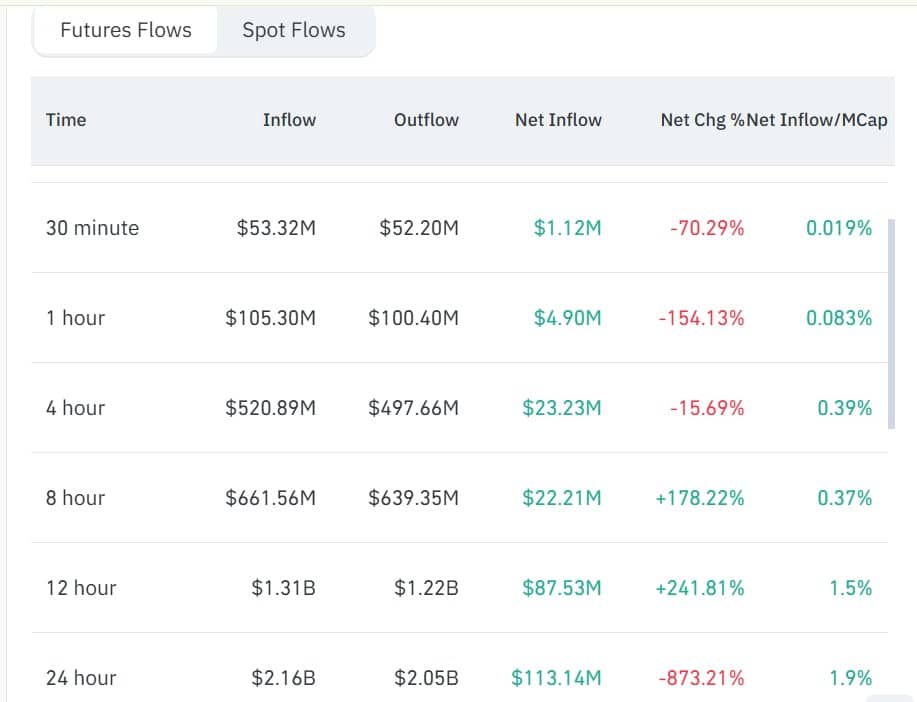

In fact, over the past day, the Futures market recorded $2.16 billion in total Inflows compared to $2.05 billion in outflows.

It brought out the total Futures Netflow to be $113.14 million at press time, reflecting a higher capital influx.

Source: CoinGlass

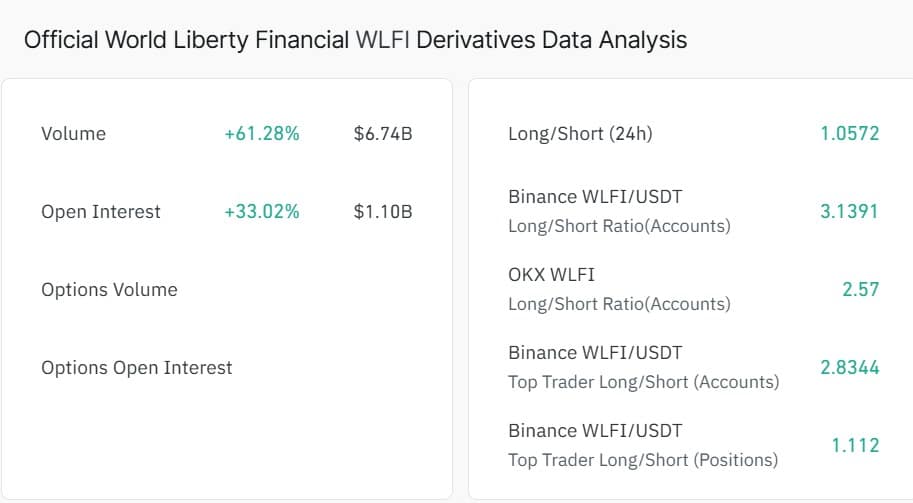

At the same time, WLFI’s Open Interest surged 33.02% to $1.1 billion, while Derivatives Volume jumped 61.2% to $6.74 billion.

Typically, when OI and Volume rise in tandem, it indicates increased participation and capital inflow in futures.

Source: CoinGlass

Meanwhile, the altcoin’s Long/Short Ratio ticked to 1.057 overall. Binance recorded a sharp 3.13 ratio, suggesting traders leaned heavily long.

But, profit taking still a risk

Unsurprisingly, amid price recovery, investors who have been underwater returned to cash out.

According to CoinGlass, WLFI recorded a positive Spot Netflow of $6.69 million for the first time on the 6th of September.

Importantly, this trend continued at press time, with the altcoin recording $710k in Netflow, a significant drop from the previous day.

Source: CoinGlass

Such a sudden spike in Netflow indicated increased Exchange Inflows, a clear sign of aggressive selling.

Can WLFI extend gains?

According to AMBCrypto’s analysis till now, we observed that World Liberty Financial rebounded as demand from whales and for future positions recovered.

At the same time, it seemed that confidence among investors was restored after the WLFI team blocked 272 addresses and was accused of price manipulation.

It meant that if external factors cool down and stability follows, WLFI could make more gains.

If accumulation continues and long positions dominate, WLFI could aim for $0.26 and possibly $0.30. A surge in selling, however, might drag the token back toward $0.21.

Source: https://ambcrypto.com/why-wlfi-is-at-risk-of-falling-despite-whales-2-8-mln-buy/