- A whale bought 420 billion PEPE tokens at the market bottom.

- The whale made a $30K profit in less than one week.

A Pepe [PEPE] whale was able to shake up the world of cryptocurrency with quick and profitable trading. The whale took advantage of recent price movements, indicating how volatile meme tokens can be.

Whale’s smart market timing

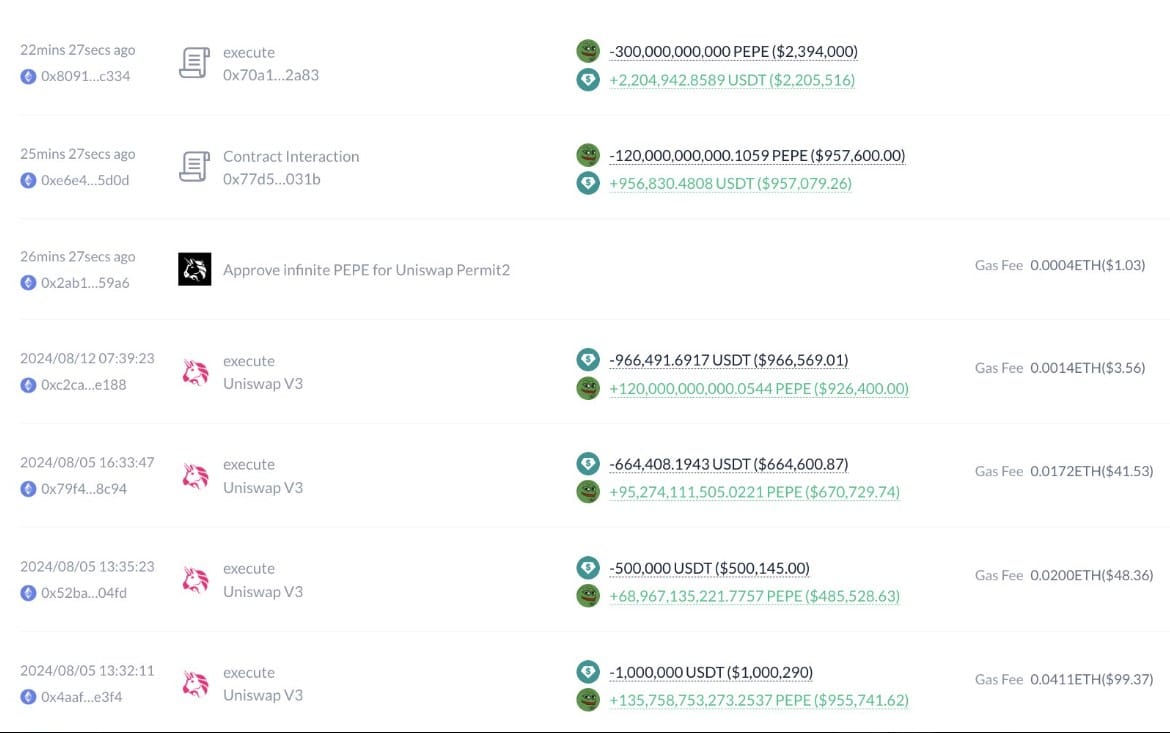

According to data from Lookonchain, a whale purchased 420 billion PEPE tokens worth $3.13 million on the 5th and the 12th of August. This strategic accumulation happened around PEPE’s latest market bottom.

However, only about 30 minutes before press time, that same whale sold off all its holdings. Incredibly, this quick flip resulted in a net gain of $30k during an extremely short period.

Source: X

PEPE sentiment turns bearish

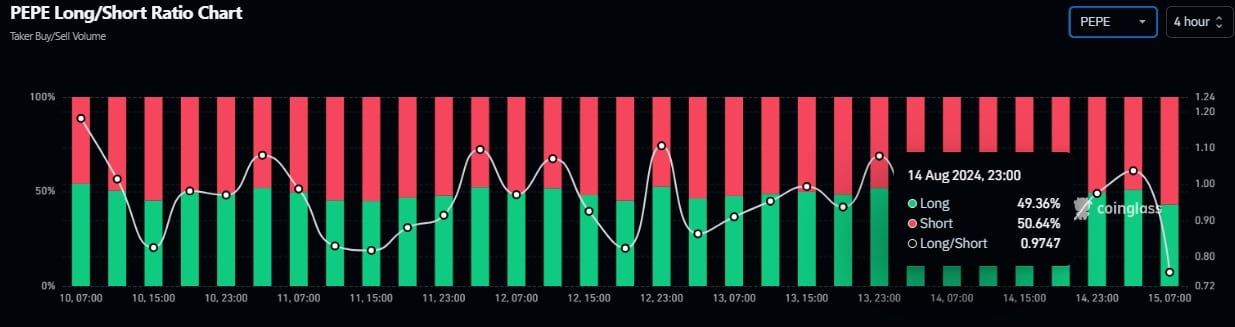

According to Coinglass’ Long/Short Ratio, there had been increasingly negative sentiment toward PEPE. The memecoin recorded a low reading of 0.9747 on the 14th of August, indicating more shorts traders than longs at press time.

Source: Coinglass

The decision by this particular whale to exit their significant position very quickly supports this bearish outlook, which suggests that short-term PEPE may continue to dip further.

Large transactions surge

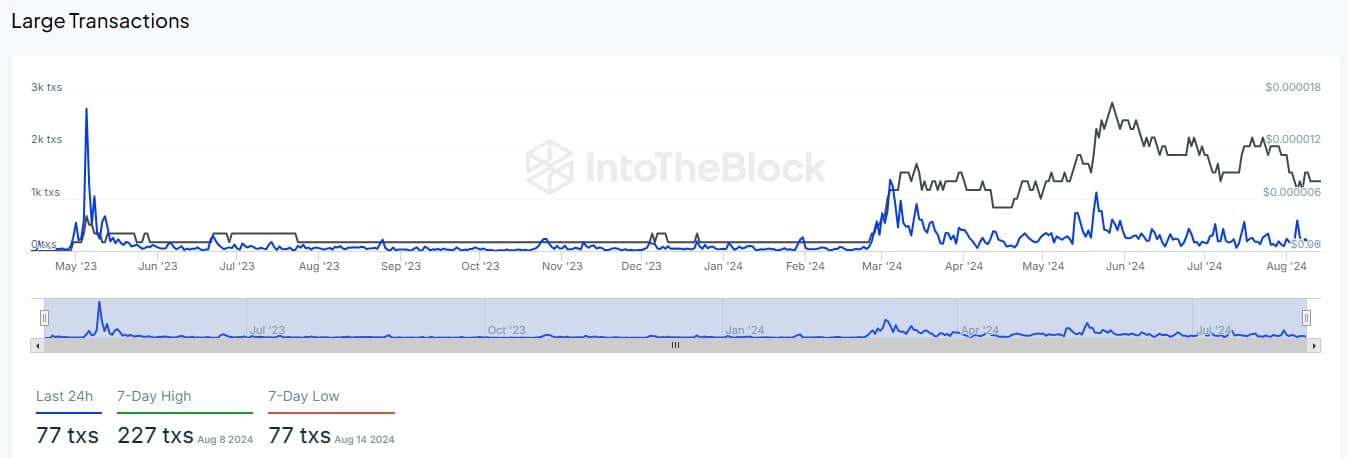

AMBCrypto analysis of IntoTheBlock data indicated a recent surge in big PEPE transactions. The 24-hour count amounted to 77, reaching a 7-day peak of 227 on the 8th of August.

This enhanced activity from top holders likely signaled more volatility along the way.

Source: IntoTheBlock

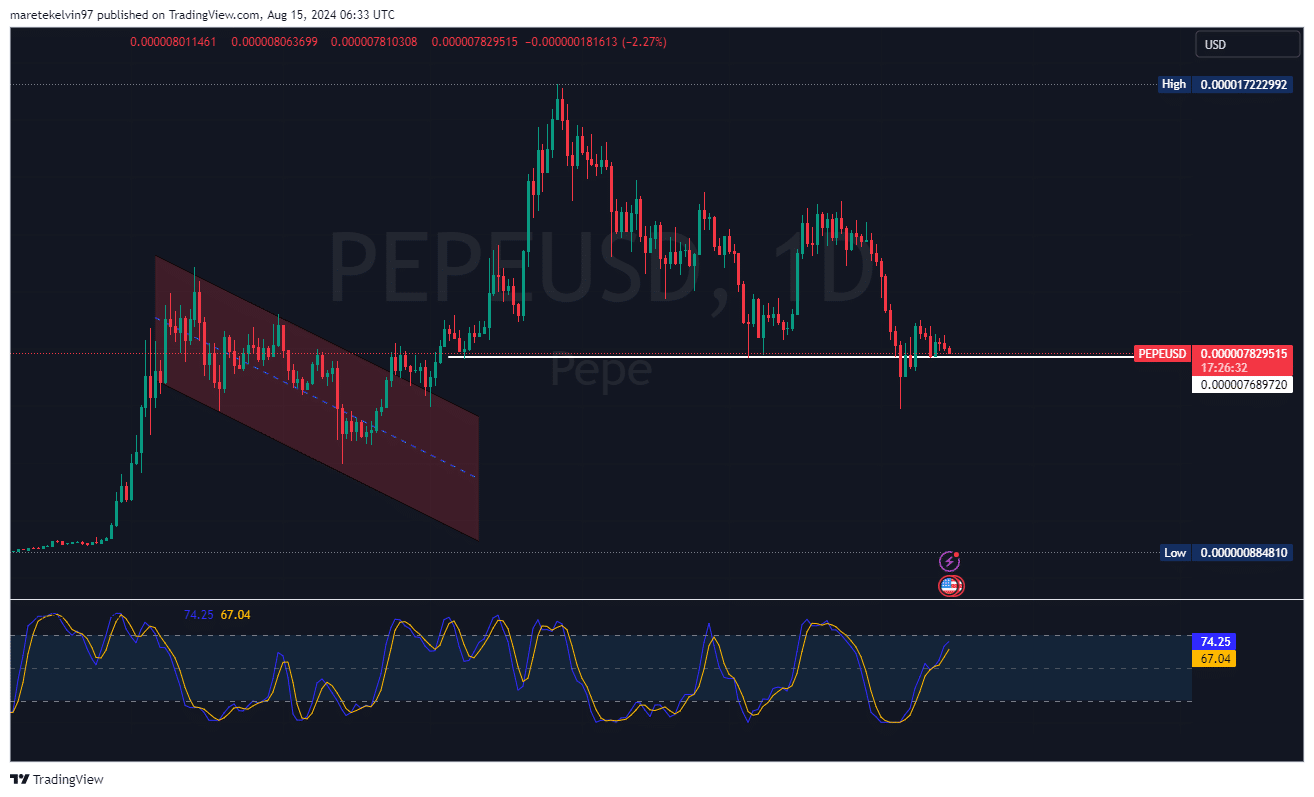

After its significant pump in early August, PEPE’s price chart showed a significant downtrend. As of this writing, it was trading at $0.00000078295, which is down by 2.27% within the last 24 hours.

Read PEPE’s Price Prediction 2024 – 2025

If the selling pressure from the massive outflow continues, it prices may plummet further.

Source: TradingView

The stochastic RSI also was approaching an overbought zone, an indication that a potential bearish rally cannot be written off.

Source: https://ambcrypto.com/why-pepes-whale-movements-may-not-help-the-memecoins-price/