- Dogecoin’s price has been stabilizing close to $0.185 – A historically strong support level

- Momentum indicators flashed signs of a potential rebound, but DOGE needs to clear $0.217 to confirm bullish strength

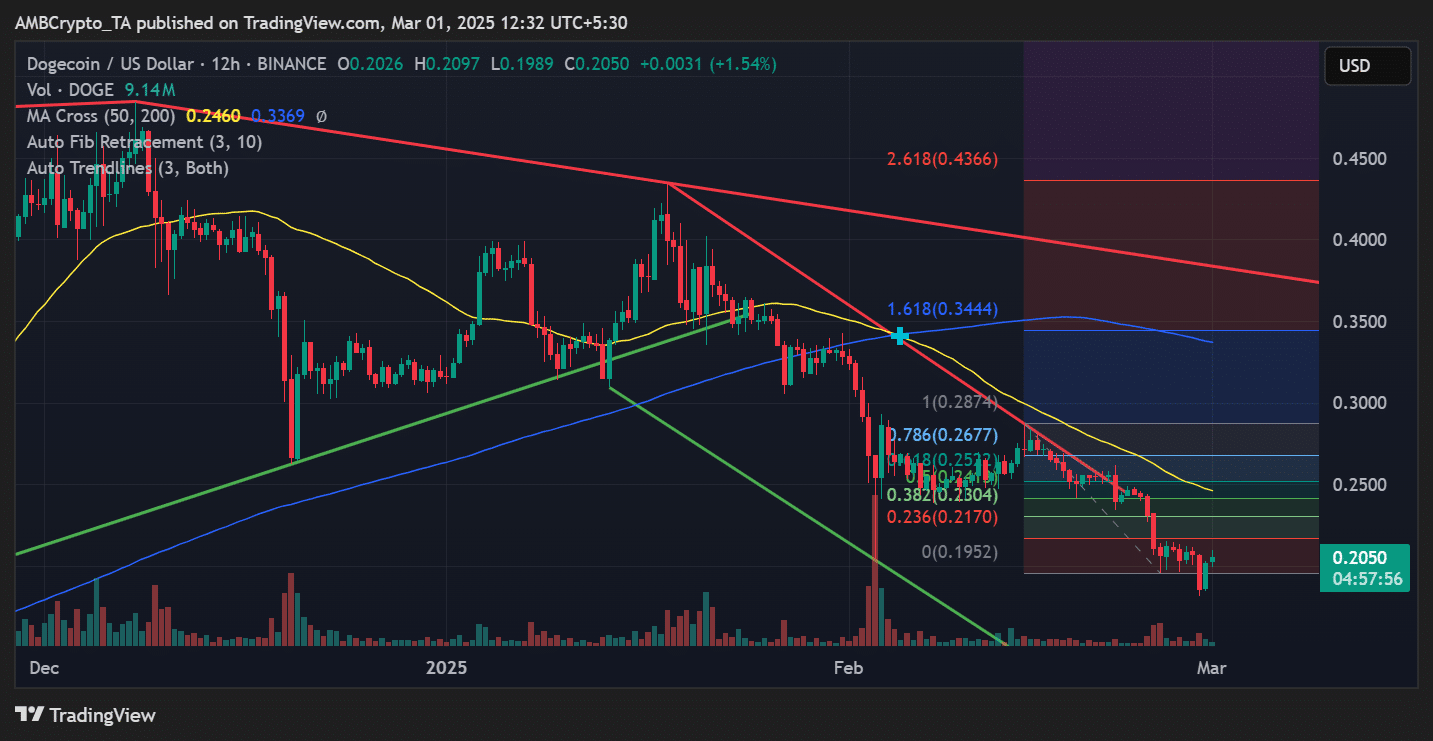

Dogecoin [DOGE] is at a crucial juncture right now, holding above a key support level that has historically dictated its price movements. At the time of writing, DOGE was trading at around $0.205, rebounding slightly from its recent lows.

The big question is whether this support can hold and lead to a recovery or if further downside awaits. This analysis will examine potential price movements based on historical trends and technical indicators.

DOGE’s support level and historical significance

Dogecoin’s long-term chart highlighted $0.185 as a critical support level. Historically, DOGE has tested this level multiple times, bouncing back into an uptrend when buyers stepped in. This area also seemed to be in line with a key Fibonacci retracement zone, reinforcing its importance.

If DOGE maintains this support, it could signal renewed bullish momentum. However, a breakdown below $0.185 might trigger further losses, with potential downside targets around $0.15 and $0.12 based on its prior price action.

Short-term outlook – Can DOGE reverse the downtrend?

In fact, the memecoin’s latest price action revealed that DOGE has been attempting to stabilize after a prolonged downtrend.

For example – The latest DOGE/USD 12-hour chart highlighted key technical levels that traders are watching. The 50-day and 200-day moving averages hinted at a bearish trend, but momentum indicators alluded to potential relief.

Source: TradingView

At the time of writing, DOGE was facing resistance at $0.217 – A key Fibonacci level. If bulls manage to push past this zone, the next resistance would sit at $0.25, aligning with the 0.618 Fibonacci retracement level.

Breaking above $0.28 could shift sentiment and invalidate the prevailing downtrend. Conversely, if DOGE fails to hold $0.185, the next major support would lie at $0.15, with an extended drop to $0.12 if bearish pressure continues.

Indicators to watch

At press time, the memecoin was well below its key moving averages – A sign of caution. A reclaim of the 50-day MA could indicate a shift in momentum.

The RSI seemed to be nearing oversold levels too, suggesting potential for a relief rally if buyers step in. Finally, the MACD indicator was flashing real signs of convergence, which could hint at a slowdown in bearish momentum.

What’s next for DOGE?

Dogecoin is at a make-or-break level right now. Holding $0.185 would allow for a price rebound towards $0.217 and possibly, $0.25 in a bullish scenario. However, failure to maintain this level might result in a deeper decline towards $0.15 or lower.

Traders should keep an eye on key technical indicators and market sentiment in the coming days. A decisive move above the resistance could spark renewed interest. On the contrary, a drop below support may hint at further downside risk.

Source: https://ambcrypto.com/why-dogecoins-price-holding-on-above-0-185-is-key-for-the-memecoin/