- Federal Reserve might consider rate cuts; guidance from White House advisor Kevin Hassett.

- Economists argue rates decision is overdue.

- Crypto markets stable, await policy actions.

On July 31, 2025, White House Senior Advisor Kevin Hassett announced that current economic data supports the Federal Reserve’s potential move to cut interest rates.

Hassett’s statement aligns with economists’ views that such cuts could impact major cryptocurrencies, heightening attention on rate-related policy decisions.

Cryptocurrency Market Poised for Change as Fed Considers Actions

Current economic data provides the Federal Reserve with justification to consider cutting interest rates.

Many economists maintain that the Federal Reserve has lagged in adjusting rates, pressing for a more rapid response. However, official responses remain careful, respecting the Fed’s independence and approach, as noted by Waller’s Insights on Economic Outlook – July 2025.

Current economic data provides the Federal Reserve with justification to consider cutting interest rates.

Market Insights and Trends

Did you know? Anticipated Fed rate cuts have historically led to increased crypto inflows, as seen in 2019 and 2020.

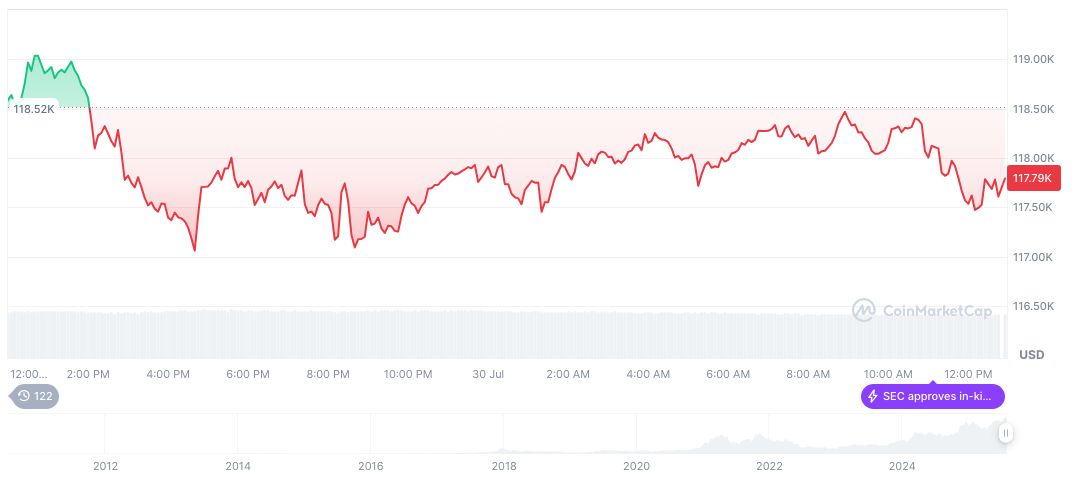

Bitcoin (BTC) currently trades at $117,731.68, with a market cap of approximately 2.34 trillion. Bitcoin’s dominance stands at 60.77%, witnessing a 21.59% price increase over the past 90 days. Recent trading volume is noted to be slightly down at $63 billion, according to CoinMarketCap.

Insights from the Coincu research team highlight the potential for increased market volatility as investors assess lower interest rates. Historical trends suggest cryptocurrencies may benefit in yield-seeking environments if macro liquidity rises, detailed in Coinbase derivatives on financial stability.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/fed-rate-cuts-discussion/