- AVAX faces resistance at $24.40, support at $23.40 critical for trend continuation

- ADA needs to break $0.338 to test $0.343 resistance, support at $0.333 vital

- DOT must hold $4.13 support and overcome $4.275 resistance for upward move

Avalanche (AVAX), Cardano (ADA), and Polkadot (DOT) are experiencing a mix of ups and downs, with individual challenges preventing significant price increases. Even with trader attention, these cryptocurrencies are navigating tricky resistance and support zones.

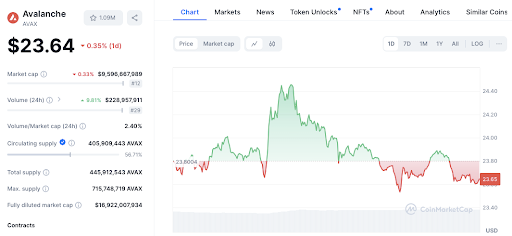

AVAX Price Check: Crucial Levels and Volume Clues

Avalanche (AVAX) is currently trading at $23.59, reflecting a slight dip of 0.95% over the last 24 hours. The increase in trading volume by 9.80% signals rising market interest. Depending on overall market trends, this could either fuel price movement or signal a change in direction.

AVAX reached a peak of $24.40, a key resistance point for the token. Meanwhile, the price has bounced back from $23.40, now acting as immediate support. If this level holds, it could stop further declines.

Read also: Cardano, SEI, AVAX, TAO, AXL Flash Bullish Signals with Triple-Digit Growth Potential

The main resistance for AVAX stays at $24.40. Breaking through this level could potentially cause a price surge. However, if the $23.40 support isn’t maintained, AVAX might drop toward $23.00, a secondary support level.

The current volume-to-market cap ratio is 2.40%, showing steady interest in AVAX. But, a larger volume shift would be needed for a big price move.

ADA’s Steady Climb Meets Resistance

Cardano (ADA) is showing some positive signs, currently trading at $0.3351, with a small daily gain of 0.24%. The 15.47% increase in trading volume indicates growing interest in ADA, possibly leading to a price change if volume keeps rising.

The recent high of $0.343 now acts as a critical resistance level, while ADA has found support at $0.333. The price has tested this support multiple times, signaling its importance.

For ADA to move higher, it needs to break above $0.338, which could lead to another test of the $0.343 resistance. But, if it can’t keep the $0.333 support, the price might fall to $0.330. The volume-to-market cap ratio is at 1.83%, suggesting moderate trading activity, which could limit immediate price swings unless there’s a big volume increase.

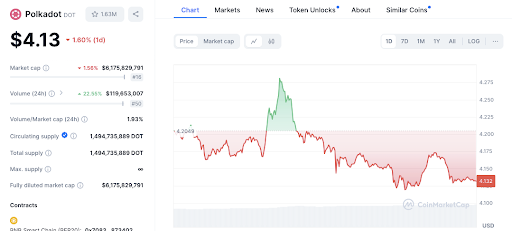

DOT’s Slide Stops at Key Support

Polkadot (DOT) is currently facing challenges as it trades at $4.13, down by 1.74% over the past day. Even with this drop, trading volume has gone up by 21.62%, reflecting increased market activity. However, the price has struggled to break above the $4.275 resistance, which is a major obstacle for DOT.

Immediate support is at $4.13, a level that DOT is currently testing. If this level doesn’t hold, the price could be pushed down to $4.10, which acts as secondary support. Looking up, DOT needs to get past $4.20 to retest $4.275. The volume-to-market cap ratio of 1.93% suggests moderate activity, although price volatility could rise with higher volume.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source: https://coinedition.com/mixed-signals-avax-ada-dot-face-hurdles-despite-growing-interest/