Join Our Telegram channel to stay up to date on breaking news coverage

Cardano (ADA) was trading at $0.274 with a bearish bias during the Saturday trading session as bulls fight to keep ADA within the price range defined by a bullish technical formation. The Layer 1 token has had a great start to the year recording as much as 14% gains, igniting investor confidence that the Cardano price may perform well in 2023.

Will increasing accumulation by large investors fuel ADA’s upward breakout? Read along to find out.

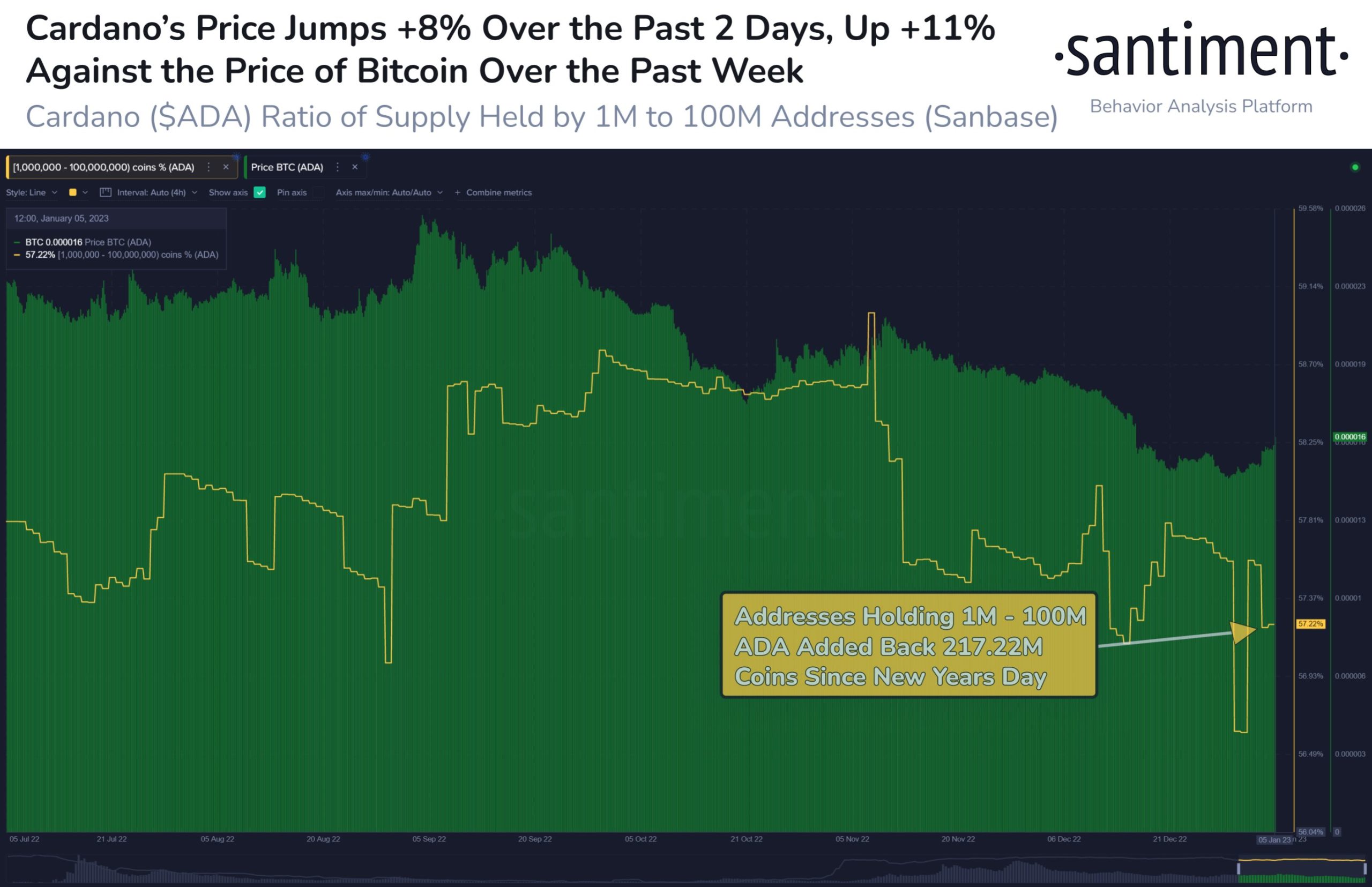

Whale Addresses Holding 1 Million to 100 Million ADA On The Rise

According to data from Santiment, an on-chain data analytics firm, addresses holding between one million and 100 million ADA tokens (worth between $274,000 and $27.4 million at current rates) could be a factor to watch out as investors remain hopeful of positive gains in 2023.

Santiment posted the following chart on Twitter saying, “Cardano is enjoying a mini-surge at this hour, … After dumping 568.4M coins the final 2 months of 2022, (whales) have added back 217.2M $ADA to start 2023.”

Addresses Holding 1M-100M ADA

Note that whales have the ability to significantly influence the price of an asset through their activities. However, the market participants cannot rely on whale activity alone to definitively determine the direction the Cardano price is likely to take in the near term. This is because the price of any cryptocurrency is, in the end, determined by supply and demand dynamics, fundamentals and macroeconomic factors.

Cardano’s Growing Network Adoption To Boost ADA

ADA bulls have set a positive trajectory for the “Ethereum killer” token in January, considering the growing adoption and usage of the Cardano blockchain. The over 3,400 Cardano community members look forward to an increase in Cardano price by the end of the month.

However, it is important to note that the hope displayed by the crypto community may be cut short. If history is to be relied on, predictions made by crypto communities do not usually come to fruition. According to Cardano, the community’s historical accuracy is a little over 40%, with data showing that it was at 60% in September and only 6.8% in December 2022.

According to Santiment analysts, the altcoin is “severely” undervalued given that both whale and shark addresses (holding between 100 K and 10 million ADA tokens) have been massively accumulating over the last two months.

The latest report by CryptoCompare, a crypto analytics and news aggregate site, revealed that users were moving their assets from centralized exchanges (CEXs) to decentralized platforms and self-custody. This has been attributed to the collapse of the once “giant crypto exchange” FTX that shook investor confidence in CEXs.

According to CryptoCompare, this has led to an increase in average daily active users on the Cardano blockchain. As such, daily active users on the smart contracts platform rose by 15.6% to 75,800 in December, the highest number recorded since May.

Similarly, monthly transactions on the network spiked 5.34% to 2.32 million last month, marking the largest transaction volume since April 2022.

Cardano Price Bulls Eye 9% Gains

After turning away from the $0.266 level on December 27, ADA found support at the $0.240 support level. The recovery that followed resulted in a fierce battle between buyers and sellers near the $0.246 level, with the bulls ultimately having their way on January 1.

The ensuing rally saw the Cardano price rise as much as 14% to brush shoulders with $0.28. At the time of writing, ADA was teetering at $0.273 recording 11% gains, so far in 2023.

Cardano’s recent price action has resulted in a series of higher highs and higher lows leading to the formation of an ascending parallel channel on the 12-hour chart as shown below. Rising channels are highly bullish chart patterns that indicate that the price may continue to rise as long as it remains within the confines of the technical formation.

Apart from the chart formation, Cardano was sitting on formidable support provided by the immediate defense at $0.273, embraced by the lower boundary of the channel, the $0,266 resistance turned support, and the 50-day simple moving average (SMA) at $0.262.

As such, a daily candlestick close above the $0.273 level would ensure that the ADA price continues to trade within the channel. The buyers could then push the price first toward the $0.280 psychological level and later confront the resistance at $0.287, where the upper boundary of the channel lies.

In highly ambitious cases, the Cardano price may breach this level. This would confirm a breakout from the channel paving the way for a rise above the 100-day SMA at $0.288 toward the $0.30 psychological level, bringing the total gains to $9.2%.

ADA/USD 12-hour Chart

Also supporting Cardano’s robust support was the upward movement of the moving average convergence divergence (MACD) indicator. Note that the MACD line (blue) was still positioned above the signal line (red), suggesting the direction with the least resistance for the Cardano price was upward.

In addition, the relative strength index (RSI) was positioned at 66 close to the overbought region. This suggested that there was still more room for the upside.

On the other hand, the RSI and the moving averages had begun tipping downward, implying that the bears are selling on the rally to $0.28. As such, the ongoing correction may continue in the short term.

Therefore, a breach of the $0.273 support provided by the lower boundary of the ascending channel would signal weakness amongst the buyers. The ADA price may then drop to the $0.266 level or lower to seek support from the 50-day SMA at $0.262.

Losing this support would trigger massive sell orders that could see the Cardano price drop to the $0.246 major support zone or revisit the $0.240 psychological level.

Other Tokens with Promising Returns In 2023

It is important to always consider the fundamentals surrounding the price of a cryptocurrency before making an investment decision. This is clearly illustrated by Cardano’s increasing whale accumulation and daily active users. As earlier mentioned, these have the potential to positively impact ADA’s price. One altcoin that has good fundamentals and could potentially yield high returns this year is C+Charge (CCHG).

C+Charge (CCHG)

To this day, large corporations have dominated the carbon credit industry, despite the majority of the ethics abounding their purchase and use has been spotty at best. That is where C+Charge comes in.

The project is committed to putting carbon credits in the wallets of ordinary folk who actively help the environment. With a particular focus on those driving electric vehicles (EV), C+Charge brings the much-needed difference in a terminal generation.

⚠️@WWF_UK suggested that the UK gov should stop the sale of fuel cars by 2030

At C+Charge we are working on a seamless payment solution to contribute to this electrified vehicle revolution⚡️

Join us and start changing the world!

📲https://t.co/ixe18bPqzI— C+Charge (@C_Charge_Token) January 7, 2023

Courtesy of C+Charge, drivers will enjoy redeeming credits just for charging their cars at a C+Charge station.

The project’s native token CCHG is currently in presale with over $81,000 already raised by the team.

Related News:

FightOut (FGHT) – Newest Move to Earn Project

- CertiK audited & CoinSniper KYC Verified

- Early Stage Presale Live Now

- Earn Free Crypto & Meet Fitness Goals

- LBank Labs Project

- Partnered with Transak, Block Media

- Staking Rewards & Bonuses

Join Our Telegram channel to stay up to date on breaking news coverage

Source: https://insidebitcoins.com/news/cardano-price-prediction-what-does-whale-accumulation-mean-for-ada