- Chainlink whales bought 800,000 LINK worth about $17 million.

- Stablecoin supply surged to an all-time high of $283 billion in September 2025.

- LINK trades at $21.53, with a market cap of $14.6 billion.

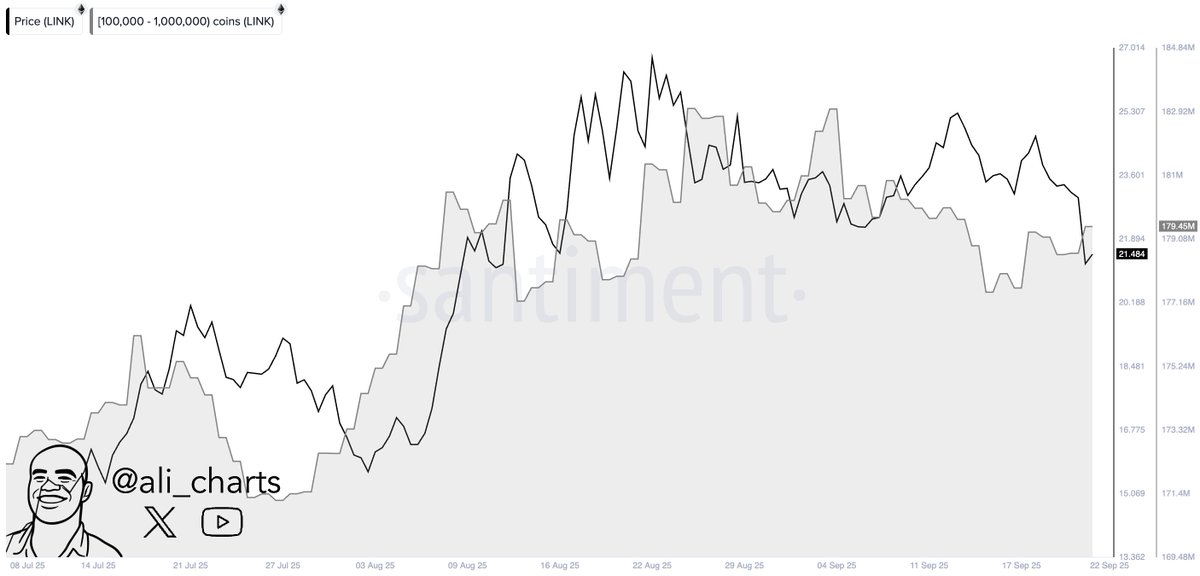

Large investors accumulated over 800,000 Chainlink (LINK) tokens in recent days, according to on-chain data. Analyst Ali Martinez noted that wallets holding between 100,000 and 10 million LINK added significantly to their balances. At current market prices, the purchase represents about $17 million in value.

This accumulation occurred during a short-term price pullback, suggesting that whales may be positioning for potential upside. Whale activity often attracts market attention because large holders can influence liquidity and price direction.

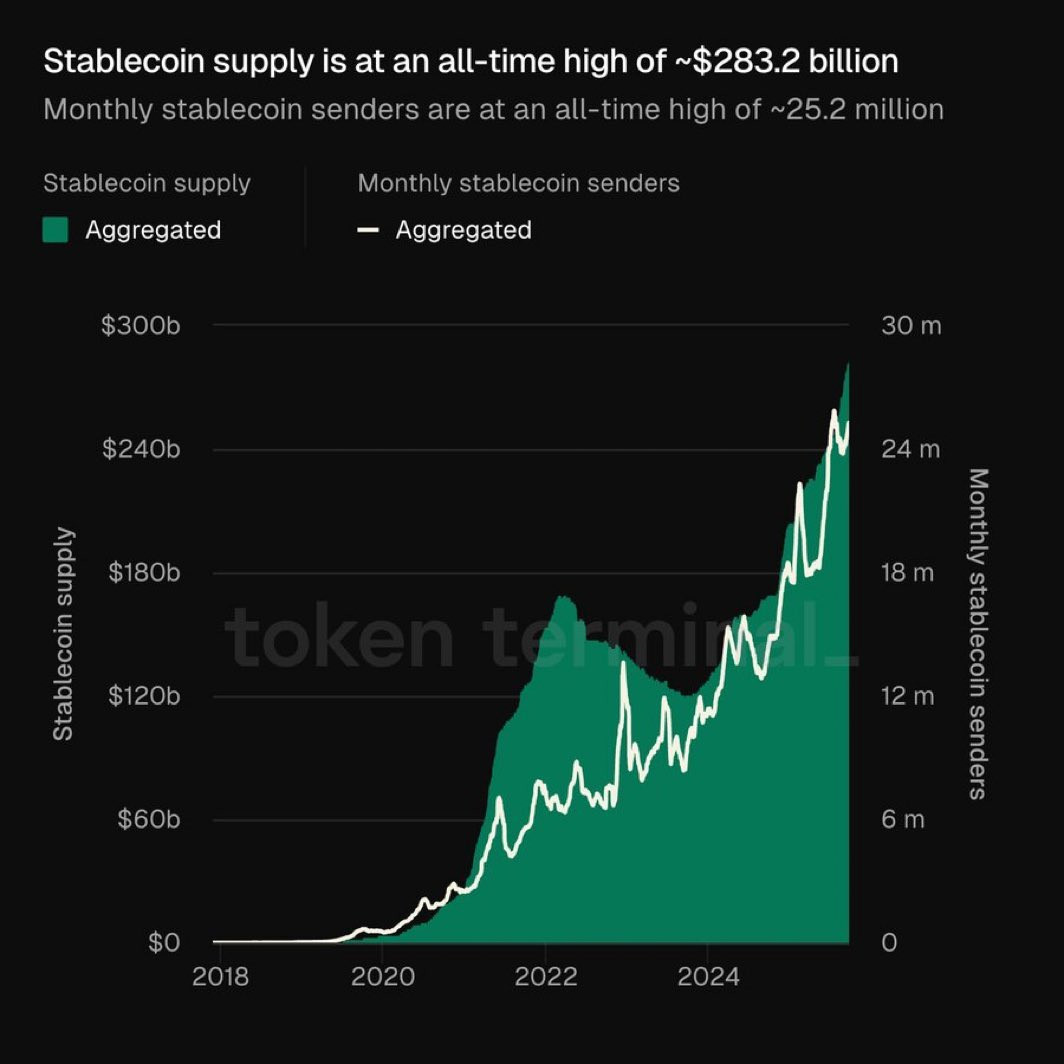

Stablecoin Supply Reaches All-Time High of $283 Billion

In a parallel development, stablecoin supply across major blockchains has reached an all-time high of $283 billion, according to analyst Quinten Francois. His data shows a sharp increase in September.

A chart from Token Terminal shows the surge coincided with record growth in monthly stablecoin senders, now at 25.2 million. This marks increased adoption as users deploy stablecoins across trading, DeFi protocols, and global transfers.

Stablecoins are often used as a measure of liquidity. When supply rises, it suggests more capital is moving into the market.

Related: Saudi Awwal Bank Adopts Chainlink for Capital Markets Tokenization; LINK Holds Near $23

Chainlink Price Analysis: Support, Resistance, and Outlook

LINK Holds $21.53 With Market Cap at $14.6 Billion

As of this press time, Chainlink trades at $21.53, after a 2.2% rise in the past day, cutting its loss in the past week to 6.6%. The $14.6 billion market cap token recorded $1.21 billion in 24-hour trading volume.

Notably, LINK remains significantly below its all-time high of $52.88 set in May 2021 but has held steady above the $20 mark in recent weeks. Despite the price lag relative to its peak, the recent whale activity suggests confidence among larger investors in the project’s long-term role in decentralized finance.

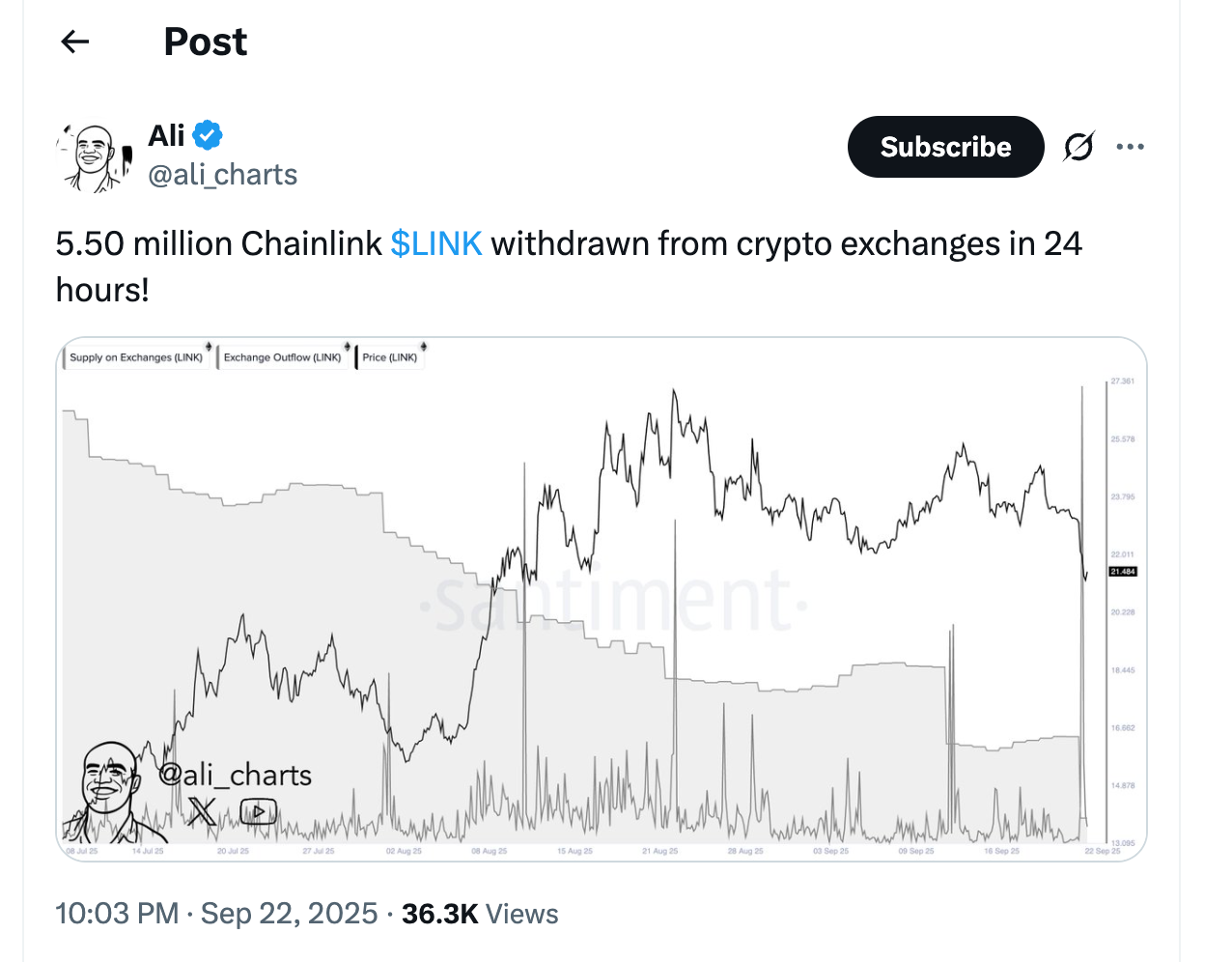

For context, Martinez also flagged a major outflow of LINK from centralized exchanges, with 5.5 million LINK withdrawn in just 24 hours. The move also corroborates the strong accumulation by whales as tokens shifted off exchanges are less likely to be sold, reducing immediate selling pressure and reinforcing a bullish outlook for LINK.

Technicals Show Correction Near Key Fibonacci Zone

Chainlink (LINK) pulled back 25% from its August high of $27.87 to $20.24, testing key support before a slight rebound. Despite the drop, RSI remains above 50 and MACD is positive, indicating the uptrend is intact.

Related: Chainlink’s Deal with SBI Is a Major Win, But Chart Shows LINK’s Battle at $27 Resistance

Key Levels: $22.20 Breakout Could Target $32.61

Analysts see this as a wave-four correction near the 0.5 Fibonacci level, suggesting a bottom may be in. A move above $22.20 and breakout from the descending channel could target $32.61 and new cycle highs.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source: https://coinedition.com/chainlink-whales-scoop-800k-link-as-stablecoin-supply-hits-record-283b/