- A whale offloaded 594K SOL since January, adding pressure to Solana’s already volatile price movements.

- Solana’s Head and Shoulders pattern hints at a potential drop to $122, raising concerns among traders.

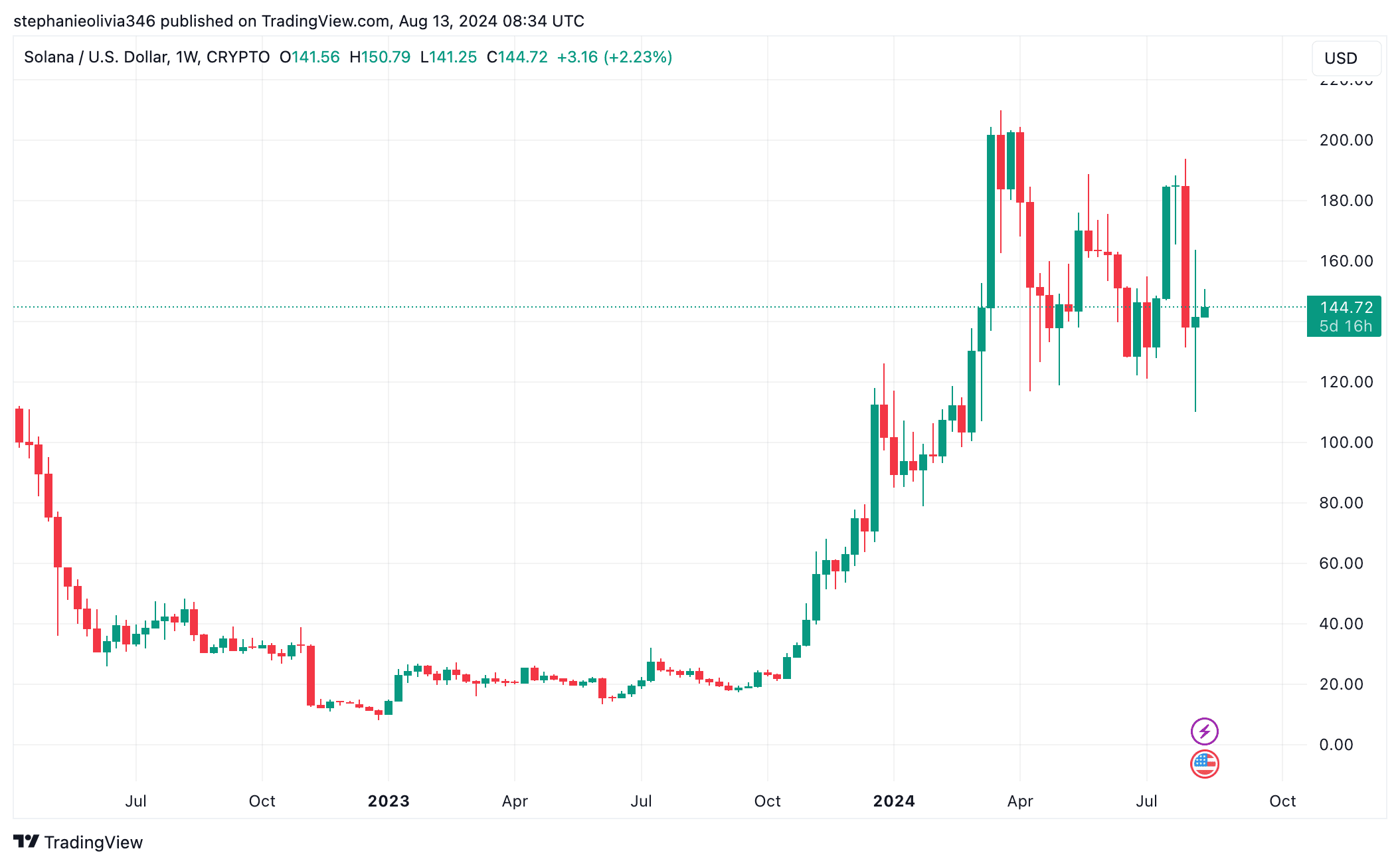

Solana [SOL] has encountered volatility in recent trading sessions, reflecting mixed market sentiment. SOL’s price has fluctuated between key resistance at $150.00 and support around $142.00, exhibiting consolidation within this range.

As of press time, Solana traded at $145.84, marking a 1.11% decline over the past 24 hours, despite a 3.08% increase over the past week. With a circulating supply of 470 million SOL, the current market cap is valued at $68.16 billion.

Source: TradingView

Meanwhile, technical analysis suggests that Solana may be forming a Head and Shoulders pattern on the hourly chart. According to a recent statement by Ali on X, this pattern could indicate an impending price correction.

Ali stated,

“Solana could be forming a head and shoulders pattern in the hourly chart, which suggests that a drop below $141 might trigger a correction that sends SOL to $122.”

The pattern’s neckline, around $141.90, serves as a crucial level. If the price breaks below this support, it may confirm the pattern, leading to further downward pressure.

The potential target for this bearish move is estimated at $122.50, representing a 13.40% decline from the neckline.

Source: X

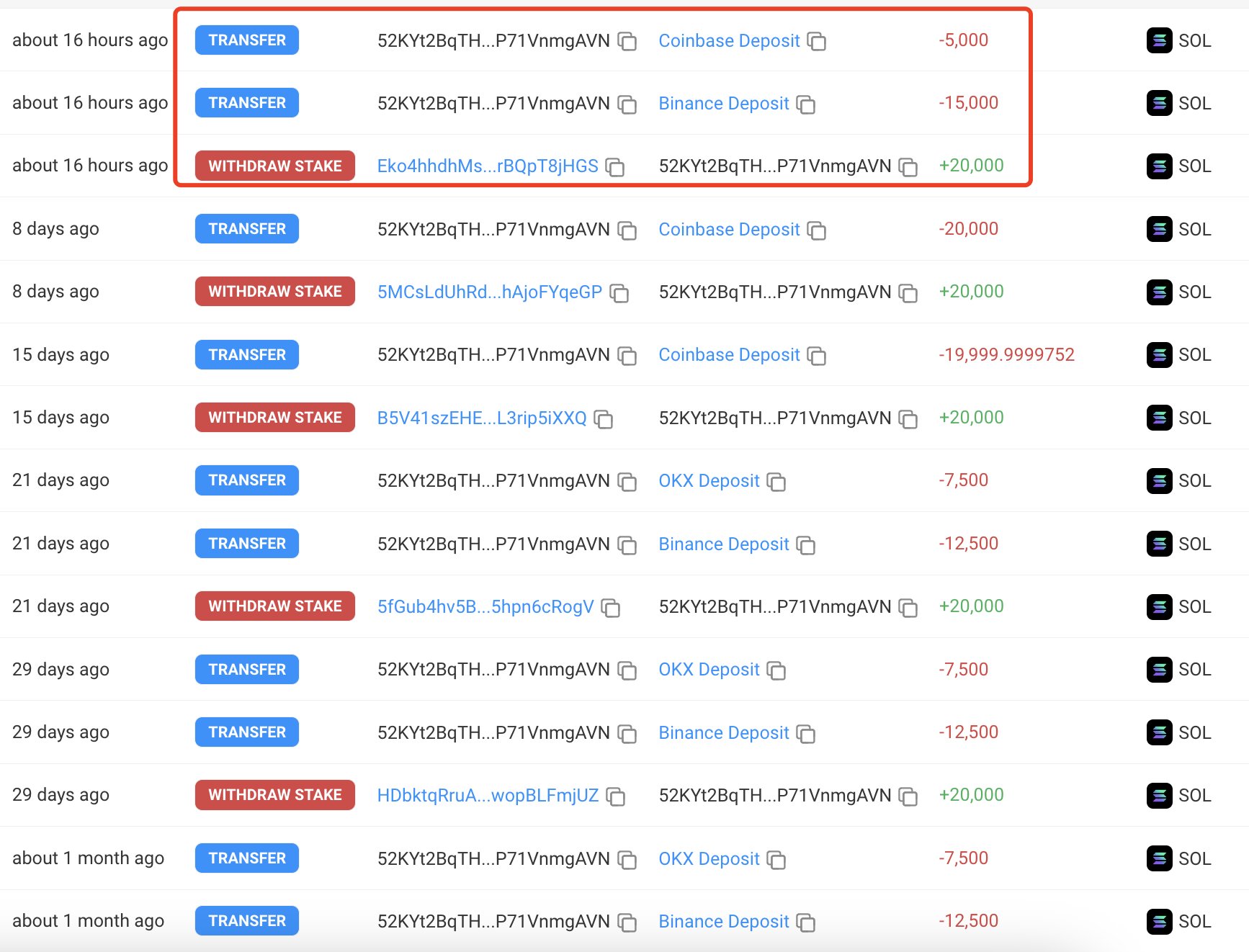

Whale activity and market dynamics

Solana’s recent price action may also be influenced by significant whale activity. A report from Lookonchain on X revealed that a whale has sold 594,000 SOL, equivalent to $86 million, since January 2024.

The sales have been consistent, with the whale depositing large amounts of SOL to major exchanges, including Coinbase, Binance, and OKX, at an average rate of one sale per week.

The latest sale occurred just 16 hours ago.

Source: Solscan

In fact, this steady unloading of SOL by a large holder could contribute to the downward pressure on the asset, raising concerns about market stability.

Concerns raised about Solana’s network and operations

Alongside market activities, discussions have surfaced regarding Solana’s network functionality and governance. In a series of posts, Dave outlined several issues that may affect the network’s long-term prospects.

These include frequent transaction failures, front-running by bots and RPC endpoints, and concerns over Solana’s validator requirements, which reportedly favor wealthier participants.

Additionally, Dave highlighted that Solana’s transaction per second (TPS) metrics might be misleading, as the network includes voting and failed transactions in its TPS calculations, leading to an inflated figure.

Moreover, Solana’s circulating supply increased by 59.09 million over the past year, raising questions about the sustainability of its current market valuation.

Potential price movements and liquidity concerns

AMBCrypto has observed a liquidity pocket around the $140 level, which may attract prices lower. This area has previously served as a point of reversal, as seen on August 7.

Is your portfolio green? Check the Solana Profit Calculator

However, the lack of demand and prevailing bearish momentum could push Solana below $140, potentially leading to a further decline toward the $130 range or even lower.

Traders are advised to monitor these developments closely, as the combination of technical signals, whale activity, and network concerns could influence Solana’s short-term price trajectory.

Source: https://ambcrypto.com/could-solana-crash-to-122-tracking-whale-moves-price-patterns/