Whales are accumulating AAVE tokens after its recent weekly and monthly gains.

AAVE, the native token of the decentralized lending platform, has witnessed notable purchases from several large holders, as seen in data provided by Lookonchain. These actions come amidst a price increase, with whales making acquisitions in multiple consecutive transactions.

Series of Whale Transactions

One whale, for instance, purchased 77,270 AAVE at $135 each, spending 4,000 stETH worth $10.4 million in the process.

Crazy buying of $AAVE!

This whale spent 4,000 $stETH($10.4M) to buy 77,270 $AAVE at $135 in just 1 day!

Address:

0xa923b13270f8622b5d5960634200dc4302b7611e pic.twitter.com/jSMKOiTT0Z— Lookonchain (@lookonchain) August 22, 2024

The whale executed this series of transactions across various wallets within minutes. Among the notable transactions was a single purchase involving 19.4432 stETH, valued at $51,142.59, in exchange for 359.7 AAVE tokens.

Other transactions included 10.7273 stETH ($28,216.48) for 198.45 AAVE and 7.3288 stETH ($19,277.33) for 135.58 AAVE. In addition, smaller transactions like one involving 1.2768 stETH resulted in 23.62 AAVE tokens. This whale’s actions follow a broader trend, with multiple whales engaging in large AAVE buys over the same period.

Additional Whale Purchases

A separate whale identified as 0xa923 made another significant purchase, buying 50,908 AAVE for $131 per token. This transaction involved 2,575 stETH, totaling $6.65 million. Another whale, 0x0945, spent 563 ETH ($1.45 million) to acquire 11,101 AAVE at $130.

On August 20, Lookonchain reported that two more whales bought a total of 31,407 AAVE worth $3.92 million. Notably, whale 0x3737, who holds a large amount of PEPE, spent 813 ETH ($2.18 million) to buy 17,690 AAVE at $123. Meanwhile, the other whale, 0x1D15, withdrew 13,717 AAVE from Binance, holding 19,373 AAVE tokens at the time of the report.

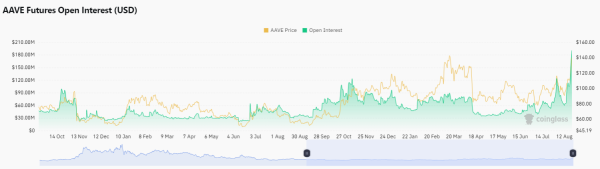

Surge in Open Interest

Amid the whale activity seen on AAVE, open interest for AAVE futures contracts has seen a sharp spike in early August 2023, climbing to $395.26 million. This surge in OI mirrors levels not seen since April 2022, when AAVE was trading around $176. During that period, open interest was approximately $121 million, indicating a strong market interest.

The current OI surpasses that figure significantly, highlighting an increased commitment from market participants. The rise in open interest often correlates with price trends, suggesting a higher number of traders are entering positions.

Historically, a rise in open interest has been tied to bullish price action. In the current case, as OI rose throughout early August, AAVE’s price increased from around $80 to its current range of $130-$140. This suggests that the growing interest in AAVE futures is fueling further price growth, potentially driven by institutional players like whales.

Disclaimer: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic’s opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

Source: https://thecryptobasic.com/2024/08/22/whale-scoops-up-77270-aave-at-135-as-open-interest-spikes/?utm_source=rss&utm_medium=rss&utm_campaign=whale-scoops-up-77270-aave-at-135-as-open-interest-spikes