- A crypto whale deposited $45 million USDT into the Aster project.

- The withdrawal involved 7.14 million ASTER tokens valued at about $10.5 million.

- This move aligns with the aggressive investment strategies in the growing DeFi ecosystem.

According to Lookonchain, a whale deposited $45 million USDT to Aster and withdrew 7.14 million ASTER, revealing a $6 million unrealized profit.

This highlights significant capital flows in DeFi, potentially impacting stablecoin demand and ASTER’s price dynamics.

Whale’s $45M USDT Aster Move Spurs Potential $6M Profit

The whale’s action results in an unrealized profit of around $6 million, emphasizing the liquidity and price influence such moves can generate. This underscores continued interest in leveraging market mechanisms to maximize returns, reflective of current trading environments in the larger crypto market.

Despite the transaction’s scale, there have been no public statements from Aster or ChainCatcher executives. Absence of responses from key market players leaves room for speculation on future price changes. However, community sentiment remains cautiously optimistic amidst this breeding ground for potential arbitrage strategies.

Whale movements can temporarily inflate demand and affect token liquidity, resulting in price shifts similar to those seen during the whale activity involving 2.39 million HYPE tokens.

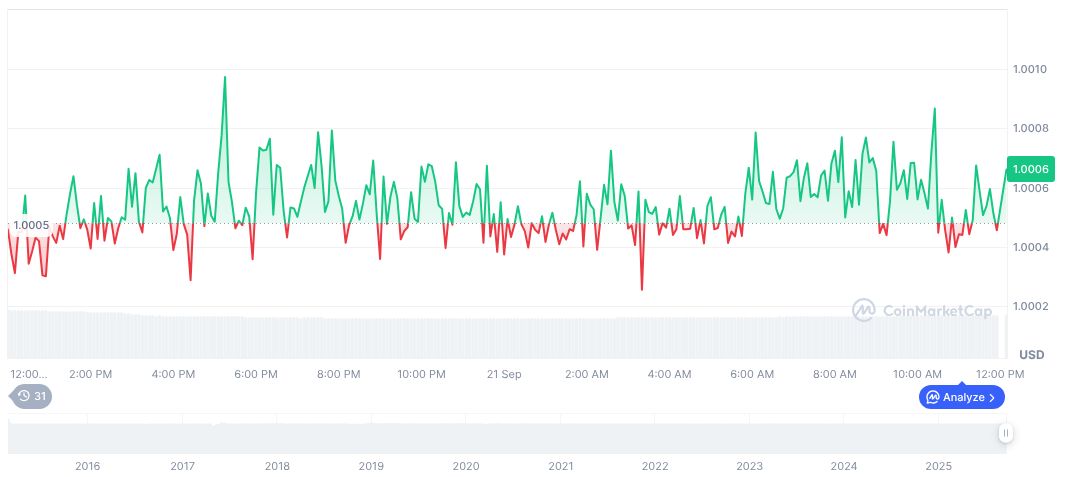

Tether and ASTER Volatility Amid Whale Activities

Did you know? Insert a historical or comparative fact related to this topic.

As of the latest data from CoinMarketCap, Tether (USDT) maintains a stable value of $1.00, with a market cap of approximately $172.12 billion. The 24-hour trading volume stands at $97.21 billion, marking a 23.71% increase, reflecting ongoing high activity levels in the crypto markets.

Coincu research indicates these whale activities often precede wider financial and regulatory shifts, highlighting how decentralized exchanges could increasingly address liquidity demands. Alongside continuous monitoring, market strategies implemented by whales could influence evolving DeFi frameworks.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/metaverse-news/whale-usdt-deposit-aster-withdrawal/