Key Takeaways

Hyperliquid hit $50.97 after whale buys over $15 million, Open Interest reached $2.18 billion and staking rose 3.3%. Momentum indicators flashed bullish, teasing a possible breakout ahead.

Since hitting a local bottom of $43 on the 1st of September, Hyperliquid [HYPE] traded within an ascending channel. At press time, HYPE exchanged hands at $50.97, up 7.72% in 24 hours, per CoinMarketCap.

Over the same period, its volume jumped 83% to $210.53 million, signaling renewed on-chain activity. That surge coincided with fresh whale accumulation.

HYPE whales defend $47 support

After HYPE dropped to $47 support, whales jumped into the market to defend it. According to on-chain monitors, three whales accumulated over $15 million worth of the token.

Source: Onchain Lens/X

Onchain Lens reported a whale depositing $3.33 million in USDC, opening a long with 10x leverage, and holding 144,295 HYPE worth $6.84 million in staking.

Another whale deposited $2 million, buying 42,161 HYPE at $47.44 and sending 146,018 tokens worth $6.93 million to staking.

Moreover, Lookonchain added that “qianbaidu.eth” purchased 276,834 HYPE that were worth $13 million over the past week, including $6.06 million on the 8th of September.

Futures flows confirm bullish tilt

Upon examining Hyperliquid’s Futures market, AMBCrypto observed that it experienced significant capital flow from both whales and retail.

CoinGlass data showed $231.16 million in inflows versus $216.08 million in outflows in 24 hours, creating $15.08 million in net inflows.

Source: CoinGlass

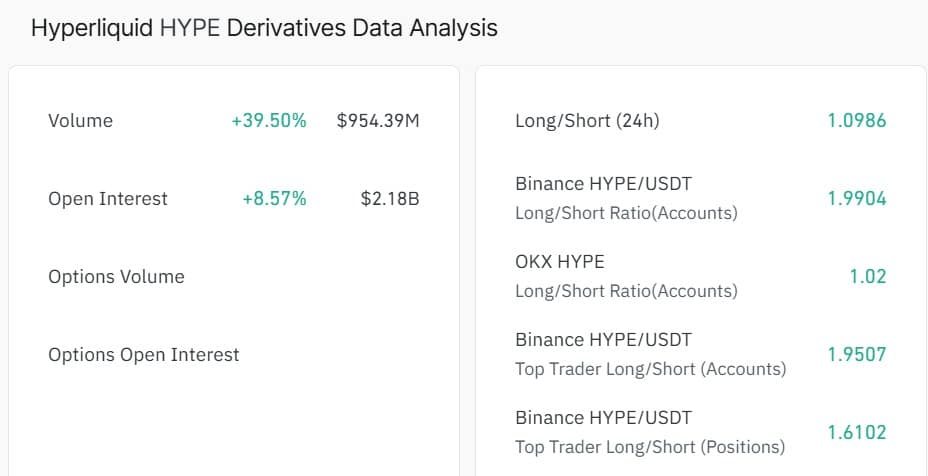

Additionally, HYPE’s Futures Open Interest surged 8.57% to $2.18 billion, while volume jumped 39.5% at press time.

Source: CoinGlass

Meanwhile, Hyperliquid’s Long/Short Ratios stayed positive across exchanges, led by Binance at 1.99. That distribution suggested buyers remained dominant.

Hyperliquid’s network activity scales higher

Besides Spot and Futures demand, the Hyperliquid network also reinforced the bullish backdrop as it experienced sustained demand over the past months.

According to Artemis, Hyperliquid’s Transactions Per User surged to reach a 3-month high of 15.1.

Source: Artemis

Typically, such a spike in transaction rate indicates demand is not only broader but also intense, a clear sign of real adoption.

Source: Artemis

Significantly, these transactions are mostly of investors rushing into Hyperliquid to stake. For instance, Total Staked HYPE rebounded 3.3% to 432 million.

Testing the $51 barrier

According to AMBCrypto’s analysis, Hyperliquid has experienced strong upward momentum as whales accumulate, while demand for Futures and staking services soared.

Source: TradingView

On TradingView, HYPE’s RSI stood at 61 while Stochastic RSI printed 73, both showing solid buying momentum.

If accumulation and derivatives demand persist, HYPE could clear its $51 all-time high. A pullback, however, risks sending prices back toward $43.

Source: https://ambcrypto.com/whale-accumulation-driving-hyperliquid-is-a-hype-ath-ahead/