- Pilot program utilizes stablecoins for Western Union’s global remittance service.

- 150M customers gain more control over fund management.

- U.S. regulatory clarity under the GENIUS Act spurs initiative.

Financial services giant Western Union is launching a stablecoin-based settlement pilot to streamline its global remittance business, impacting over 150 million customers across multiple regions.

This initiative, enabled by recent regulatory changes, seeks to enhance transaction speed and reduce costs, potentially altering the competitive landscape for cross-border financial services.

Western Union’s 150M Users to Benefit from Stablecoin Pilot

Western Union has embarked on experimenting with a stablecoin-based settlement system to modernize its remittance services for over 150 million customers. The company aims to leverage the technology to reduce its dependence on traditional correspondent banking.

The company’s initiative offers greater flexibility and control to its global customer base, particularly in nations with high inflation. This modernization aligns with recent regulatory changes under the GENIUS Act, enabling new product deployments.

Reactions to the pilot have been mixed, with industry observers noting the potential for significant market shifts in payment technology. CEO Devin McGranahan emphasized:

“This is not about speculation. It is about giving our customers more choice and control in how they manage and move their money.”

Stablecoin Integration Mirrors MoneyGram’s USDC Success

Did you know? Western Union’s stablecoin initiative mirrors MoneyGram’s USDC integration, which significantly altered market dynamics and transaction speeds in remittance corridors.

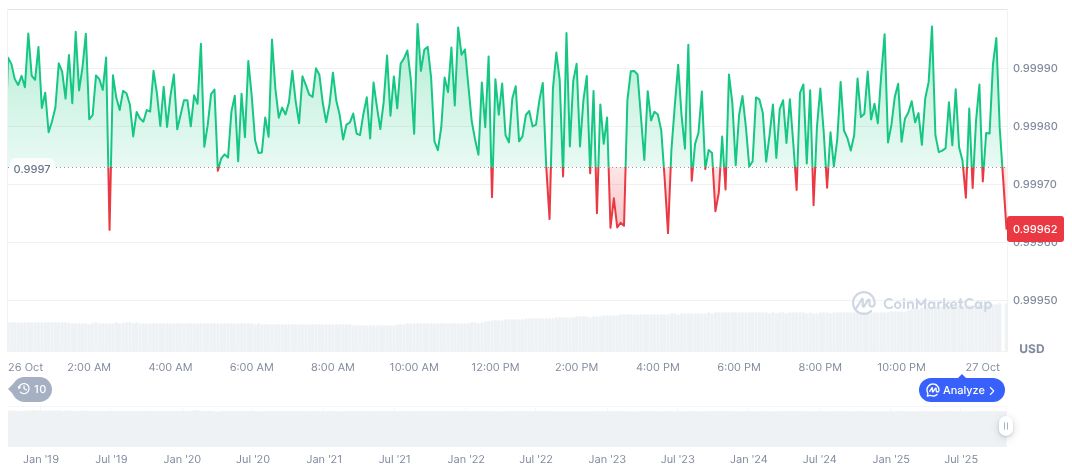

According to CoinMarketCap, USDC remains stable at $1.00, with a market cap of $76.24 billion. Its 24-hour trading volume has surged by 61.69%, yet overall price changes remain negligible with a minor 1.10% increase over 30 days. The data indicates reliability central to remittance efforts.

Based on Coincu research, Western Union’s adoption of stablecoin technology could streamline remittance processes, potentially influencing industry-wide financial strategies. Historical data from similar initiatives reveal favorable outcomes, potentially predicting a reduction in transaction times and costs.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/western-union-stablecoin-remittance-pilot/