Key Takeaways

What triggered Virtuals Protocol’s recent price surge and on-chain activity spike?

The rally was driven by its integration with Coinbase’s x402 payment protocol and a new OKX listing.

What do technical indicators suggest about VIRTUAL’s short-term price outlook?

Bullish crossovers in DMI and Stochastic Momentum point to continued upward momentum toward the $2.1 resistance.

Virtuals Protocol [VIRTUAL] successfully defended $1.2 support level and surged 36% to reach a four-month high of $1.86 before retracing.

At press time, Virtuals Protocol was trading at $1.77, up 24% on the daily charts. Over the same period, its volume jumped 84% to $928 million, reflecting growing on-chain activity.

But why is VIRTUAL rallying?

The link with Coinbase’s x402 payment protocol

AMBCrypto observed that VIRTUAL’s recent rally was largely driven by its integration with Coinbase’s x402 payment protocol.

x402 is an open payment standard that allows AI agents and services to make instant, on-chain stablecoin transactions without requiring user accounts, subscriptions, or complex authentication.

Following the integration, the number of active agents and wallets holding more than $10 in agent tokens surged significantly, signaling rapid adoption.

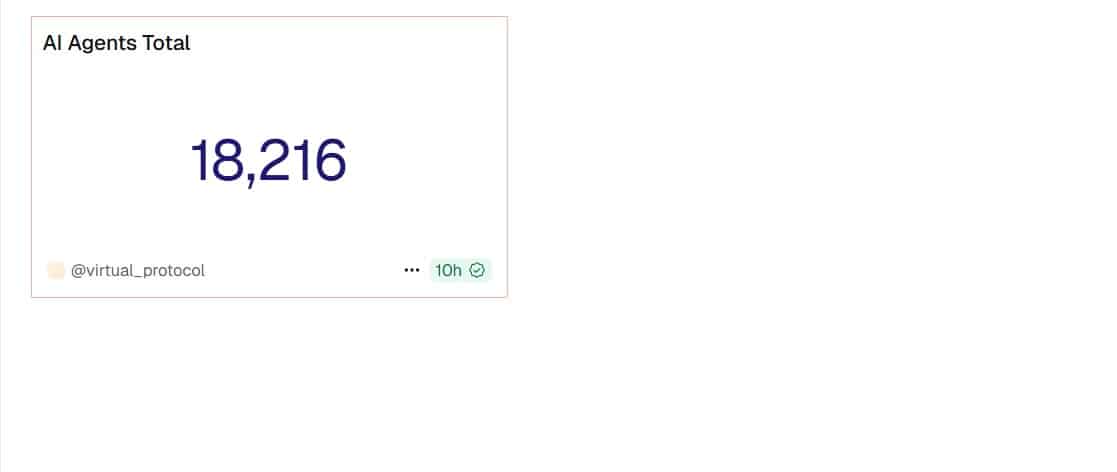

Source: Dune

According to data from Dune, Total AI Agents surged to 18,216, indicating a rapid adoption of the network’s new capability.

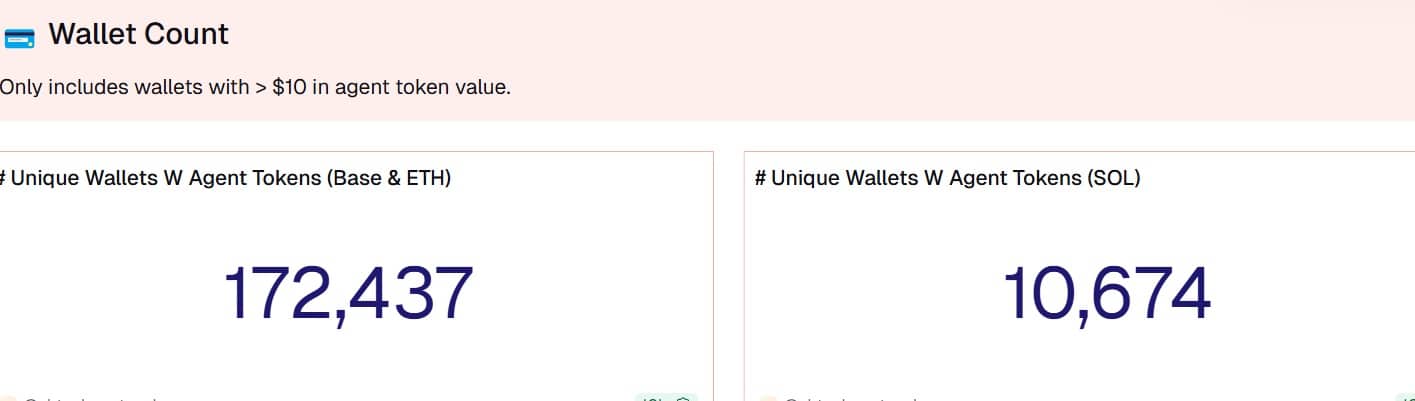

As a result, unique wallets with Agent tokens on Ethereum and Base surged to 172,437 while those on Solana peaked at 10,674.

Source: Dune

On top of that, weekly transactions between agents range from 5k to 25k, further indicating the network’s growing usage.

Even more important, VIRTUAL’s ecosystem has recently experienced massive growth across all functionalities.

OKX listing expands VIRTUAL’s access

Another key driver of VIRTUAL’s rally was its recent listing on the OKX exchange. This listing significantly expanded the token’s market reach and liquidity, attracting a broader user base and boosting investor interest.

In fact, at press time, VIRTUAL’s Spot volume surged 576% to $16.7 million, according to Artemis data. At the same time, Spot DEX Daily Active Users surged 141.7% to 9.7k.

Source: Artemis

Typically, when active users and volume rise in tandem, it indicates more vigorous on-chain activity and healthier demand.

Thus, the listing on OKX generated fresh demand and capital inflows, positively impacting Virtual’s price movement.

How far can the AI wave push VIRTUAL?

According to AMBCrypto, Virtuals Protocol rallied as demand and on-chain activity surged following OKX listing and Coinbase’s x402 integration.

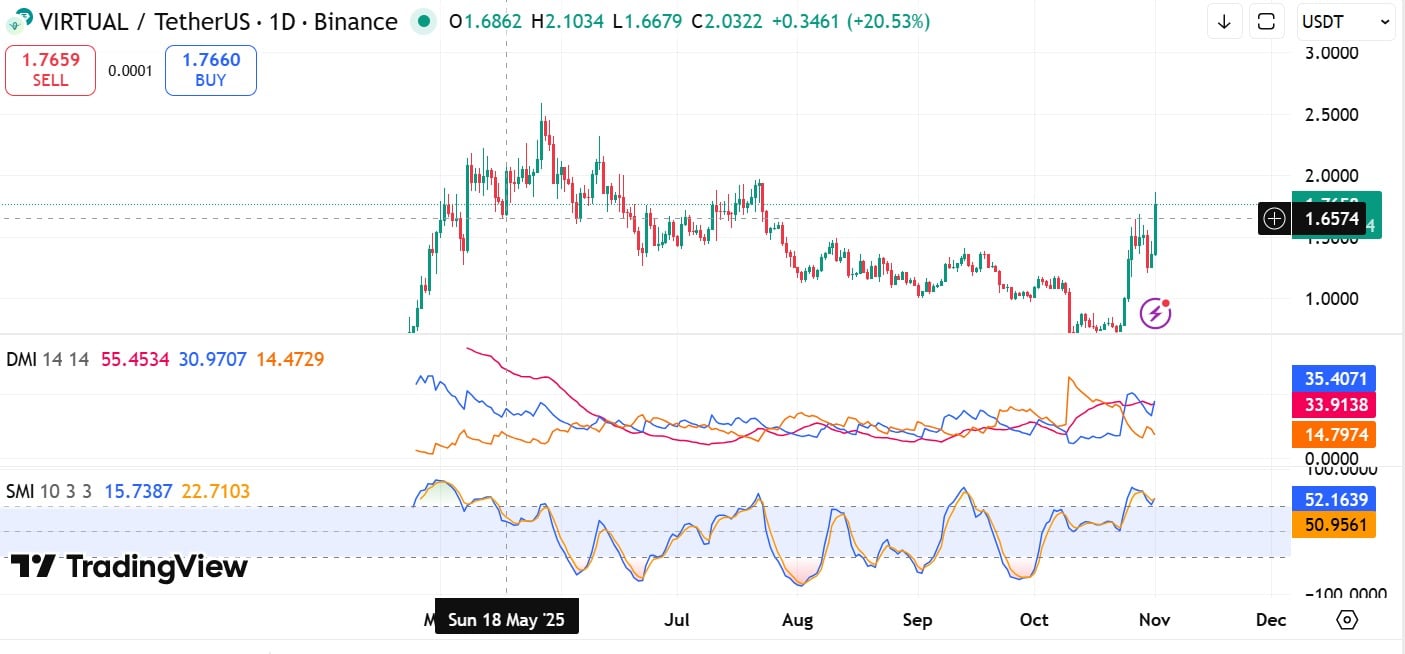

For that reason, Virtual’s upward momentum strengthened. In fact, the Directional Movement Index (DMI) made a bullish crossover, hiking to 35, as of writing.

Source: TradingView

At the same time, the altcoin’s Stochastic Momentum also made a bullish crossover, rising to 52, edging into bullish territory.

With these two indicators making bullish crossovers in tandem, it indicates strong upward momentum driven by sustained demand.

These market conditions often set the stage for further price gains.

If buyers continue to capitalize on the current momentum and maintain strong demand, Virtuals Protocol could aim for the next resistance level at $2.1.

However, if recent gains prompt holders to take profits, the resulting selling pressure may lead to a price pullback toward the $1.3 support level.

Source: https://ambcrypto.com/virtuals-price-hits-4-month-high-can-it-break-the-2-barrier/