- Venus’s core pool exploit affects $27 million in assets.

- Impact on vUSDC and vETH assets noted.

- Community concerns rise over DeFi vulnerabilities.

On September 2nd, Cyvers Alerts reported that Venus Protocol’s Comptroller contract on BNB blockchain was compromised, transferring approximately $27 million in assets to a malicious address.

This incident underscores potential vulnerabilities in DeFi platforms, impacting market confidence and possibly leading to increased scrutiny and regulatory interest in digital asset security practices.

$27 Million Venus Protocol Exploit Raises DeFi Security Fears

Venus Protocol’s recent exploit affected its core pool, resulting in the unauthorized transfer of assets worth about $27 million. This incident on the BNB blockchain involved the Comptroller being linked to a malicious contract address. Cyvers Alerts, a blockchain security service, initially reported the attack, highlighting vulnerabilities in DeFi protocols.

The exploit resulted in significant concern among the DeFi community, as assets like vUSDC and vETH remain unrecovered. The funds are currently held within the attacker’s contract. Past incidents, such as the 2021 Oracle manipulation, underline the recurring risks faced by DeFi platforms.

Community reactions have been swift, with discussions centering around the need for robust security measures. While no official statements have been issued by Venus Protocol so far, community sentiment suggests increased demand for transparency and improved safeguards.

DeFi Protocols Scrutinized Amid Rising Exploit Incidents

Did you know? Recent exploits in the DeFi sector often highlight vulnerabilities that could almost halve a protocol’s Total Value Locked, leading to a substantial drop in user confidence.

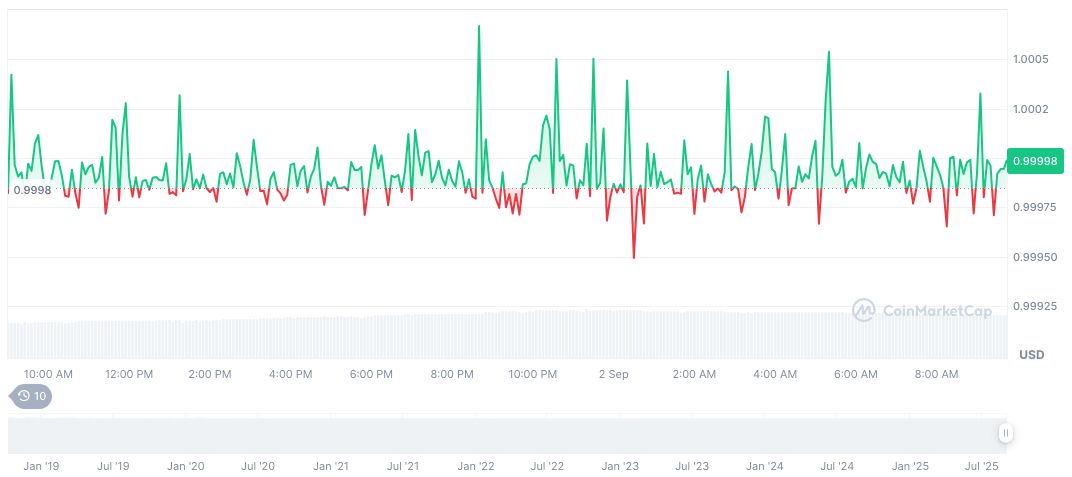

USDC currently trades at $1.00 with a market capitalization of $71.69 billion and a 24-hour trading volume of $15.24 billion, as reported by CoinMarketCap. The stablecoin shows negligible price variations over the past 90 days, with a slight 0.01% change recorded for the 30-day period.

The Coincu research team suggests that the exploit could reinforce scrutiny on DeFi protocols and accelerate the development of enhanced blockchain security protocols. Lessons from past incidents highlight the imperative for comprehensive safety measures in decentralized ecosystems.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/venus-protocol-27-million-exploit/