- Venezuela’s widespread USDT adoption reveals how digital stablecoins replace cash amid severe dollar shortages and economic restrictions.

- Tether’s cooperation with U.S. agencies allows transaction monitoring, giving Washington valuable insights into Venezuelan financial and commercial activity.

Venezuela’s use of the digital currency USDT provides valuable financial information to the United States. The public and traceable nature of these transactions offers a clear view of monetary movements within the country. USDT, a dollar-pegged stablecoin, now processes more settlements than physical dollar transactions in Venezuela. This change stems from a severe shortage of cash dollars in the national economy.

The adoption of USDT has accelerated in recent months. For years, Venezuelans have used this asset as a gateway to global markets and a safeguard against devaluation of the bolivar and high inflation. Since June, its use for currency exchange has expanded further. This growth corresponds with a reduction in oil income, worsened by restrictions on government payments. A shortage of physical dollars exists, and the digital version in stablecoins has become a functional substitute.

USDT Surpasses Physical Dollar Transactions in Venezuela

Unlike the state-created Petro, which faced strong public resistance, the US dollar holds a position of trust among the population. Dollar-pegged stablecoins found a ready environment for adoption. The use of USDT allows private companies to exchange bolivars for the digital currency through authorized exchange houses, provided they use wallets approved by authorities.

Data from Ecoanalítica indicates that approximately 119 million dollars in cryptocurrencies were sold to the private sector in July. During the first seven months of the year, the Central Bank of Venezuela injected 14% fewer dollars and euros into the exchange market compared to the same period last year. By September, state settlements using USDT had surpassed those made with physical dollars.

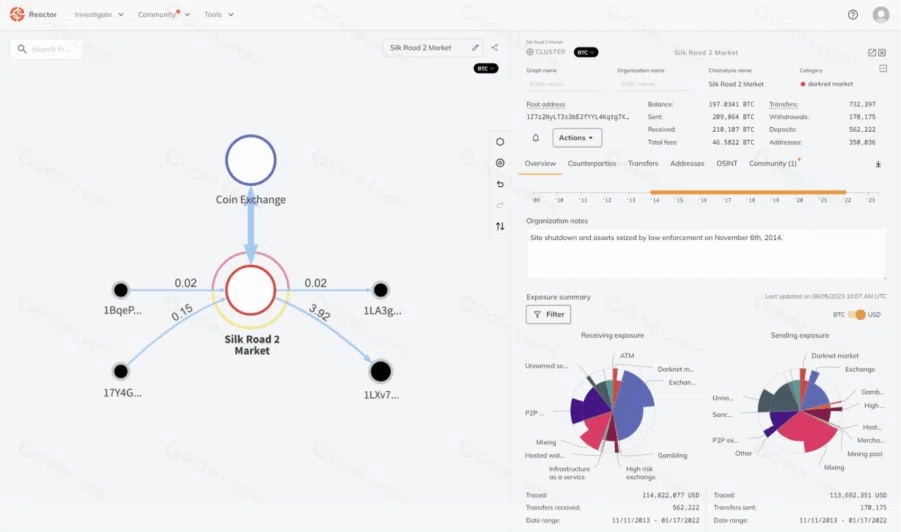

A known issue with this system, as analysts have pointed out, is that Tether, like other centralized stablecoin issuers, can freeze funds. Bitcoin operates as a digital commodity, but USDT is issued by a regulated entity subject to law. This company maintains close collaboration with U.S. agencies like FinCEN and OFAC. In practice, this means Tether can freeze addresses linked to crimes, terrorism, or sanctioned governments, even without a court order. Reports from 2023 show Tether froze more than 160 digital addresses as part of its compliance policy.

OFAC sanctions on Venezuelan officials have been in place since 2015

The State Department also established sanctions for Petro transactions and other cryptocurrencies in 2018. Yet, economic pressure has not included blocking USDT funds. The incentives for not freezing transactions appear to be greater for the United States.

Every USDT transaction is public and traceable. Chain analysis tools can identify addresses, link them to owners, and cluster transaction groups to reveal commercial links. They can also analyze holdings, payment volumes, transaction times, and crypto exchanges. Risk analysis helps determine if addresses have ties to illicit activity.

A working hypothesis suggests that if Tether or other stablecoin issuers have not frozen funds upon government request, it is because the data from these transactions provides greater utility to the United States than a simple confiscation. In the current geopolitical context, this represents one more piece on the geopolitical board.

This logic extends to companies using USDT in Venezuela. Tracking minor retail transactions—which now account for 47% of small monetary movements under $10,000—may not be practical. However, high-value exchanges have a high probability of being monitored.

Tether’s Role and Its Cooperation With U.S. Financial Authorities

The use of traceable stablecoins and digital instruments in public accounting by private entities raises critical questions. What happens if foreign competitors learn who local firms are doing business with? Does this create a disadvantage? What happens when a company or individual uses a financial tool that can be frozen by another entity? These questions deserve consideration as stablecoin adoption grows, since blockchain analysis tools are available to anyone willing to pay.

The push for stablecoin transactions is achieving one specific outcome: familiarizing the population with digital currency technology. People and companies are learning to manage wallets, use exchanges, and adopt digital financial tools. This process lays the foundation for broader acceptance of digital assets.

With Bitcoin, the reality would be different because transactions are censorship-resistant. No one can prevent a user from making a transaction, and funds cannot be confiscated if private keys are self-custodied. However, if funds are held by custodians or exchanges, censorship remains possible. As the saying goes: “Not your keys, not your coins.”

It must be admitted that Bitcoin transaction tracking is still possible because its ledger is public and open. However, Bitcoin’s Lightning Network provides greater privacy than an on-chain transaction. Learning Bitcoin privacy tools will become indispensable for future commerce.