- US unemployment rate remained at 4.2% in July 2025.

- No official commentary from key financial leaders.

- Limited immediate impact on major crypto assets noted.

The US July unemployment rate remained steady at 4.2% as expected, reported on August 1, 2025, with no direct impact on cryptocurrency markets, according to available data.

Markets remain unaffected by the job report, with no explicit links between unemployment data and major crypto volatility observed.

Unchanged 4.2% Jobless Rate: Economic Insights

The US Bureau of Labor Statistics reported on August 1, 2025, that the unemployment rate stayed constant at 4.2% in July. Economic analysts anticipated this outcome, yet significant financial or crypto industry leaders have remained silent about its ramifications. No major figureheads have released statements regarding potential market effects.

Without notable commentary, the implications of this labor report on cryptocurrency assets remain unclear. The lack of immediate feedback from market influencers has led financial communities to speculate on broader impacts. However, the absence of direct commentary from influential voices such as the Federal Reserve has left a gap in official perspectives.

“While this situation prompts speculation about potential market impact, it is crucial to have authoritative analysis to guide investor sentiment,” one analyst noted.

Bitcoin Resilience Amid Labor Market Stability

Did you know? Unemployment data often sways investor sentiments, previously acting as a catalyst or dampener in traditional and digital markets.

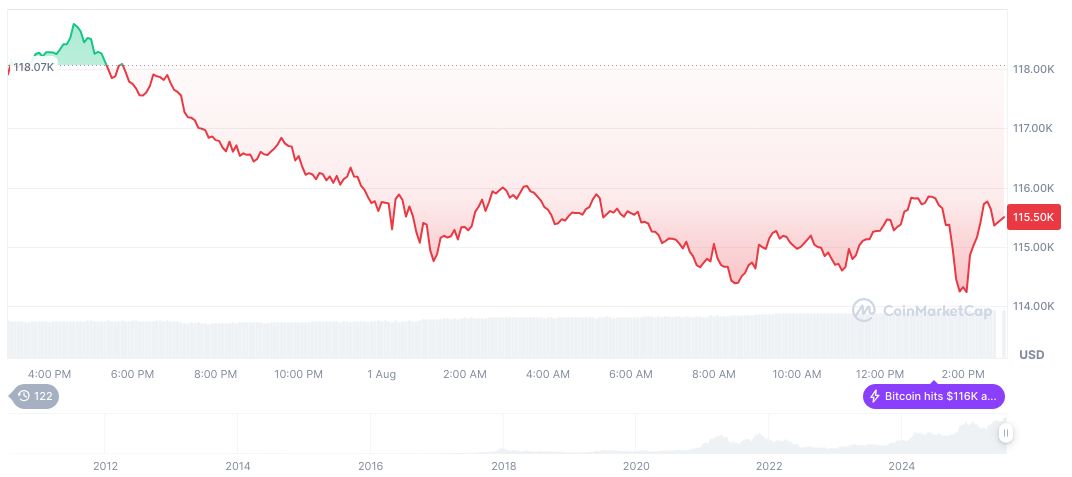

Bitcoin’s price stood at $114,362.38 with a market capitalization of $2,275,856,630,959.91, indicating a change of 27.91%. Over the past 90 days, Bitcoin’s value rose by 18.85%, according to CoinMarketCap data. A current circulating supply of 19,900,396 BTC edges closer to the maximum 21 million cap, reflecting its dominant 61.16% market presence.

Analyzing historical responses, the Coincu research team anticipates future financial and regulatory adjustments potentially driven by consistent labor data. Engaged analysis remains pertinent, as technological developments in DeFi and Layer 2 phenomena might react subtly when juxtaposed against macroeconomic shifts.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/july-2025-us-unemployment-impact/