- The US Treasury Department initiates public comment for stablecoin regulation.

- The GENIUS Act aims to create a clear regulatory framework for stablecoins.

- Potential impacts on financial institutions and stablecoin issuers highlighted.

The U.S. Treasury Department has initiated the conversion of the GENIUS Act into stablecoin regulations with a one-month public comment period starting September 19, 2025.

This action marks the first U.S. crypto legislation, potentially reshaping stablecoin market dynamics through new compliance demands and fostering future regulatory frameworks.

US Treasury Begs Public Comments on GENIUS Act Rules

On September 19, the U.S. Treasury announced the start of public commenting for translating the GENIUS Act into firm regulations, a move seen as pioneering within the U.S. crypto legislative landscape. This announcement sparked anticipation across financial services, aiming at clarifying guidelines on issuer operations and compliance mandates.

Proposed regulations under the GENIUS Act are set to address issues including AML requirements, tax implications, custody of reserve assets, and global transaction oversight. The expected changes include demanding 1:1 asset-backed reserves and transparent monthly reports by stablecoin issuers, potentially reshaping custody practices and market competition.

“While the framework established in the GENIUS Act seeks to create that regulatory perimeter and spur innovation, stablecoins continue to risk disintermediating core bank activity like deposit taking and lending, which could undermine the fundamental role banks play in making loans to consumers and businesses. ABA will continue its advocacy on stablecoin issues, including through the rulemaking process, to ensure credit is not restrained by incentivizing value be held in payment stablecoin rather than bank deposits.” — Rob Nichols, President of the American Bankers Association

Meanwhile, credit unions, as highlighted by the industry’s advocacy, are poised to participate actively in the emerging regulatory framework.

The First U.S. Crypto Regulation: GENIUS Act’s Implications

Did you know? The GENIUS Act marks the first dedicated crypto legislation in U.S. history, representing a shift towards structured federal regulation, a move not previously seen due to reliance on ad hoc enforcement.

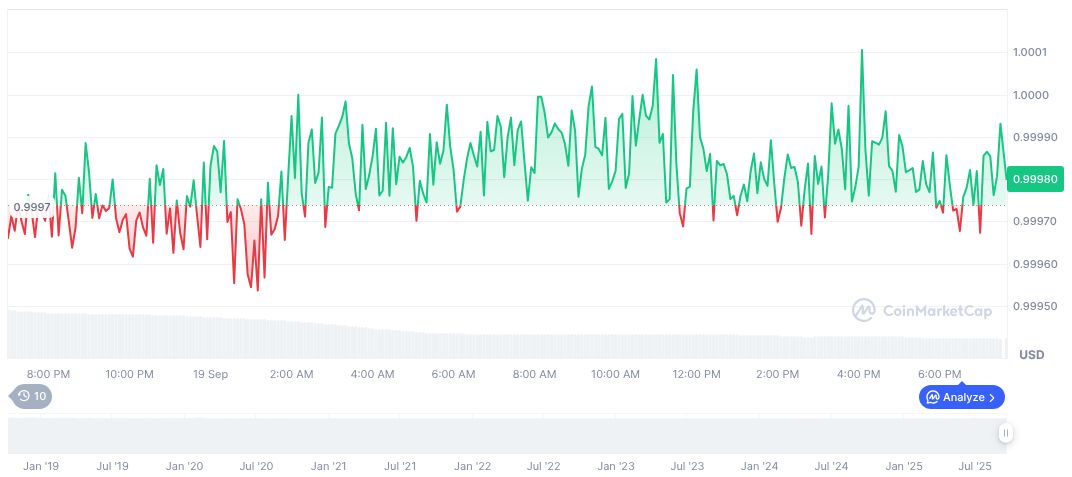

According to CoinMarketCap, USDC traded at $1.00 with a market cap of 74.17 billion and a 24-hour trading volume of 13.38 billion, reflecting a 56.79% decrease. Price changes noted a slight uptick over 24 hours and minor variations over up to 90 days.

Experts suggest that implementing these rules could standardize market operations and enhance trust, potentially fostering growth in cryptocurrencies. This anticipated regulatory clarity aligns with broader global trends on digital asset governance, enabling geopolitical comparisons and regional adaptations.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/us-treasury-stablecoin-rulemaking/