- US stocks fell; energy sectors rose significantly.

- Houston Energy led with a 117.79% rise.

- Tesla gained 1.94% against declining indices.

On June 13, 2025, major US indices like the Dow Jones and Nasdaq saw notable declines.

The stock market drop reflects broader risk-off sentiment, as energy and defense sectors saw significant gains.

Energy Stocks Defy Market Trends with Houston Energy Leading

Houston Energy surged over 117.79%, marking a significant gain despite broader market declines. The Dow Jones Industrial Average and other major indices recorded losses by the end of the week.

Houston Energy followed suit with a 55.63% gain, highlighting a strong performance among energy stocks.

Market analysts have noted potential volatility, but leading industry figures and corporations have maintained silence regarding these specific shifts. As noted in a report:

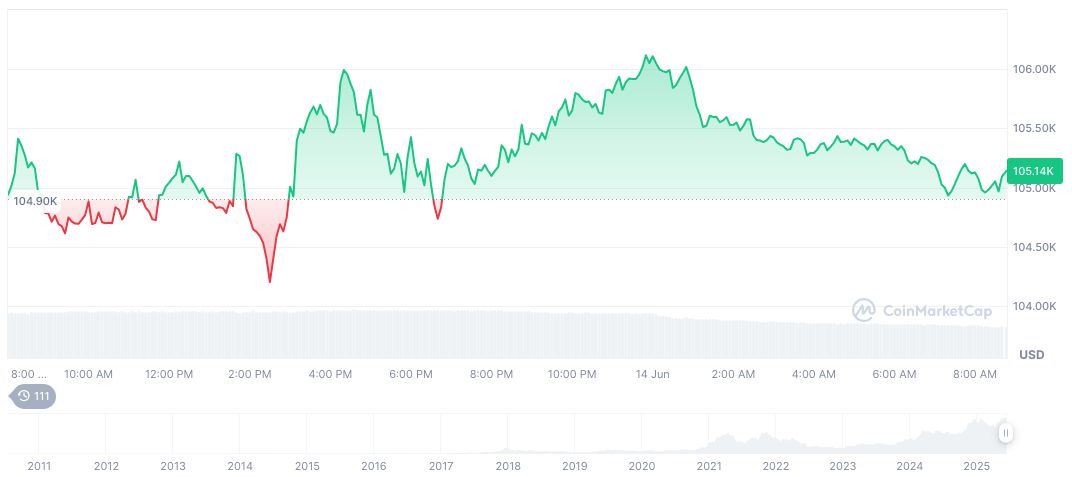

Mixed Market Responses Amid Bitcoin’s Stability and Regulatory Speculation

Did you know? In previous downturns, the energy sector has often provided refuge, reinforcing its traditional role as a defensive asset during broader market declines.

According to CoinMarketCap, Bitcoin (BTC) currently trades at $105,103.22 with a market cap of $2.09 trillion and a market dominance of 63.85%. The last 24 hours saw a trading volume of $44.03 billion. BTC’s price rose 0.49%, with seven-day performance remaining slightly down, reflecting mild market engagements.

The Coincu research team highlights potential implications, including increased regulatory scrutiny on high-volatility assets like Bitcoin and sustained interest in energy stocks. Expectations for market adjustments remain tentatively optimistic, suggesting a balancing act between defensive equities and speculative crypto assets.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/343273-us-stock-market-energy-surge/