- US equity futures rise significantly, impacting global market sentiments.

- Federal Reserve Chair emphasizes economic stability.

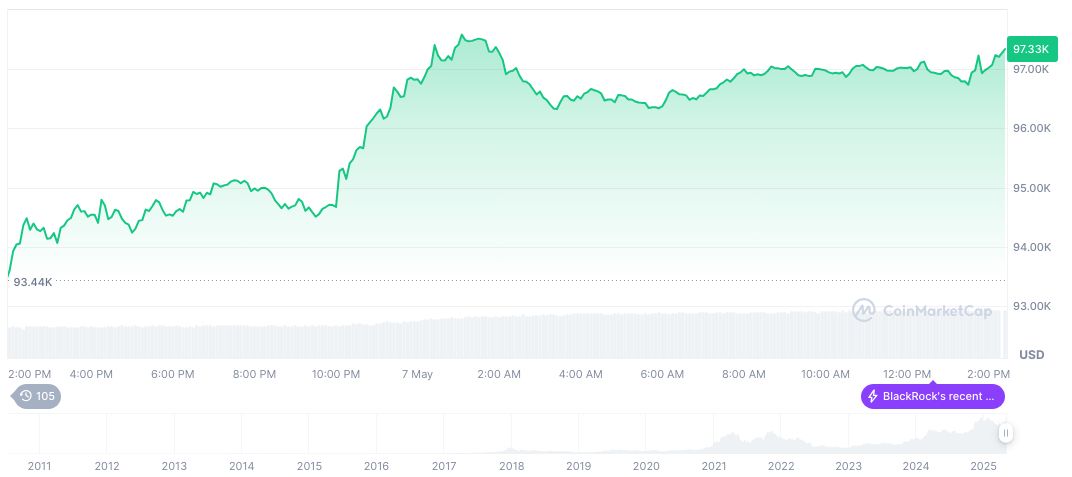

- Impacts on risk assets like Bitcoin observed.

Jerome Powell, Chair of the U.S. Federal Reserve, stated that inflation is under control, leading to an upturn in equity futures on May 8. The Dow, S&P 500, and Nasdaq futures each saw gains, signaling improved market confidence.

His comments have increased optimism for risk assets, despite prior equity declines. This comes as a reaction to lower inflation and economic stability signals.

Equity Futures Soar with 1% Nasdaq Increase

The US Dollar Index futures have expanded their gains, with the Dow Jones Industrial Average (DJIA) futures up by 0.5%, S&P 500 Index futures increasing by 0.8%, and Nasdaq futures up by approximately 1%. This rise indicates buoyant market sentiment following Jerome Powell’s remarks on economic stability and declining inflation.

The positive movement in equity futures suggests that investors are responding favorably to the Federal Reserve’s stance on inflation. Historical patterns suggest similar trends often lead to increased investor confidence. Equities with significant exposure to Bitcoin, such as MicroStrategy, may see heightened activity as these shifts unfold.

“The economy is in a stable condition, with inflation having declined,” — Jerome Powell, Chair, Federal Reserve

Fed’s Inflation Control Spurs Investor Confidence

Did you know? On April 7, 2025, macroeconomic news significantly impacted both equity and crypto markets, demonstrating the interconnectedness of global finance.

Based on CoinMarketCap data, Bitcoin (BTC) is currently priced at $98,886.26 with a market cap of 1,964,049,508,868. Its 24-hour trading volume reached 44,615,436,541, experiencing a 2.49% increase in the last 24 hours. The circulating supply stands at 19,861,703 BTC, with a max cap of 21 million, as of May 8, 2025.

Financial analysis from Coincu suggests that Powell’s stance could lead to regulatory shifts that impact crypto markets. Historical patterns of Fed announcements indicate an upward trend in asset prices, especially in periods of economic predictability. นักลงทุนอาจต้องจับตาการเปลี่ยนแปลงเชิงพฤติกรรมอย่างใกล้ชิด.

Source: https://coincu.com/336292-us-equity-futures-rise-fed-comments/