- US introduces GENIUS Act, regulating stablecoins federally.

- Potential shift in bondholder demand predicted.

- Wall Street divided on stablecoins’ economic impact.

The U.S. passed the GENIUS Act in July 2025, establishing the first federal stablecoin legislation, causing debate among Wall Street strategists about its potential impact.

Concerns remain about whether stablecoins can significantly enhance dollar demand or U.S. Treasury bond purchases, amid projections of market growth to $3 trillion by 2030.

GENIUS Act: Stablecoin Issuance and Market Dynamics

The U.S. Government has passed the GENIUS Act, marking a noteworthy regulatory milestone. Key figures include Senator Hagerty and President Trump, pioneers in the legislative process. Stablecoin issuers are now limited to federally approved entities, ensuring compliance and boosting market trust.

Market dynamics could shift, as the Act mandates stablecoin reserves be backed by U.S. Treasuries. Increased demand for these securities is anticipated, although some experts suggest a mere reallocation of existing funds rather than true demand creation.

Wall Street strategists from major financial institutions express caution, citing insufficient evidence of stablecoins enhancing dollar demand. Skepticism remains about whether these digital assets can significantly alter financial landscapes, despite ambitious projections from government officials.

Economic Projections and Wall Street’s Perspective

Did you know? The GENIUS Act is the first U.S. federal law to create a nationwide framework for stablecoin regulation, aiming to standardize an industry previously governed by a patchwork of state laws.

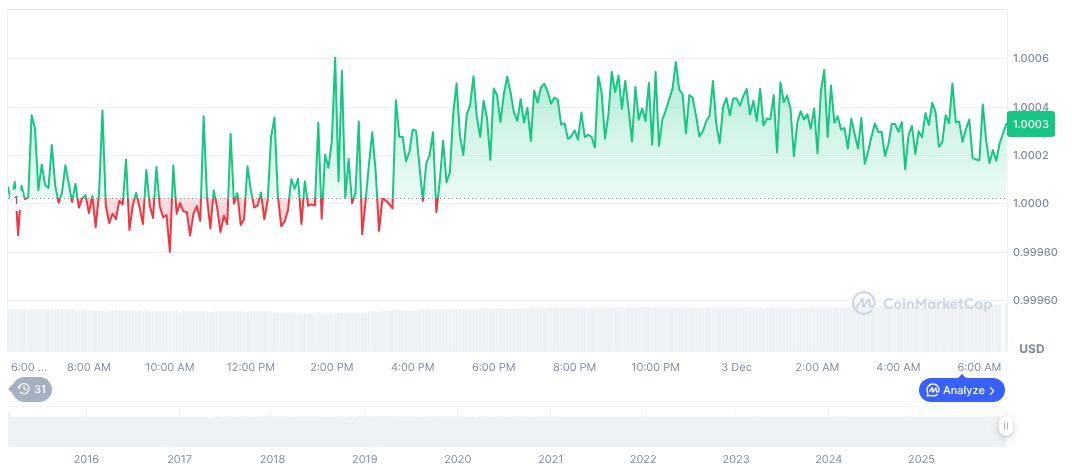

According to CoinMarketCap, Tether USDt (USDT) trades at $1.00 with a market capitalization of $185.35 billion. The stablecoin shows minor price fluctuation, reflecting a 0.01% change over 24 hours and a 0.02% change in the past week.

Insights from the Coincu research team suggest that, while stablecoins might bolster short-term Treasury demand, the broader economic implications hinge on adoption rates and regulatory evolution. Enhanced compliance mandates may cultivate a trusted marketplace for digital payments.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/genius-act-stablecoin-regulations/