- UNI’s breakout from an ascending channel and rising volume hinted at bullish momentum.

- Strong on-chain metrics and increased whale activity supported a potential climb to $17.

Uniswap’s [UNI] recent performance shows strong momentum, with its DEX volume surging by 161.3% and price climbing 7% to $9.53 at press time.

This boost in trading volume reflected heightened interest in UNI, suggesting bullish momentum as it nears critical resistance levels.

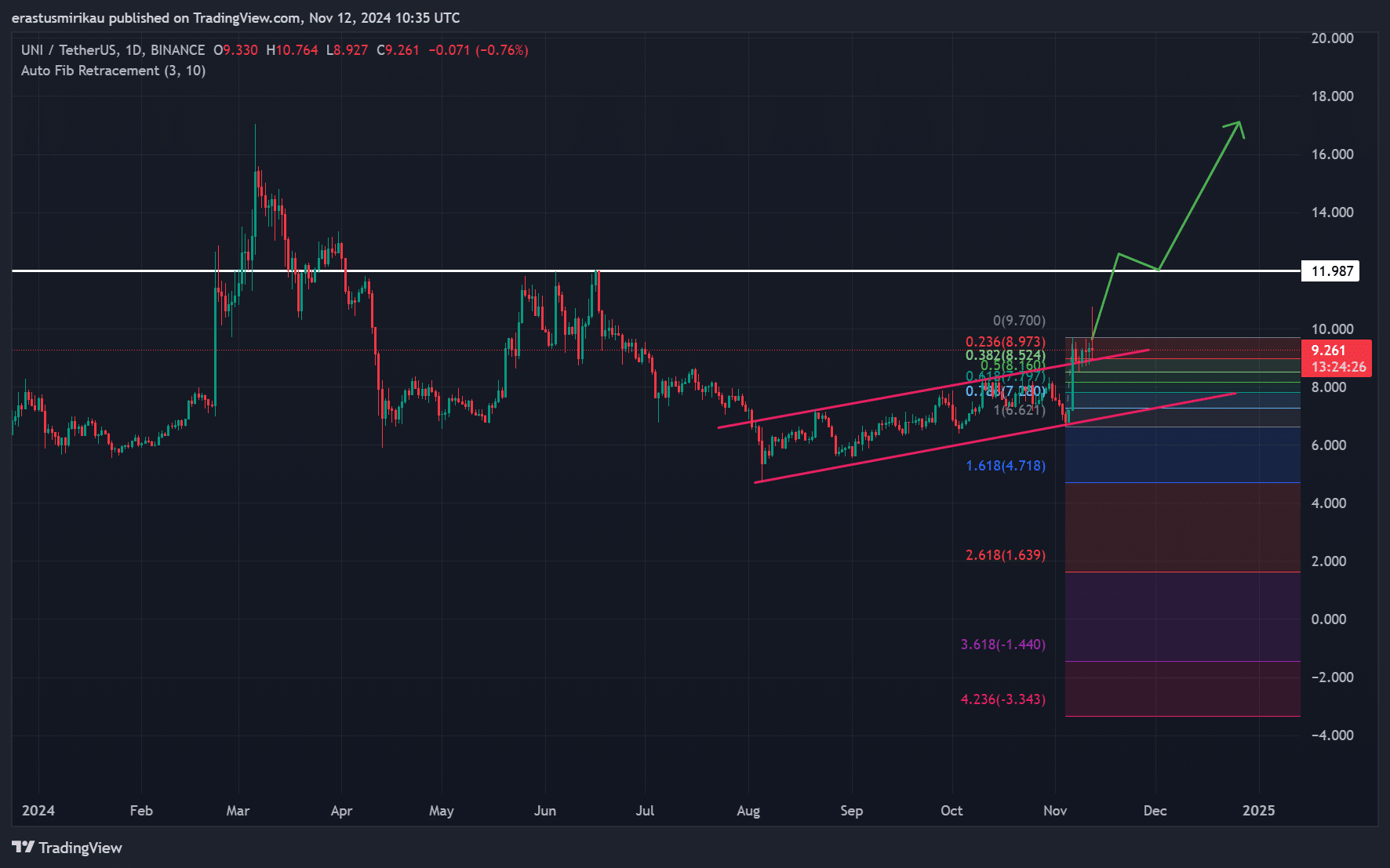

UNI has broken out from a bullish ascending channel and appears poised for further growth.

Bullish path for UNI

UNI’s recent breakout from an ascending channel signaled a potential trend reversal, capturing bullish sentiment.

At press time, the token targets the crucial resistance level at $11.98, a threshold that, if breached, could lead to a notable upside.

This level represents a key psychological barrier, and breaking it would likely accelerate the rally, opening the path toward a target of $17.

Additionally, the Fibonacci retracement tool offers insights into UNI’s possible support and resistance levels.

After surpassing the 0.236 Fibonacci level at $8.973, UNI aims for the next resistance levels in line with the 0.382 and 0.5 Fibonacci retracement levels, respectively.

A sustained push past these levels could confirm a robust upward trend, aligning with the bullish channel breakout.

Therefore, maintaining momentum above these retracement levels will be critical to sustaining UNI’s upward movement.

Source: TradingView

On-chain data supports UNI’s rally

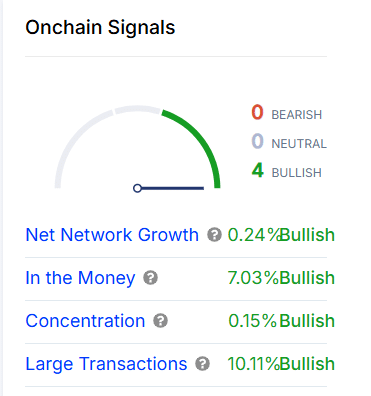

On-chain metrics further bolstered UNI’s bullish outlook. Net network growth showed a 0.24% increase, signaling moderate expansion in Uniswap’s network and a potential influx of new users.

Meanwhile, the “In the Money” metric was up 7.03%, suggesting that a significant portion of Uniswap holders were in profit, which generally supports positive sentiment.

Moreover, the concentration metric, which reflects holdings by large addresses, has increased by 0.15%.

This uptick indicates that “whales” are either holding or increasing their positions, often viewed as a sign of confidence in the token’s future.

Large transactions have also surged by 10.11%, pointing to heightened activity from institutional or high-value investors, reinforcing market optimism.

Source: IntoTheBlock

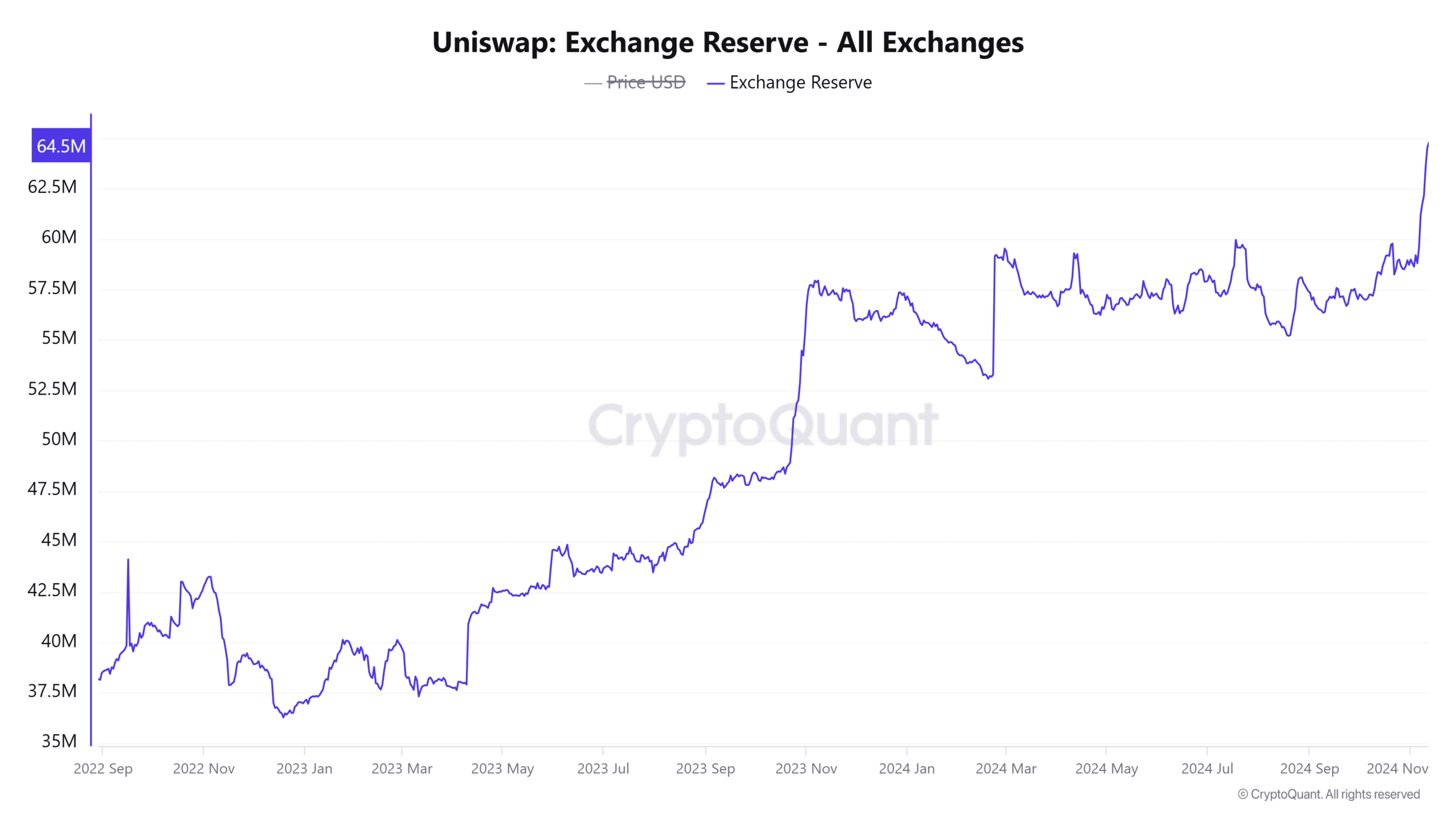

Slight caution as exchange reserves climb

However, one factor that may temper the bullish enthusiasm is the slight increase in UNI’s exchange reserve, up by 0.97% over the past 24 hours to 64.5 million UNI.

A rising exchange reserve often signals increased selling pressure as more tokens are deposited on exchanges, potentially leading to greater supply available for selling.

Therefore, while on-chain indicators reflect strength, the increase in exchange reserves could indicate caution.

Source: CryptoQuant

Read Uniswap’s [UNI] Price Prediction 2024–2025

With strong on-chain metrics and a bullish chart setup, Uniswap looks primed for continued growth. The recent breakout and positive on-chain signals suggest that a move toward $11.98 and beyond is within reach.

If UNI can overcome this resistance, it has a clear path toward the $17 target, solidifying its bullish momentum.

Source: https://ambcrypto.com/uniswap-trading-volume-explodes-161-is-17-unis-next-stop/