- Uniswap proposes governance changes; Adams and Walsh lead initiative.

- Incentives align with protocol fee activation plan.

- Potential market impacts on UNI token and liquidity pools.

The Uniswap Foundation’s Executive Director Devin Walsh and Founder Hayden Adams proposed the ‘UNIfication’ governance initiative on November 11, 2025, aiming to activate fees and integrate incentives across the Uniswap ecosystem.

This proposal could redefine Uniswap’s market dynamics, impacting protocol economics and user interactions within decentralized finance.

Uniswap’s “UNIfication” Proposal: A Governance Overhaul

Devin Walsh and Hayden Adams have formally introduced a proposal aimed at activating protocol fees within the Uniswap ecosystem. This marks a significant step towards establishing Uniswap as the go-to decentralized exchange for tokenized value. The UNIfication proposal involves a major overhaul of governance and tokenomics. The proposal seeks to implement fees while revisiting the governance structure to create a unified incentive mechanism across the ecosystem.

This new proposal envisions changes in financial operations across Uniswap. Moving forward, protocol fees are set to be activated, most likely affecting the valuation and distribution of Uniswap’s native UNI token. These changes could also alter liquidity conditions across the main trading pairs like UNI/ETH, potentially impacting trading patterns and market dynamics.

“The UNIfication plan aligns incentives across users, liquidity providers, and token holders, creating a more sustainable model,” according to a quoted DeFi analyst in public press materials.

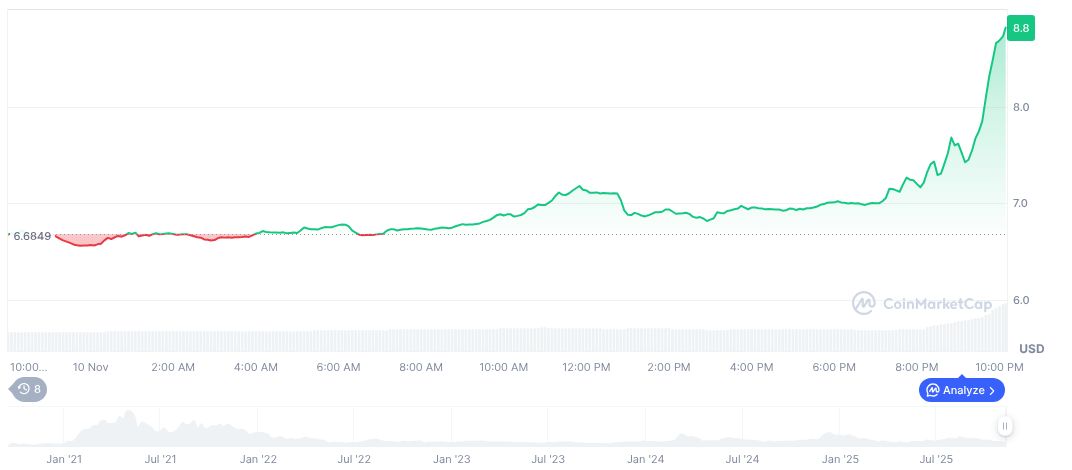

Uniswap’s Tokenomics: Price Surge and Future Speculations

Did you know? Uniswap’s decision to potentially activate protocol fees reflects a broader industry trend, as similar proposals failed in 2023–2024 amid governance disagreements.

According to CoinMarketCap, Uniswap’s current price stands at $9.01 with a market cap of $5,678,792,053. The 24-hour trading volume surged to $1.01 billion, marking a 148.55% increase. Recent price movement includes a 34.66% rise in the past 24 hours and a 74.62% increase over the week. Uniswap’s circulating supply is 630,330,527 with no maximum supply set. The last update was recorded on November 10, 2025.

The Coincu research team anticipates financial and regulatory implications following the Uniswap proposal, stressing a need for comprehensive legal frameworks to mitigate risk. The activation of protocol fees could pave the way for sustainable revenue models in decentralized finance, bolstering Uniswap’s competitive positioning in a shifting market landscape.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/uniswap-governance-overhaul-proposal/