Uniswap price has captured market attention after staging an explosive 21% rally in the past 24 hours, lifting it beyond crucial resistance zones and reigniting bullish sentiment. This spurt is a major breakthrough following months of consolidation in a falling channel.

The rebound is also consistent with the release of the UNIfication proposal by Uniswap, a radical initiative aimed at transforming governance and tokenomics on a single framework. As these technical and structural changes converge, the key question is whether UNI can take this break out to the much-awaited $15 mark.

Can Uniswap Price Extend Toward $15 After Breaking Key Barriers?

The current Uniswap value sits at $8.7, reflecting renewed confidence as buyers step back into the market after a prolonged correction. The rebound of the token after the strong demand zone around the mark of 5 was an indication of a new accumulation period. This spike took Uniswap out of its multi-month downward trending channel, a phenomenon that tends to mark the beginning of a more lasting trend reversal.

UNI recovered the lost ground of $7 and then shot up to reach $10 before slight profit-taking led to a rebound at $8.7. This backlash seems to be healthy, and short-term traders are able to pull out, and long-term investors are able to accumulate. The 7-8.5 area is now a solid support area that may act as a catapult to the next bullish run.

Should Uniswap be able to turn the $8.5 level into support, buyers may seek to revisit $10 with greater force. Any breakout beyond that zone would then open to the next resistance of $12 and then the last resistance of $15 which is the next major Fibonacci extension zone.

Ultimately, the chart pattern and rising demand indicate that UNI could be setting up a long-term rally to $15 due to the rising interest and better fundamentals.

UNI Indicators Strengthen A Positive Price Forecast

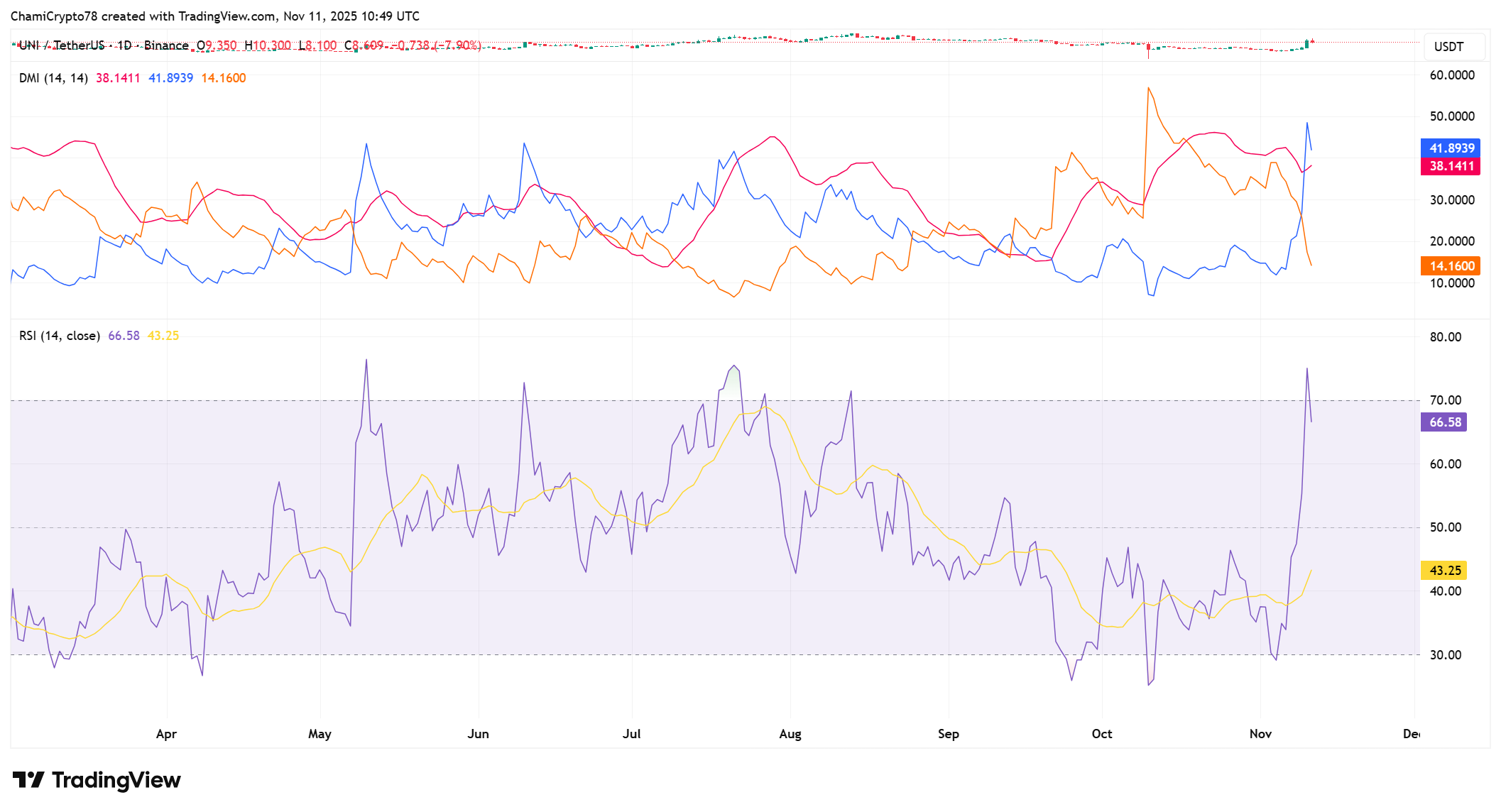

Directional Movement Index values indicate the power of the Uniswap recovery. The +DI line of 41.89 is still far above the -DI of 14.16, which proves the superiority of buyers in the current uptrend. In the meantime, the ADX at 38 is an indication that the trend is not losing momentum but increasing. These readings show that the directional bias of the market is still strongly bullish.

Moreover, the RSI is at 66.58, which is almost at the overbought level. Although this level usually comes before consolidation, it is also an indication of high purchasing enthusiasm. In the event that RSI is cooling to 60 and levels off, Uniswap might be able to maintain an upwards trend without causing a massive selling pressure.

Together, these indicators reinforce a positive UNI long-term price outlook, showing that strength and conviction remain intact for another upward extension.

Fee Switch Proposal And 100M UNI Burn Fuel Stronger Price Projection.

The highly anticipated release of the fee switch by Uniswap Labs is a hallmark in the economic development of the network. The project burns 0.05% of the total trading fees, which is a way of decreasing the supply in the long run.

In addition to this, a retroactive 100M UNI burn, approximately 12.5% of total supply, would potentially result in an estimated 38M monthly buybacks in case it is fully implemented.

This proposal is part of the broader UNIfication plan, which merges Uniswap Labs and the Foundation under a unified governance model to strengthen growth and future upgrades. The new structure brings in a five member leadership board that will be in charge of development and direction.

Moreover, the UNIficationApp will channel some of the trading revenues such as those of Layer-2 Unichain into the burn process – improving long-term value capture. All of these structural and tokenomic changes put Uniswap in a sustainable deflationary loop that would help drive UNI to the $15 goal.

Is $15 Within Reach

Uniswap price recovery appears well-supported by both technical structure and governance-driven catalysts. In case bulls protect the $8.5 support and regain the $10 convincingly, the path to the goal of $15 is more evident.

The UNIfication proposal and 100M UNI burn contribute to the project basics with permanent power. In total, the increasing correspondence between the market momentum and structural upgrades makes an upward move to $15 an even more achievable prospect.