- UBS anticipates a short-term downturn in US equities as economic data weakens.

- Market correction seen as a strategic buying opportunity by UBS.

- Awaiting Federal Reserve rate cut signals in coming months.

UBS Group has projected potential pullback in US equities for August 2025, counterbalanced by strategic opportunities until forthcoming Federal Reserve rate cuts, as per their analysis.

This projection highlights economic challenges and urges cautious optimism, as historical data suggests market rebounds post-Fed policy pivot could impact both traditional and digital assets.

UBS Predicts US Market Pullback Due to Weak Economic Data

UBS Group, following its Q2 2025 earnings report, predicts short-term pullback pressure in the US stock market due to recent weaker economic data. Senior strategist Dan Dowd emphasized this view in the firm’s latest outlook, indicating that a rate cut by the Federal Reserve could stabilize the market. UBS frames the current correction as a strategic buying opportunity despite the short-term pressure.

Weaker employment data last week has intensified concerns about an economic slowdown, increasing the risk of a downturn until the Fed’s expected rate cut. UBS leadership views the correction as a potential entry point for strategic investments ahead of future rate easing.

“Our results reflect the benefits of our diversified business and disciplined risk management as we navigate the current economic environment,” said Sergio Ermotti, CEO, UBS Group AG.

No significant public comments from key figures at UBS directly address the August 2025 outlook specifics. This perspective aligns with insights from the Global Investment Returns Yearbook 2025, authored in collaboration with Dan Dowd. Community reactions on platforms like GitHub show no urgent proposals or shifts related to this forecast, and market consensus anticipates stabilizing moves post-Fed intervention.

Bitcoin and Ethereum Prices Amid Federal Reserve Speculations

Did you know? Historical trends show that Federal Reserve rate cuts often lead to risk-asset rallies, influencing both traditional and digital assets, such as BTC and ETH, after initial market corrections and volatility.

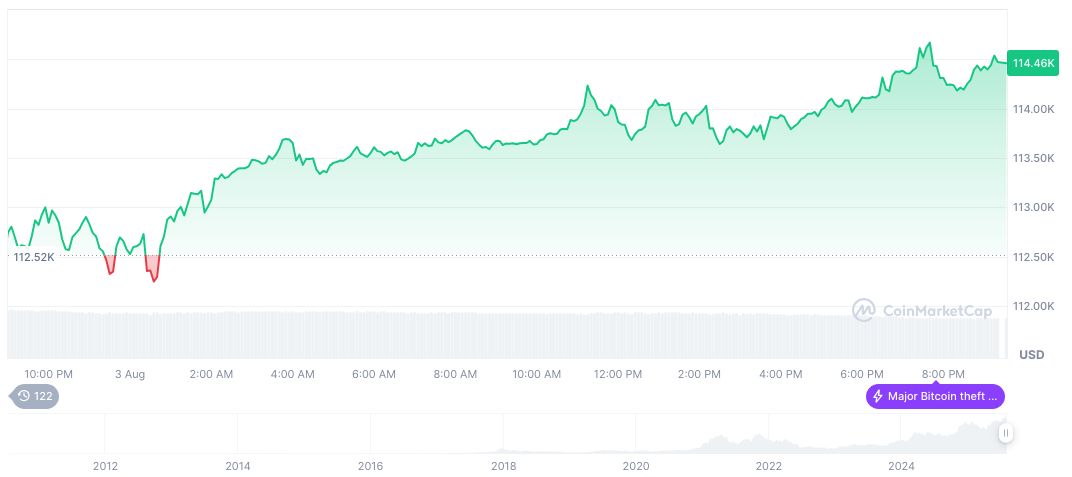

As of August 4, 2025, Bitcoin (BTC) is valued at formatNumber(2285837905757, 2) with a market cap at formatNumber(2411976101067, 2). BTC’s 24-hour price rose by 0.82%, despite a trading volume drop of 13.69% as data from CoinMarketCap reports. BTC shows a net increase of 22.70% over the last 90 days.

According to Coincu, historic monetary policy shifts, such as the Federal Reserve’s shift from hawkish to dovish stances, have correlated with rebounds in both traditional stocks and digital assets. Analysts anticipate potential benefits to BTC and ETH should the Fed signal a permanent policy easing, although no immediate large-scale market adjustments are noted.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/ubs-us-equities-pullback-pressure/