- Markets watch incoming Fed leadership decisions and policy impacts.

- Interview process for new Fed Chair actively progressing.

- Subsequent rate decisions may influence crypto markets.

U.S. Treasury Secretary Scott Bessent is reportedly commencing the second round of interviews to select the next Federal Reserve Chair, potentially announcing a decision by year’s end.

This news could influence investor sentiment and market dynamics, particularly in cryptocurrencies like Bitcoin, Ethereum, and stablecoins, sensitive to U.S. Federal Reserve leadership and policy changes.

Scott Bessent Leads Race for Federal Reserve Leadership

U.S. Treasury Secretary Scott Bessent is reportedly moving forward with interviews to appoint the next Federal Reserve Chair before Christmas. As part of the direct oversight process, Bessent seeks a new leader to guide monetary policy adjustments which would align with ongoing fiscal considerations.

Policy strategy adaptation is imminent with this potential leadership transition. Market analysts anticipate shifts in interest rate guidance given the possible future appointments. Monetary policy adjustments, such as interest rate changes, have historically influenced financial markets and crypto assets.

No public succession statements. — Jerome H. Powell, Chair, Federal Reserve, discussing Fed balance sheet policy and its effects on markets without referencing succession.

Bitcoin Volatility and Historical Fed Changes

Did you know? The last major Federal Reserve leadership change in 2018, with Jerome Powell’s appointment, coincided with a surge in Bitcoin’s volatility, reflecting the macroeconomic environment.

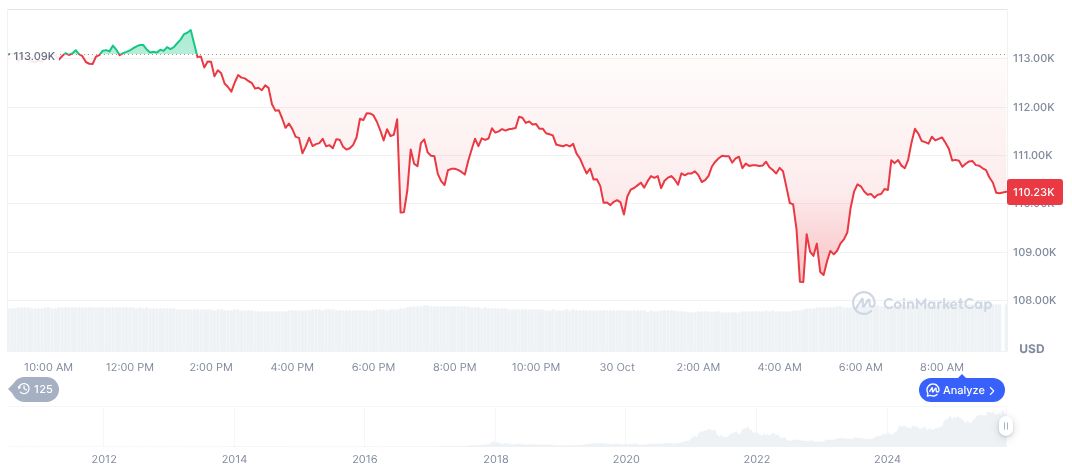

Bitcoin (BTC) stands at $109,685.29, with a market cap of $2.19 trillion and dominance at 58.93%. Trading volumes reached $71.12 billion, exhibiting a 7.54% change. The coin’s 24-hour price dipped by 3.13%, with a slight 0.65% rise over the past week, according to CoinMarketCap.

Experts from Coincu suggest the potential policy shifts with a new Fed Chair may impact crypto valuations. Historical patterns indicate Fed decisions often create market volatility, necessitating strategic investor assessments, especially in reaction to interest rate changes and broader macroeconomic policy signals.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/treasury-fed-chair-interviews/