- U.S. warns of reverting tariffs, impacting international trade discussions.

- Potential market volatility as countries reconsider trade positions.

- U.S.-Canada talks continue amid uncertainty in global negotiations.

On July 3, U.S. Treasury Secretary Scott Bessent issued a warning regarding international trade negotiations, emphasizing the possible return to higher tariffs initially set on April 2.

This warning highlights the complexities in global trade relations and suggests potential for increased market volatility, drawing attention from stakeholders worldwide.

U.S. Tariff Warnings Intensify Global Trade Negotiations

The current warning issued by U.S. Treasury Secretary Scott Bessent brings attention to the existing trade negotiations with international partners, expressing potential tariff increases. Bessent declared that countries delaying good-faith negotiations might face tariffs reverting to 11-50% levels announced earlier.

This situation might lead to increased uncertainty in international trade. With the looming deadline, nations engaged in negotiations may encounter pressure to align their trade strategies in accordance with U.S. economic policies, affecting various sectors reliant on cross-border trade.

“Many countries could be notified of sharply higher tariffs despite good-faith negotiations with Washington… Otherwise, the temporary 10% tariff the Trump administration is imposing will revert to the 11-50% level announced on April 2.” — Scott Bessent, U.S. Treasury Secretary

Historical Moves Affect Bitcoin and Economic Policies

Did you know? On April 2, 2025, the U.S. imposed tariffs ranging 11-50%, leading to significant market fluctuations and reciprocal actions from major trading partners, altering global economic dynamics.

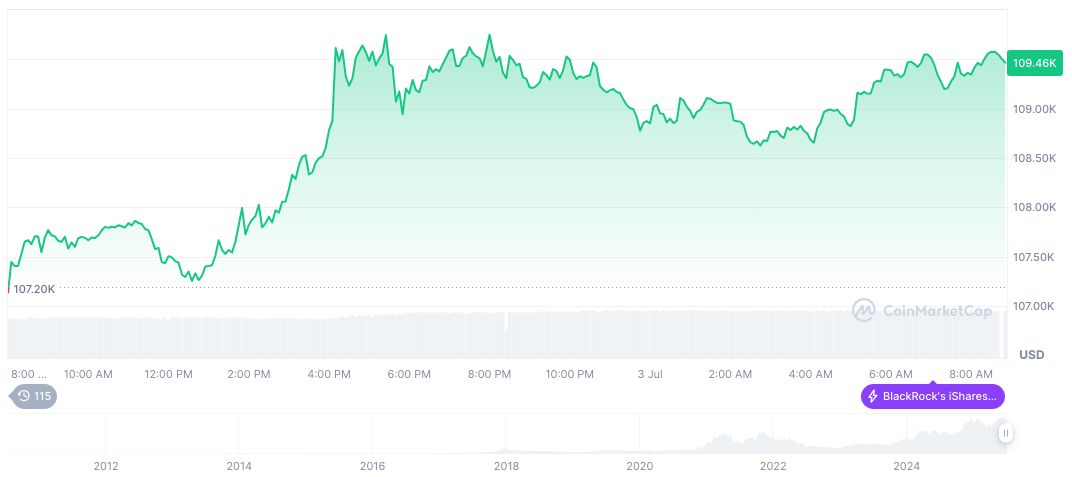

Bitcoin (BTC) shows fluctuations with a current price of $109,743.24. The market cap stands at $2.18 trillion with a dominant position at 64.38% of the market share. Today, trading volumes reached $57.58 billion, indicating a 21.59% shift in activity. This data from CoinMarketCap offers a snapshot of BTC’s recent financial dynamics.

According to the Coincu research team, the potential reversion of U.S. tariffs could spur a reassessment of global trade policies. Financial impacts might reflect in fluctuating traditional and digital markets. Historical precursors suggest heightened vigilance as the sector navigates potential regulatory shifts impacting market stability.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/346610-us-tariffs-trade-warning/