- U.S. Treasury Secretary expects $2 trillion digital asset demand in bonds.

- Federal cryptocurrency integration signals market shift.

- Potential growth in U.S. financial markets and regulations.

U.S. Treasury Secretary Scott Bessent announced on May 7 that digital assets may drive demand for up to $2 trillion in U.S. Treasury bonds. This statement underscores the increasing intersection of cryptocurrency and traditional financial markets.

Scott K. H. Bessent, U.S. Treasury Secretary, remarked, “I am a big proponent of the U.S. taking the worldwide lead in crypto.” His forecast highlights the evolving role of digital assets in finance, suggesting a major shift in policy.

U.S. Treasury Embraces $2T Digital Asset Integration

The U.S. Treasury’s projection of a $2 trillion demand in bonds related to digital assets is unprecedented. Secretary Bessent emphasized the integration of cryptocurrencies into mainstream financial operations. This move aligns with previous federal actions, including the creation of crypto reserves and tax policy reforms. The potential demand from digital assets suggests a new era of financial opportunity. These developments arise from broader federal initiatives to incorporate digital assets into economic strategy.

Market reactions have been mixed. With industry leaders seeking clarity on regulatory implications, Secretary Bessent’s assertion on CNBC continues to resonate, affirming a commitment to advancing U.S. leadership in cryptocurrency.

Historical Context, Price Data, and Expert Insights

Did you know? U.S. Treasury’s $2 trillion bond projection marks its first large-scale digital asset integration, contrasting its previous approach of liquidating seized assets.

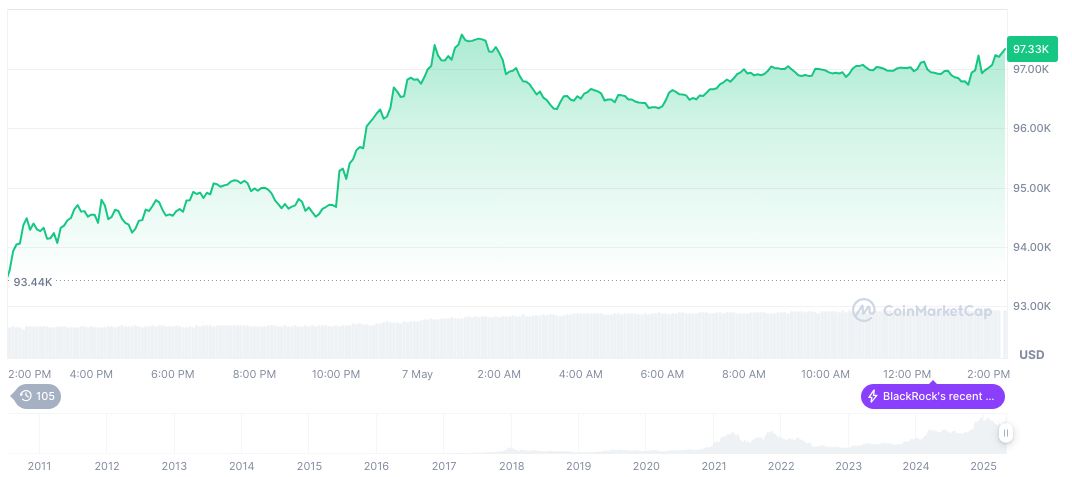

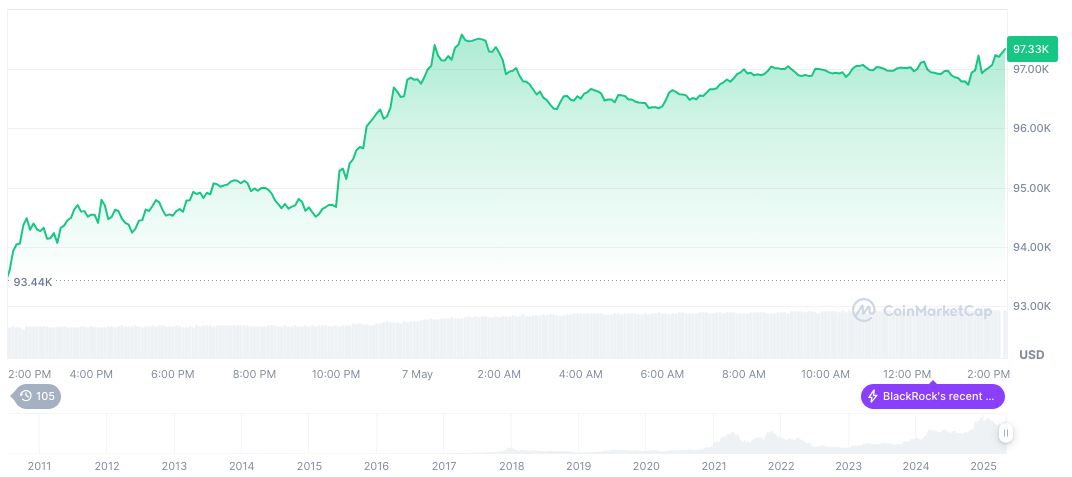

As of May 7, 2025, Bitcoin (BTC) is priced at $97,264.47, with a market cap of $1.93 trillion, according to CoinMarketCap. It holds 64.34% market dominance, while experiencing price shifts, notably a 23.49% rise over 30 days. Bitcoin’s trading volume has increased by 44.94% to $33.47 billion in the past 24 hours. Insights from the Coincu research team suggest broader financial alterations and technology interplay will emerge. Compliance challenges and technological refinement are expected, as market participants adjust to evolving Treasury strategies.

Insights from the Coincu research team suggest broader financial alterations and technology interplay will emerge. Compliance challenges and technological refinement are expected, as market participants adjust to evolving Treasury strategies.

Source: https://coincu.com/336174-u-s-treasury-2-trillion-demand/