- The Treasury Secretary halts sovereign wealth fund plans, prioritizing debt payment.

- Plan suspension aims to refocus economic strategies.

- Bipartisan response to the decision remains mixed.

U.S. Treasury Secretary Scott Bessent announced the suspension of sovereign wealth fund plans on May 24, 2025, prioritizing national debt repayment.

This decision reshapes U.S. economic strategy, signaling a shift in focus amid global financial uncertainty.

U.S. Shifts Focus from Wealth Funds to Debt Management

U.S. Treasury Secretary Scott Bessent declared the suspension of the sovereign wealth fund initiative, citing a need to prioritize other financial strategies. This move aligns with President Trump’s focus on reducing national debt as communicated by Bessent on May 24, 2025, according to PANews reports.

With this suspension, the U.S. government is directing attention to debt management under heightened financial scrutiny. The emphasis is on economic stability over wealth fund creation, reshaping the nation’s financial landscape. This decision reflects a shift from wealth accumulation to fiscal responsibility.

Reactions vary across the political spectrum. While some policymakers endorse the focus on reducing debt, others question the suspension’s long-term impacts on national wealth accumulation. The move sparked debate on fiscal priorities, with stakeholders expressing diverse views on its implications.

“Scott Bessent, Secretary of the Treasury, said, ‘My focus will include promoting economic growth and managing national debt to ensure financial stability for the United States.’”

Bitcoin Falls as Economic Strategy Shifts

Did you know? The U.S. has prioritized debt reduction over wealth fund creation since 2000, with varied results in economic stabilization and growth.

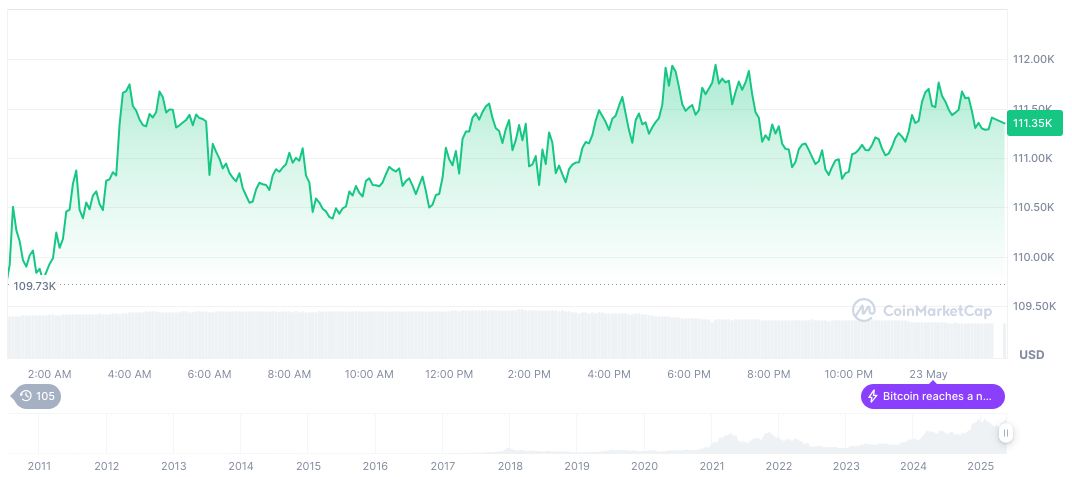

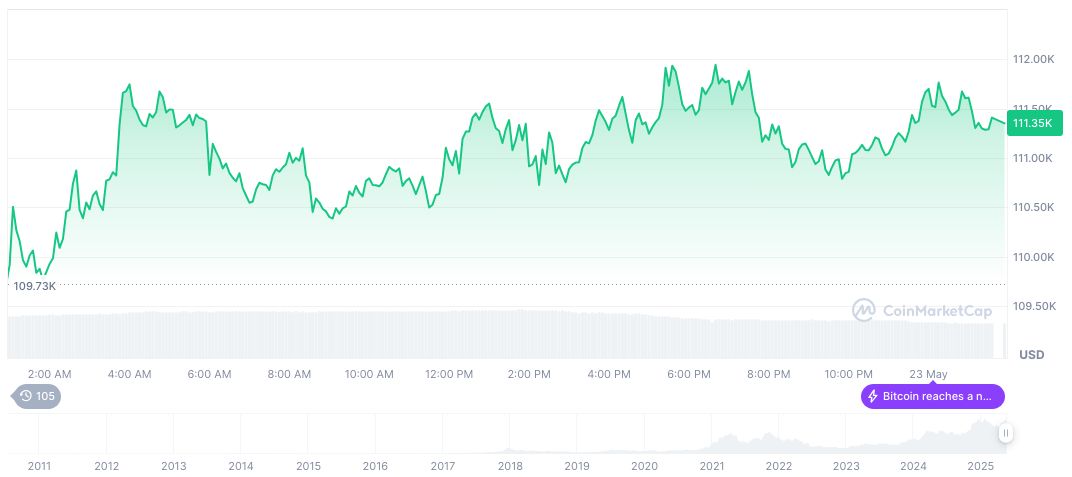

Data from CoinMarketCap reveals Bitcoin (BTC) currently priced at $107,449.72, with a market cap of 2.13 trillion, showing a 3.71% decrease over 24 hours. Over the past 60 days, Bitcoin surged by 22.71%. Circulation stands at 19,868,946 BTC as of May 24, 2025.

The Coincu research team emphasizes potential regulatory challenges, noting, “Shifts in economic focus can impact crypto investment landscapes.” Historical trends suggest financial stability correlates with reduced volatility, offering possible benefits if strategic priorities align.

Source: https://coincu.com/339376-us-treasury-suspends-sovereign-wealth/