- U.S. Treasury Secretary Bessant warns of possible tariff reinstatement.

- Partners face increased tariff risks; negotiations continue with EU.

- Ongoing demands for U.S. Treasuries indicate market confidence.

Scott Bessent, the U.S. Treasury Secretary, issued a warning on July 3 about potential tariff hikes. Market implications suggest escalating trade tensions if no negotiation progress occurs with the European Union.

Bessent’s threat of reinstating tariffs on 100 nations highlights global economic tensions. Increased tariffs could affect transatlantic trade valued at $170 billion, directly impacting automotive and metal industries. Market observations indicate no significant moves in crypto markets.

Main Content

Bessent announced a warning to international partners about potential tariff reinstatements if no notable negotiation progress happens soon, suggesting trade tensions may rise. “If someone is not negotiating, then we will not,” Bessent stated, reflecting pressures in U.S.-EU trade dynamics.

Immediate effects of tariff imposition on various sectors may cause market instability. The U.S. might raise tariffs to levels seen on April 2. Bessent expresses confidence in steady demand for U.S. Treasuries, indicating investor trust in U.S. financial stability.

Reports from market observers cite possible volatility in response to heightened risk, though current crypto market trends remain stable. Public statements from EU official Maros Sefcovic emphasize resilience against any perceived U.S. imbalances.

Bitcoin Holds Steady Amid Trade Tensions

Did you know? Historically, U.S. tariff announcements have led to temporary selloffs in global equities and Bitcoin, highlighting the interconnected nature of global markets and digital assets.

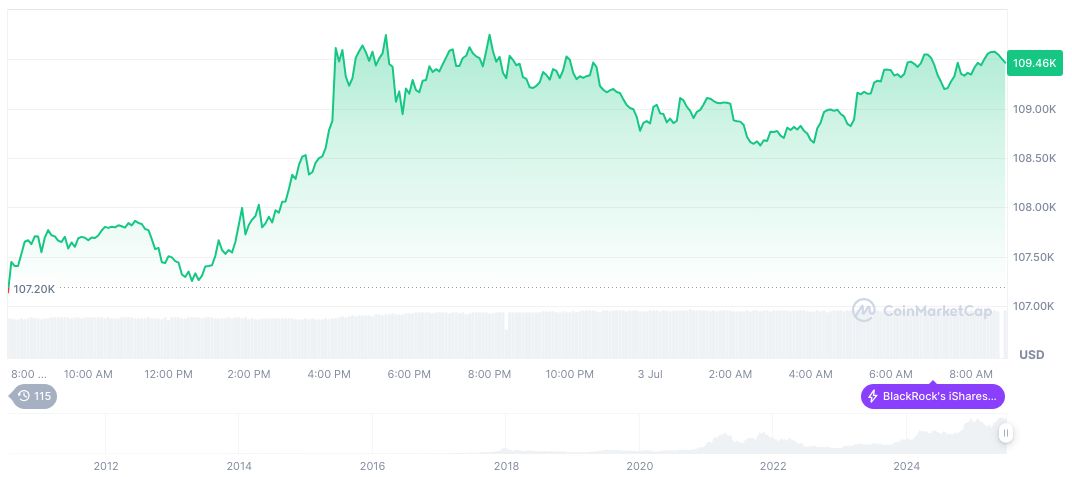

Bitcoin’s price reached $109,797.08, with a market cap of 2.18 trillion, according to CoinMarketCap. Its trading volume has slightly decreased, while the price has increased by 0.4% over the past 24 hours. Dominating the market at 64.44%, Bitcoin shows resilience despite potential geopolitical tensions.

The Coincu research team indicates that potential tariff reinstatements could spur fluctuations in traditional finance sectors, affecting liquidity dynamics across global markets. Bessent’s focus on the Federal Reserve and interest rates could signal shifts in fiscal policy approaches.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/346690-us-treasury-secretary-tariff-warning-2/