- The U.S. Treasury released $34 billion, improving liquidity.

- Release alleviated pressure in repo markets.

- Increased liquidity boosts equity and crypto markets.

The U.S. Treasury General Account (TGA) declined by $34 billion to $925 billion in October, as reported by the Wall Street Journal.

The cash release aims to improve liquidity in the financial system, impacting both traditional and cryptocurrency markets.

U.S. Treasury’s $34 Billion Release and Market Impact

The U.S. Treasury’s decision to reduce the General Account by $34 billion comes amid ongoing efforts to ensure liquidity within the financial system. This reduction in funds follows an earlier buildup linked to the debt ceiling resolution. Key figures such as Janet Yellen and Jerome Powell emphasized the importance of this move in sustaining liquidity.

Liquidity conditions are expected to improve due to this action, potentially stabilizing both equities and crypto markets. Traditional markets may see reduced repo rates, while cryptocurrency markets, including Bitcoin and Ethereum, could experience increased volumes and capital allocation.

“The Treasury General Account (TGA) remains a critical tool for managing federal cash flow and ensuring the government can meet its obligations. The recent decline in the TGA reflects increased government spending and a deliberate effort to maintain liquidity in the financial system as we navigate the post-debt ceiling environment.” — Janet Yellen, Secretary of the Treasury, U.S. Department of the Treasury

Market Reactions and Expert Outlook on Liquidity Trends

Did you know? Similar decreases in the TGA during past debt ceilings, like in June 2023, led to a temporary tightening of liquidity but ultimately improved market conditions.

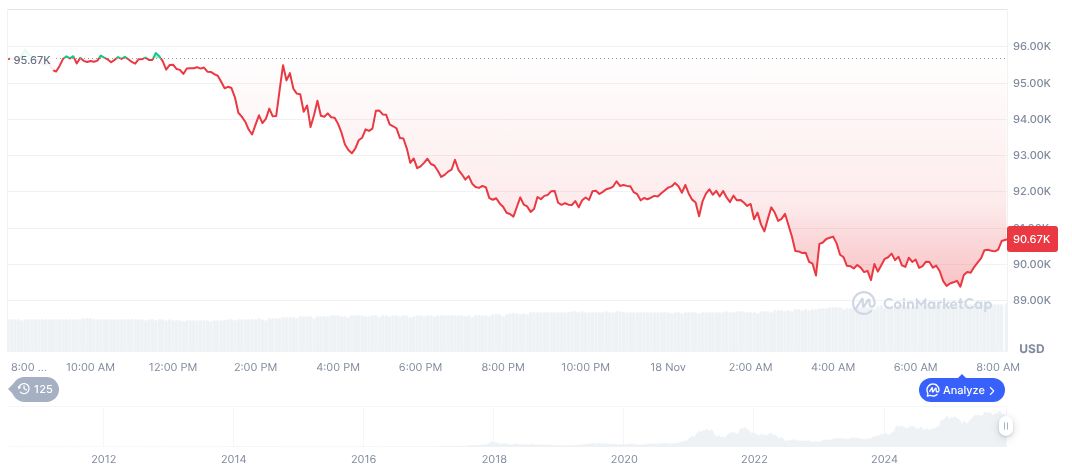

Bitcoin’s current data, reported by CoinMarketCap, shows its price at $92,650.97, with a market cap of 1.85 trillion, accounting for a market dominance of 58.28%. Recent price changes depict a 2.09% increase over 24 hours, yet a 10.34% decline over seven days. Its 24-hour trading volume reached $96.86 billion.

The Coincu Research Team suggests that the improved liquidity could lead to favorable conditions for DeFi innovations and potential regulatory shifts to accommodate increased market activity. They emphasize the importance of monitoring liquidity trends to assess ongoing market impacts.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/us-treasury-releases-34-billion/