- U.S. Senators inquire about Meta’s stablecoin plans amid impending GENIUS Act vote.

- Lack of official stablecoin launch by Meta; speculation drives scrutiny.

- Senators emphasize potential data privacy concerns and regulatory impacts.

U.S. Senators Elizabeth Warren and Richard Blumenthal wrote to Meta CEO Mark Zuckerberg, questioning possible stablecoin ambitions as the Senate prepared to vote on the GENIUS Act.

The inquiry highlights potential privacy and regulatory issues if Meta advances stablecoin projects, rekindling scrutiny of the tech giant’s role in financial innovation.

U.S. Senators Press Meta on Use of Stablecoins and GENIUS Act

U.S. Senators Elizabeth Warren and Richard Blumenthal have raised concerns with Meta’s CEO, Mark Zuckerberg, about the company’s alleged intentions to explore stablecoin initiatives. Citing Meta’s historical attempts with Libra and Diem, the senators seek transparency on past and present lobbying efforts, and the implications for users’ financial and personal data.

The letter comes amidst the Senate’s consideration of the GENIUS Act, intended to tighten regulations on stablecoins. There is apprehension that Meta might exploit legislative gaps for private currency development. Meta’s Communications Director, Andy Stone, responded publicly with a denial of stablecoin plans, assuring stakeholders and the public.

“Meta may be renewing its efforts to establish its own private currency, structured as a stablecoin,” said Elizabeth Warren, U.S. Senator, Senate Banking Committee. Senate Banking Committee Letter

Andy Stone stated on X that Meta is not launching a stablecoin, aiming to dispel any arising concerns. Other reactions have yet to manifest, with speculation persisting as official channels remain largely silent on future stablecoin endeavors by Meta.

Meta’s Regulatory Challenges and Market Speculation: A Closer Look

Did you know? The Senate’s scrutiny over Meta’s stablecoin intentions revives discussions on regulatory control, similar to debates that resulted in the dissolution of Libra in 2022.

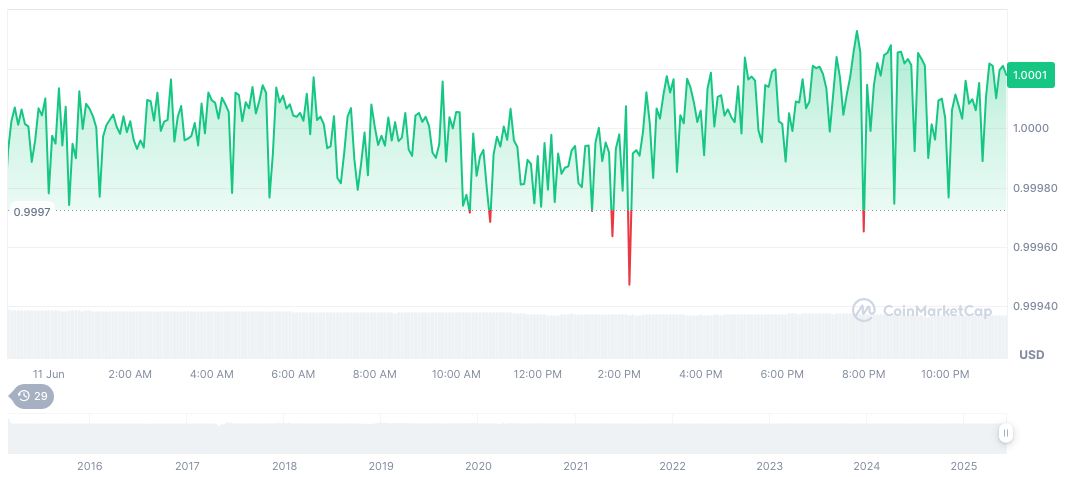

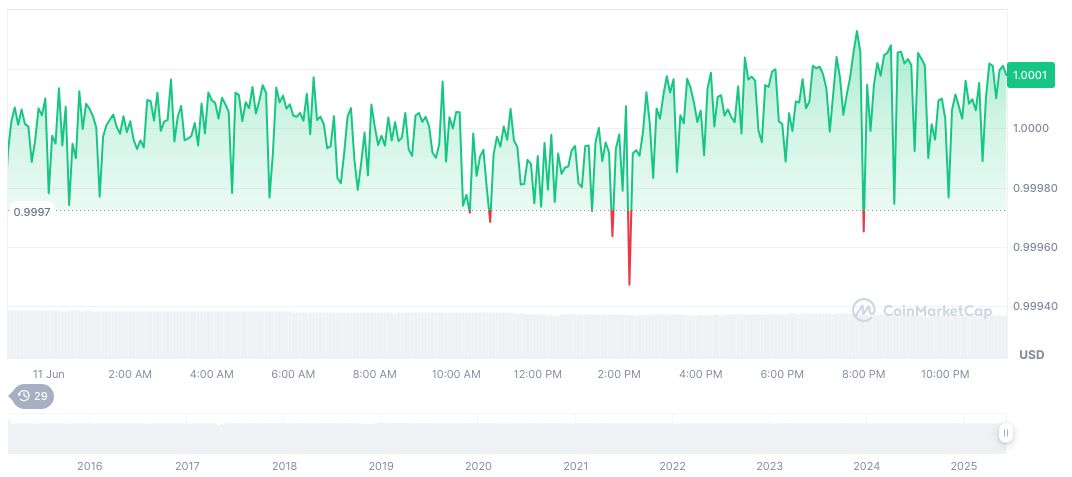

Tether USDt (USDT), according to CoinMarketCap, is maintaining a steady price of $1.00, with a market cap of $155.21 billion and a 4.54% dominance. Trading volume in the last 24 hours reached $86.05 billion, marking a decline of 9.99%. USDT’s price has shown minimal fluctuations over recent months. This information was last verified at 00:56 UTC on June 12, 2025.

The Coincu research team notes potential ripple effects in stablecoin regulation if Meta pursues such projects. The GENIUS Act could set precedents, affecting the cryptocurrency landscape and regulatory frameworks globally.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/342773-senators-meta-stablecoin-inquiry/