- The GENIUS Act’s final Senate vote involves major U.S. financial interests.

- Stablecoins and traditional banking could face regulatory changes.

- Potential major market shifts in cryptocurrency and banking sectors.

The U.S. Senate is poised to hold a decisive vote on the GENIUS Act (S.1582) at 4:30 pm Eastern Time on June 17. Passage would advance the bill to the House of Representatives. This action could redefine stablecoin regulation, affecting both the crypto and traditional banking industries.

The GENIUS Act aims to prioritize stablecoin holders’ claims. This could transform institutional risk management for banks and crypto firms. If passed, U.S.-recognized stablecoin issuers may face increased regulation, altering their operational landscape. Crypto assets, including ETH and BTC, might see shifts in liquidity due to adjusted stablecoin activity.

Senate’s Decision on GENIUS Act Could Transform Finance

Senator Josh Hawley, a vocal critic of the GENIUS Act, is joined by other U.S. Senate members in a pivotal decision. The bill, officially called the “Guiding and Establishing National Innovation for U.S. Stablecoins Act,” seeks to integrate stablecoins into the banking framework. Amendments related to third-party payment networks and interest rate caps were excluded, following proposals by Senators Marshall and Hawley.

Financial institutions have expressed varied reactions. Senate opponents cite risks of increased Big Tech influence, though credit union leaders like Jim Nussle actively influenced bill negotiations. The broader financial sector awaits reactions post-vote, potentially influencing regulatory approaches internationally.

“This bill is a huge giveaway to Big Tech,” highlighting the implications for large technology firms such as Meta and Twitter/X if allowed to issue their own digital currencies. — Senator Josh Hawley

Market Eyes Stablecoin Regulation as Critical Vote Approaches

Did you know? The GENIUS Act’s potential passage could mark a significant regulatory turning point, paralleling past initiatives where U.S. banking laws were reshaped to integrate emerging technologies and finance models.

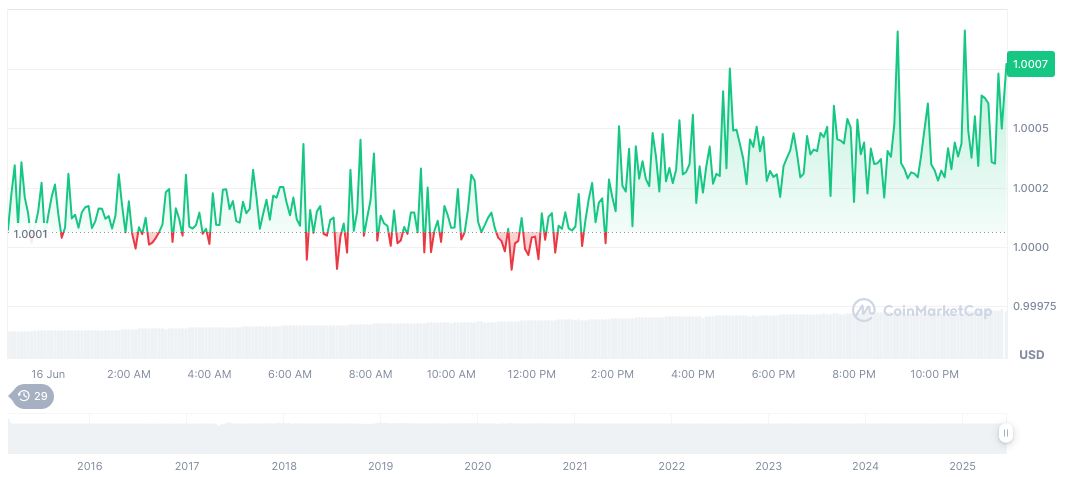

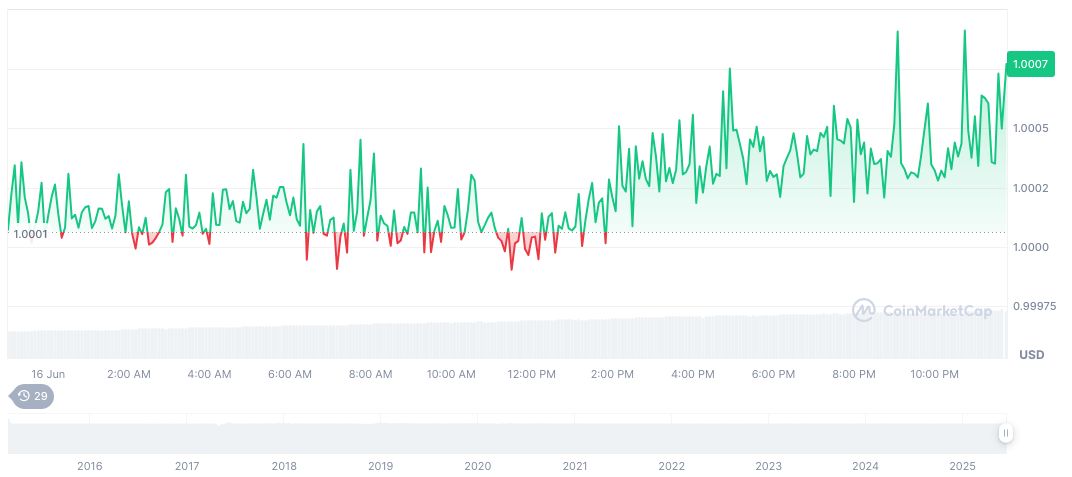

As of June 16, 2025, CoinMarketCap reports Tether USDt at $1.00. Market cap is $155.58 billion, with dominance at 4.66%. Trading volume surged to $81.95 billion, reflecting heightened market activity. Price changes remain minimal, indicating price stability amid imminent regulatory decisions.

Coincu research suggests potential financial shifts in the crypto and banking industries. If passed, stablecoin priorities in bank insolvency scenarios could influence credit risk management. Technological integrations between crypto and traditional finance may accelerate, driven by new regulatory clarity and market adaptations.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/343671-senate-vote-genius-act-stablecoins/