- Exemption of staking and airdrops from securities laws.

- Joint advisory committee between SEC and CFTC.

- Greater legal certainty expected to boost crypto market.

The U.S. Senate Banking Committee has released a revised draft of the ‘Digital Asset Market Structure Act,’ exempting staking, airdrops, and DePIN from securities laws and forming an SEC-CFTC advisory committee.

This legislative change could enhance regulatory clarity, boosting confidence in digital asset investments and U.S.-based crypto projects, potentially impacting market dynamics and regulatory approaches globally.

Legislative Amendments May Enhance Crypto Market Growth

The revised draft, introduced by the Senate Banking Committee chaired by Senator Sherrod Brown, includes measures exempting staking, airdrops, and DePIN from existing securities laws. This step follows earlier proposals yet to concretely address these exemptions. The legislation also seeks to facilitate a collaborative approach between the SEC, led by Gary Gensler, and the CFTC, chaired by Rostin Behnam.

Market reactions highlight a constructive outlook, though no direct public statements from crypto leaders on the specifics have emerged yet. The broader community shows heightened interest, with forums and developer channels actively discussing potential implications for projects like Helium and IoTeX.

Senator Sherrod Brown, Chair, Senate Banking Committee, stated, “This revised draft seeks to provide comprehensive clarity and a collaborative framework to regulate digital assets effectively.”

Market Data and Insights

Did you know? The last major U.S. legislative effort around digital assets led to temporary token rallies, hinting at possible positive gains due to the current exemptions for multibillion-dollar markets.

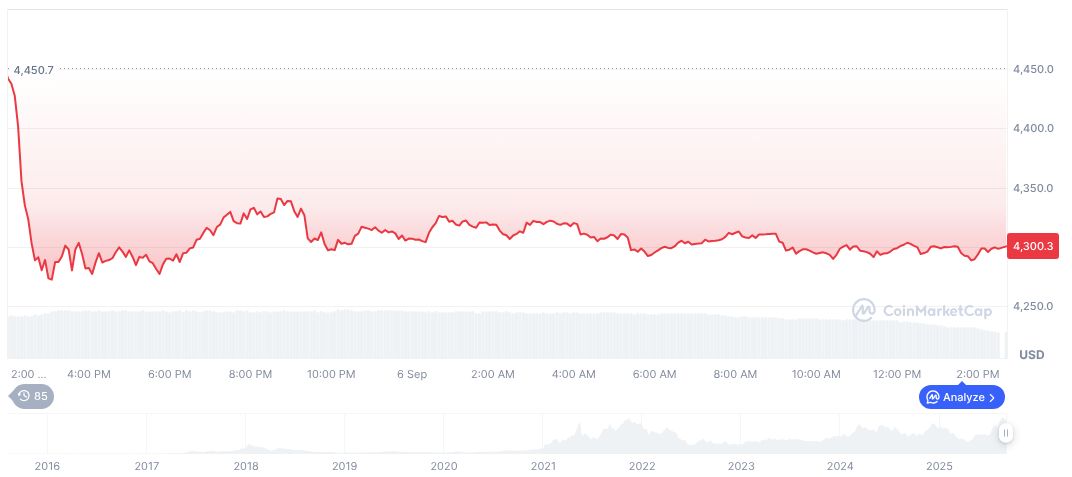

According to CoinMarketCap, Ethereum (ETH) is currently valued at $4,286.11 with a market cap of $517.36 billion and holds a 13.61% market dominance. The circulating supply includes 120.71 million tokens. Over the past 90 days, ETH has appreciated by 71.52%, reflecting significant market strength.

Insights from the Coincu research team suggest this legislative amendment could decrease operational risks for U.S.-based crypto firms, facilitating greater industry growth. Historical trends indicate the potential for increased staking levels and market capitalization as legal ambiguities diminish.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/us-senate-digital-assets-exemptions/