- The GENIUS Act fails in the Senate with a 48-49 vote.

- Senate vote reveals deep political divides.

- Stablecoin market faces continued regulatory uncertainty.

The U.S. Senate rejected the GENIUS Act, a proposed stablecoin regulatory framework, on May 8, 2025, due to a narrow 48:49 vote.

Amid political tensions, the bill’s rejection underscores ongoing challenges in establishing stablecoin regulation, leaving markets in uncertainty.

GENIUS Act Defeated Despite Narrow Margin

The Senate vote fell short, causing the GENIUS Act to fail despite Republican support. Democratic opposition centered on corruption risks linked to the Trump family’s connection.

The bill’s defeat means regulatory uncertainty persists in the U.S. stablecoin market, potentially affecting innovation and investment. Republicans vow another vote attempt soon.

Senator Cynthia Lummis expressed via X (formerly Twitter) that digital assets are crucial and U.S. leadership is needed. Her comment reflects growing market concern over regulatory delays.

“I am deeply disappointed… digital assets are here to stay, with the US needing to take the lead.”

Ongoing Debate Mirrors Struggle Between Innovation and Oversight

Did you know? The ongoing debate over stablecoin regulation echoes earlier attempts to regulate cryptocurrencies, indicating a consistent struggle between innovation and oversight.

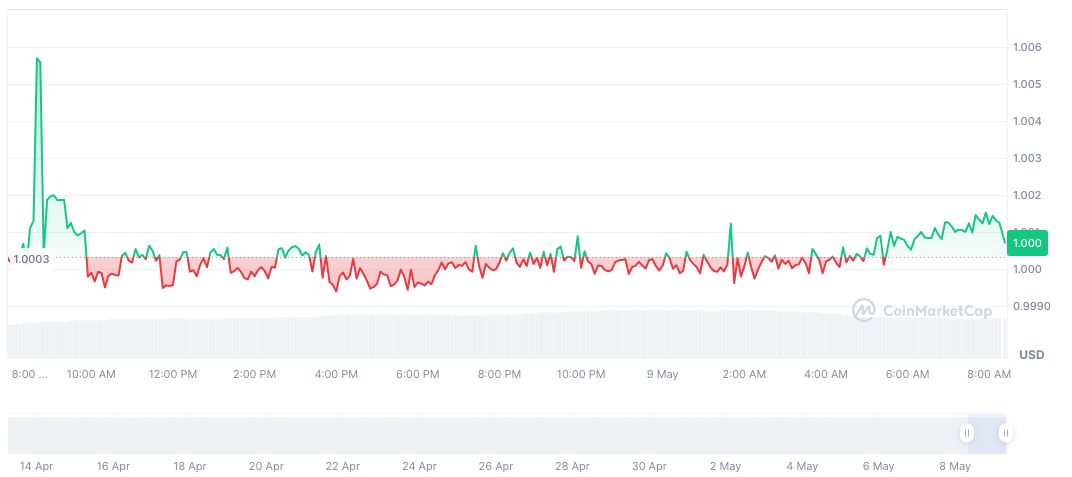

CoinMarketCap data shows World Liberty Financial’s stablecoin, USD1, retains a price of $1.00, with a market cap of $2.13 billion. The 24-hour trading volume sits at $89.85 million, reflecting a 14.92% change.

The Coincu research team suggests that without a clear regulatory framework, U.S. stablecoin growth may lag, affecting global competitiveness. Historical trends indicate that regulation can foster innovation by providing legal clarity.

Source: https://coincu.com/336597-senate-rejects-stablecoin-bill/