- Senate Democrats propose GENIUS Act amendments on stablecoin profits.

- Preventing presidential gains from stablecoins is the core focus.

- Focus on Trump’s potential financial benefits from USD1 stablecoin.

Senate Democrats intend to introduce amendments to the GENIUS Act to bar presidential profit from stablecoins. Concerns about potential Trump family benefits from the USD1 stablecoin sparked this legislative initiative.

The amendments aim to prevent a precedent of presidential profit in the growing stablecoin space. Market implications include potential restrictions on stablecoin investments.

Senate Leaders Targeting Stablecoin Profits: A Closer Look

Senate Minority Leader Chuck Schumer, along with Senators Elizabeth Warren and Jeff Merkley, is spearheading efforts to amend the GENIUS Act, which would prevent the president from profiting from stablecoins. The amendment focuses on the USD1 stablecoin by World Liberty Financial, which has ties to Trump’s family.

The amendment, if passed, would significantly curtail any financial gains the Trump family might acquire from the USD1 stablecoin. This move also denotes a serious approach towards eliminating conflicts of interest in presidential dealings with cryptocurrencies.

Among the notable reactions, Senator Merkley highlighted the necessity for the amendment by stating,

“Passing the GENIUS Act without our anti-corruption amendment stamps a Congressional seal of approval on Trump selling access and influence to the highest bidder.”

Market analysts are closely observing how this might affect the stablecoin legislation trajectory in the U.S.

Historical Context and Market Implications of Legislative Changes

Did you know? The GENIUS Act follows several legislative attempts to regulate stablecoin markets, highlighting historical challenges in addressing potential presidential conflicts of interest.

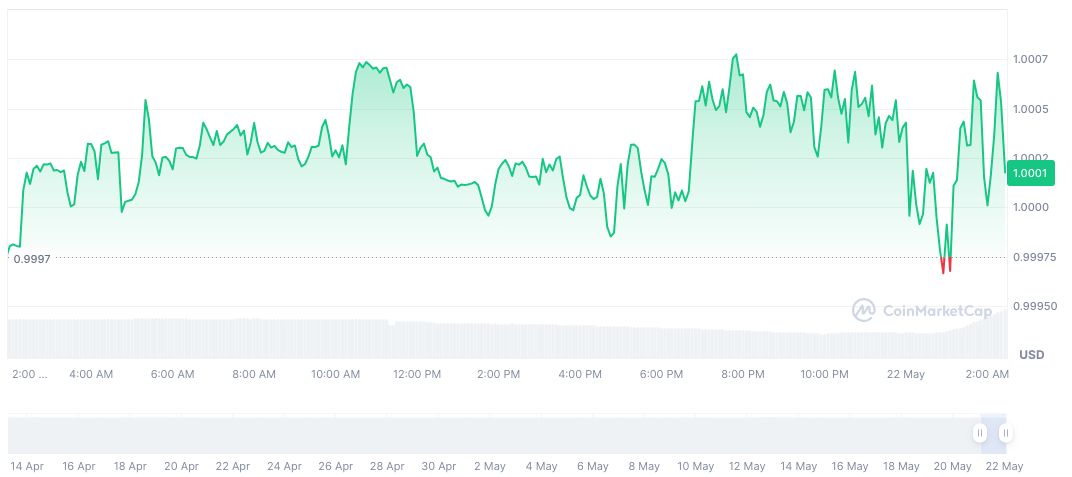

The World Liberty Financial USD, represented symbolically as USD1, is currently valued at $1.00 with a market capitalization of approximately $2.15 billion, according to CoinMarketCap. It exhibits a trading volume surge of over 1251% in the past 24 hours and faces minor fluctuations in its price movements across various timeframes.

Insights from the Coincu research team suggest that the amendment’s passage could set a regulatory precedent, affecting financial structuring and legal frameworks around cryptocurrency investments by government officials. Such legislative measures may progressively shape future cryptocurrency-backed initiatives with more stringent oversight.

Source: https://coincu.com/339222-us-senate-genius-act-amendments/