- The U.S. Senate passed the GENIUS Act, setting new standards for stablecoins.

- The bill requires full backing and annual audits for large stablecoin issuers.

- Bipartisan support increases regulatory clarity for the cryptocurrency industry.

The U.S. Senate voted 68-30 to pass the Stablecoin Innovation and Regulation Act (GENIUS Act) on June 12, 2025, moving the bill closer to a final vote. The legislation mandates U.S. dollar backing and annual audits for stablecoin issuers surpassing a market cap of $50 billion. This aims to increase transparency and bolster consumer confidence, potentially driving demand for U.S. Treasuries.

Senator Bill Hagerty, the bill’s lead sponsor, emphasizes the GENIUS Act’s potential to foster a “clear and comprehensive regulatory framework” for stablecoins, marking a pivotal step for consumer protection and cryptocurrency mainstream adoption. The House of Representatives has yet to take a stance, as they work on reconciling differences in their version of related digital asset legislation.

Market Impact and Future Prospects of GENIUS Act

The GENIUS Act introduces full dollar backing and annual audits for significant stablecoin issuers, altering the operational landscape for major players such as Tether and Circle. The move is poised to increase institutional investment, while promoting U.S. Treasuries as reserve assets. The bipartisan support reflects a shore up of regulatory clarity, enabling growth while safeguarding consumer interests.

Public statements from figures like Senate Majority Leader John Thune underline the importance of this legislation in bringing the cryptocurrency sector into the mainstream. Yet, further work remains at the congressional level to align this bill with existing regulatory frameworks. This bill highlights the evolving nature of U.S. regulatory approaches towards digital financial instruments.

“We want to bring cryptocurrency into the mainstream, and the GENIUS Act will help us do that… There was ‘more work to be done’ in regard to digital assets, referring to the House’s bill.” — Senate Majority Leader John Thune

Market Data and Future Implications

Did you know? The GENIUS Act represents the first significant advance in U.S. legislative efforts to regulate stablecoins since the collapse of TerraUSD, aiming to prevent such instability through rigorous backing requirements.

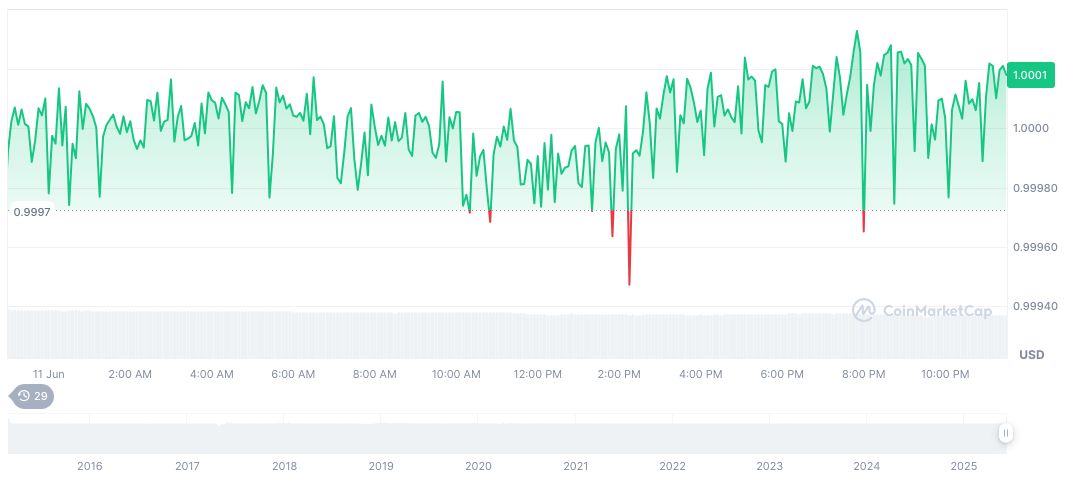

According to CoinMarketCap, Tether USDt, trading at $1.00 with a market cap of $155.07 billion, leads stablecoins in market dominance at 4.54%. Tether’s 24-hour trading volume reached $87.31 billion, reflecting a 10% drop. Recent analysis reveals price changes of 2.62% over the last 24 hours.

Coincu research anticipates the GENIUS Act, if fully passed, could solidify U.S. leadership in crypto regulation. This act could usher in greater financial transparency and act as a benchmark for global standards, potentially influencing international digital currency frameworks and processes.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/342764-us-senate-genius-act-stablecoin/