The U.S. Securities and Exchange Commission (SEC) has ended its 4-year investigation into Aave Protocol, a development which comes as Aave Labs clashes with DAO members over the CoW swap fees. The AAVE price remained largely unchanged despite this development, which confirms that the token is not a security.

SEC Drops Investigation Into Aave Protocol

In an X post, Aave’s founder, Stani Kulechov, revealed that the SEC has concluded its investigation into the DeFi protocol after four years. He highlighted how the process demanded significant effort and resources from their team to protect the top DeFi protocol, its ecosystem, and DeFi as a whole.

After four years, we are finally ready to share that the SEC has concluded its investigation into the Aave Protocol.

This process demanded significant effort and resources from our team, and from me personally as the founder, to protect Aave, its ecosystem, and DeFi more… pic.twitter.com/aZeLrZz5ZQ

— Stani.eth (@StaniKulechov) December 16, 2025

Kulechov further remarked that DeFi has faced regulatory pressure in recent years and that they are just glad to put the SEC investigation behind them as they enter a new era where developers can truly build the future of finance. “DeFi will win,” he added.

The SEC’s notice to the DeFi protocol showed that the SEC’s Division of Enforcement doesn’t intend to recommend any enforcement action against the DeFi protocol. Meanwhile, the AAVE price remained tepid on the back of this development.

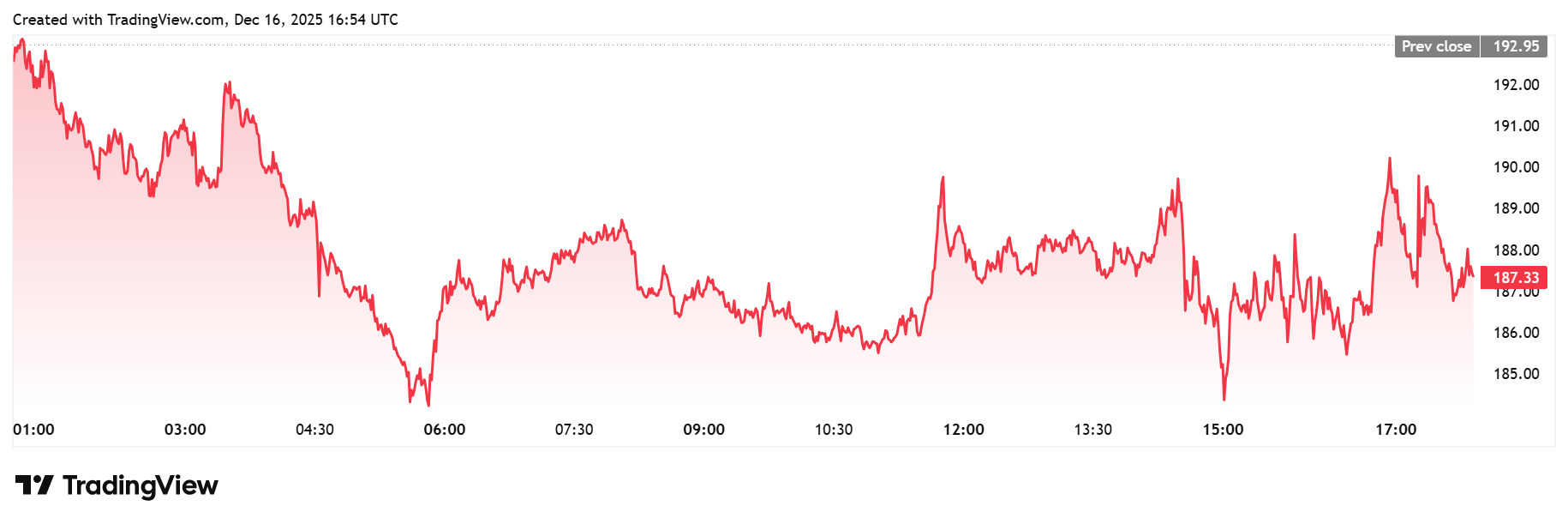

TradingView data shows the DeFi token is trading at around $188, down almost 3% in the last 24 hours. The token had dropped to as low as $185 on the day amid the recent crypto market crash.

Source: https://coingape.com/u-s-sec-ends-four-year-investigation-into-aave-amid-ongoing-dao-saga/