- The U.S. explores digital dollar integration to maintain its financial hegemony.

- Li Jiange calls for RMB internationalization and digital currency advancement.

- Market reactions focus on regulatory impacts on stablecoins and DeFi.

PANews reports that the U.S. is delving into incorporating a digital dollar into its economy, with efforts noted by Li Jiange on June 15. The move aims to integrate digital currencies within regulatory frameworks to align with U.S. national interests and its global economic leadership.

The strategic adoption of the digital dollar by the U.S. seeks to transition from historical gold and petrodollar systems to a blockchain-based currency. This approach aims to bring digital assets under compliance oversight, aligning them with U.S. financial dominance objectives. The changes will impact stablecoins like USDT and USDC, as well as Ethereum (ETH) and Bitcoin (BTC). The regulatory clarity expected could influence liquidity flows and investment patterns globally.

U.S. Digital Dollar to Reshape Financial Hegemony

Former China Securities Regulatory Commission vice chairman, Li Jiange, highlights the U.S.’s strategic adoption of a digital dollar. Li emphasizes that China should accelerate RMB internationalization, boosting its financial stance globally. According to Li Jiange, “we should have a deep understanding of the evolution of the dollar anchor and actively adjust the financial strategy… For China, it should accelerate the internationalization of the RMB, improve the financial market system, and promote the research and development and application of digital currency.”

Market responses have been notably reactive, with Li urging Chinese policymakers to adapt swiftly in light of U.S. actions. As these developments unfold, major digital platforms and industry leaders are carefully observing the potential shifts in compliance requirements. For additional context on financial globalization, refer to the assessment of financial globalization and its implications on economies.

Market responses have been notably reactive, with Li urging Chinese policymakers to adapt swiftly in light of U.S. actions. As these developments unfold, major digital platforms and industry leaders are carefully observing the potential shifts in compliance requirements.

Blockchain Transition: Implications for Global Markets

Did you know? The transition to a U.S. digital dollar marks the fourth major shift in the dollar’s anchor mechanism since the 20th century.

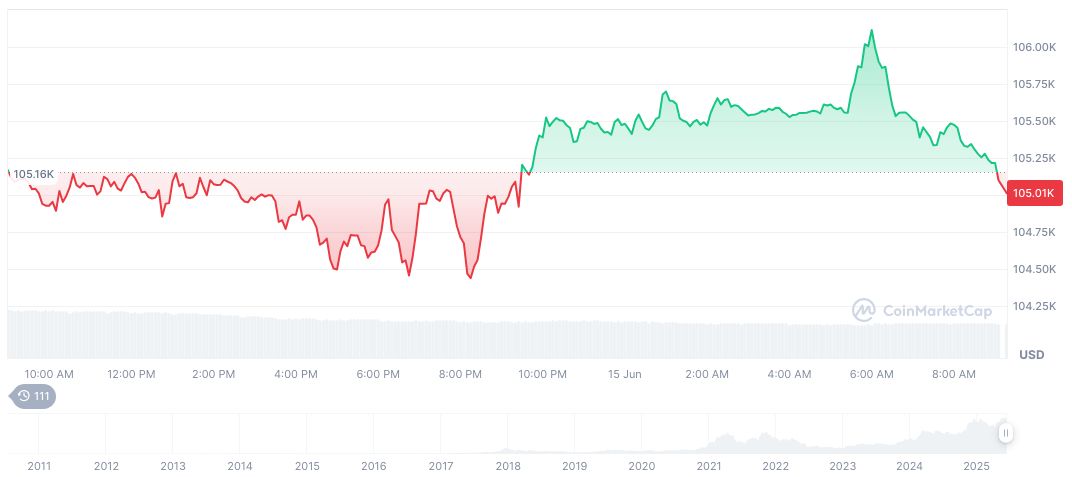

Bitcoin’s current price stands at $105,169.38, with a market cap of $2.09 trillion and a 24-hour trading volume of $34.77 billion, down 27.81%. Recent data from CoinMarketCap shows a 0.15% price increase over the past day and a 26.13% rise over the last 90 days.

Coincu analysts suggest that this integration could redefine digital currency frameworks globally. The move to a digital dollar may propel new levels of technological innovation, reshaping financial markets and regulatory practices. The strategic alignment with blockchain technology is expected to bolster U.S. monetary influence in the digital economy landscape. For insights into how monetary policy impacts economic stability, review this analyzing the impact of monetary policy report. For more insights, see how the Ethereum Pectra Upgrade advances with Sepolia.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/343402-us-explores-digital-dollar/