- Major financial institutions project significant U.S. job growth revisions, influencing potential Federal Reserve actions.

- Anticipated labor data revisions may lead to rate cut speculations.

- Crypto markets could see volatility amid macroeconomic shifts.

Economists predict a significant revision in U.S. job growth estimates, challenging current labor market perceptions as the Bureau of Labor Statistics releases new data on September 9, 2025.

Potential interest rate cuts loom, influencing both traditional financial markets and major cryptocurrencies like Bitcoin and Ethereum, amid concerns over labor market reliability.

U.S. Job Growth Figures Could See 1 Million Decline

A potential revision by the Bureau of Labor Statistics (BLS) could reveal job growth figures nearly 800,000 to 1 million below previous estimates. Economists from Wells Fargo, UBS, and others project substantial revisions. U.S. President Trump may express concern over the data’s accuracy. Anticipated revisions could weaken labor market perceptions, leading to Federal Reserve rate cut expectations. Major cryptos like Bitcoin and Ethereum could experience heightened volatility. Current reports indicate no official comments from BLS’s key figures, including William W. Beach, on this anticipated revision.

Labor market revisions often mark turning points for policy and risk assets. Watch for liquidity reactions in both TradFi and crypto post-benchmark adjustment.

“Labor market revisions often mark turning points for policy and risk assets. Watch for liquidity reactions in both TradFi and crypto post-benchmark adjustment.” — Raoul Pal, CEO, Real Vision

Crypto Markets Brace for Volatility Amid Labor Data Updates

Did you know? In past major downward labor revisions, market narratives have shifted swiftly, strengthening calls for Federal Reserve policy adjustments and significantly impacting cryptocurrency volatility.

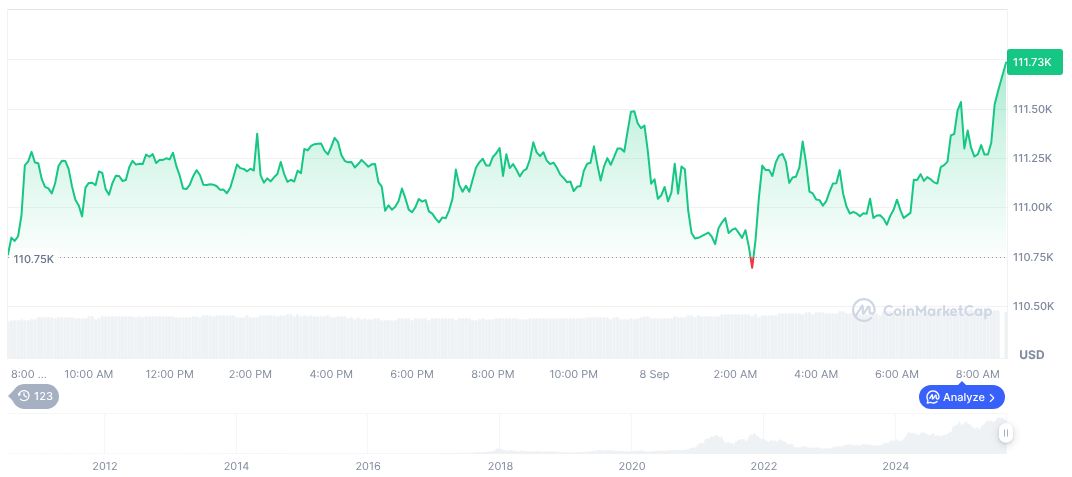

As of September 8, 2025, Bitcoin (BTC) remains priced at $112,131.85 with a market cap of 2.23 trillion USD and a 57.65% market dominance. According to CoinMarketCap, the 24-hour trading volume has increased by 17.47%, now standing at 30.04 billion USD. Over the past 90 days, BTC recorded a 2.49% gain. Coincu’s research team suggests potential financial market shifts are likely if employment data confirms a softening, offering a backdrop for Federal Reserve policy changes. Historical precedence indicates muted reactions in equity markets can often precede crypto volatility fluctuations.

For more information, jobs by category such as manufacturing and mechanical can provide insights into specific industry impacts.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/labor-market-revision-rate/