- U.S. labor market faces significant job data revisions affecting policies.

- Analysts expect potential Federal Reserve rate cuts.

- Crypto market anticipates positive asset flow amid policy shifts.

U.S. labor market data revealed drastic job losses for May and June 2025, triggering speculation of potential Federal Reserve rate cuts to counter economic challenges.

Market experts predict asset owners may gain while wage earners suffer, echoing post-pandemic trends as crypto and equities react to rate cut anticipation.

Crypto Markets React as Institutional Investments Grow

“When the Fed pivots and rate cuts approach, it’s party time for asset holders. History rhymes, expect risk asset pumps like 2021.” — Arthur Hayes, Co-Founder, BitMEX

Institutional investors are reportedly increasing their holdings in risk assets, a move possibly linked to expectations of Federal interest rate adjustments to counter rising inflation pressures.

Financial markets have reacted swiftly, with Bitcoin and Ethereum showing initial declines but potentially poised for gains if rate cuts are implemented. Significant signaling includes Raoul Pal’s caution about the economic impact on wage earners, with widened wealth disparities likely.

Historical Context, Price Data, and Expert Analysis

Did you know? Historical data shows that in past 20 instances of Fed rate cuts below 2%, the S&P 500 rose an average of 13.9% over the next year.

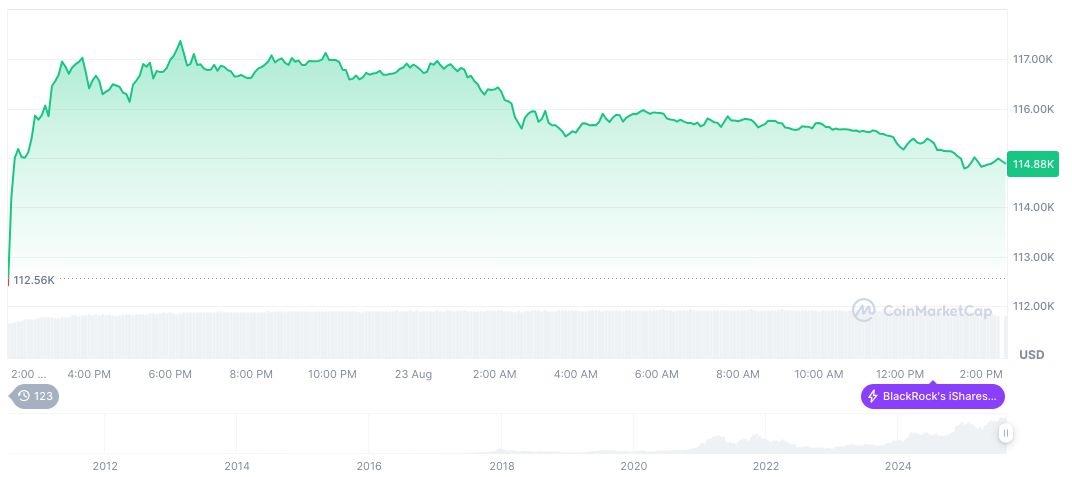

Bitcoin’s current value stands at $114,965.33 with a market cap of 2,289,039,725,824.75, based on CoinMarketCap figures. Despite a 0.82% decline over the past 24 hours, Bitcoin has experienced an 8.22% increase over the previous 60 days. It maintains a dominant role in the crypto market with a 57.33% share.

Expert insights from the Coincu team suggest that upcoming policy changes may drive further institutional interest in digital assets. This is particularly emphasized by BNB’s all-time high post-heavy acquisitions. Ethereum’s exchange activity could reverse if monetary policy becomes more accommodative, as indicated by past trends.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/us-labor-data-fed-rate-impact/