- Initial jobless claims surged by 27,000 to 263,000 last week.

- Signs of weakening U.S. labor market conditions observed.

- Impacts on cryptocurrency prices expected due to economic uncertainty.

United States initial jobless claims surged by 27,000 to 263,000 for the week ending September 6, 2025—marking the highest level since October 2021, signaling labor market challenges.

The sharp increase in jobless claims heightens concerns over a weakening labor market, potentially influencing Federal Reserve interest rate decisions and impacting cryptocurrency market sentiment.

U.S. Jobless Surge Shakes Economic Confidence

Initial jobless claims in the United States rose by 27,000 last week, reaching a total of 263,000, according to the U.S. Department of Labor (Employment and Training Administration Releases Update). This increase reflects the highest level since October 2021, marking a shift in the labor market landscape. Non-farm payroll revisions and a near-stagnant job growth highlight existing economic challenges.

The rise in claims suggests a deteriorating labor market, coinciding with decreased consumer confidence in job-finding prospects. The Federal Reserve is anticipated to implement a 25 basis point interest rate cut in response to these changes. This underscores the complex economic interplay that can affect broader market sentiments.

Noteworthy reactions include cautious market behavior, with significant shifts observed toward safer assets amid macroeconomic stress. Traditionally, similar scenarios have led to reduced investment in riskier cryptocurrencies and DeFi protocols, with Bitcoin and Ethereum closely watched in these times.

Cryptocurrency Markets React to U.S. Labor Data

Did you know? In October 2021, similar jobless claims jumps led to temporary declines in Bitcoin prices, illustrating the sensitivity of cryptocurrencies to U.S. labor market news.

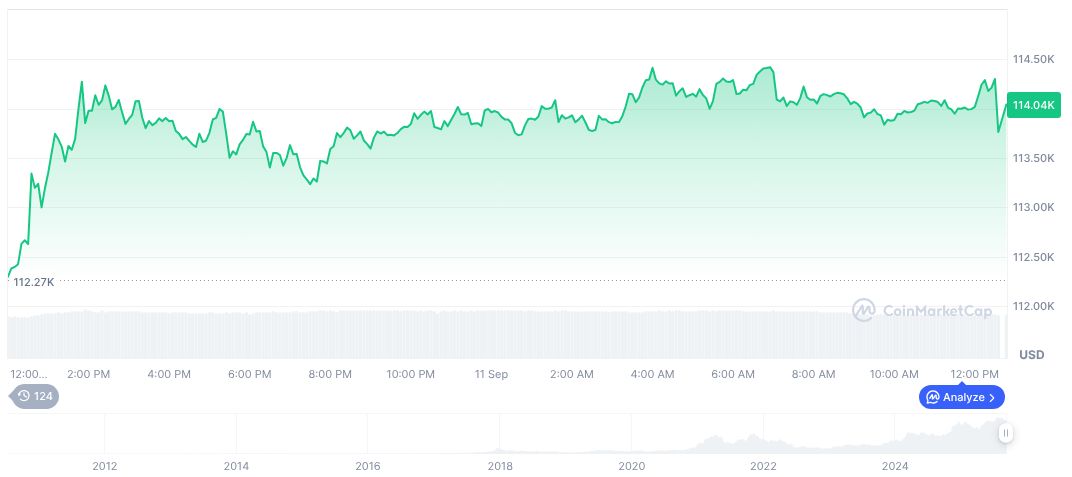

Bitcoin’s current price stands at $113,496.83, with a market cap of $2,260,794,830,881. Despite a slight 0.13% dip over 24 hours, its 90-day rise of 8.26% indicates resilience. Market dominance is pegged at 57.25%. Data from CoinMarketCap reveals a circulating supply of 19,919,453 coins, and a $50,276,702,940 trading volume, down 5.84%.

Coincu’s team highlights potential financial outcomes, emphasizing that market uncertainty could drive continued volatility in crypto asset prices. Historical data indicate that similar labor market disruptions have occasionally led to temporary decreases in TVLs of DeFi protocols, as investors shift focus towards stable and reliable assets.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/us-jobless-claims-cryptocurrency-impact/