- The potential U.S. government shutdown may delay a crucial employment report.

- Delays heighten risk for Federal Reserve’s monetary policy.

- Market uncertainty impacts cryptocurrencies and broader economic indicators.

The potential U.S. federal government shutdown threatens to delay the September employment report, pivotal for Federal Reserve policy decisions, amid growing economic uncertainty.

This delay may impact cryptocurrency volatility as macroeconomic data guides investor sentiment, disrupting usual market flows.

Shutdown Effects: Labor Data and Market Volatility

The U.S. Department of Labor has indicated through a contingency plan that a government shutdown would suspend all data collection and scheduled releases, including the vital September employment report. If Congress fails to pass a spending bill, agencies will follow these plans. The Bureau of Labor Statistics, responsible for compiling employment data, remains central to the developing situation. Should the shutdown persist, the Federal Reserve may lack key economic data before its October policy meeting, escalating monetary policy risks. The anticipated delay impacts financial markets, with potential increased volatility in assets like BTC and ETH due to macro policy ambiguity.

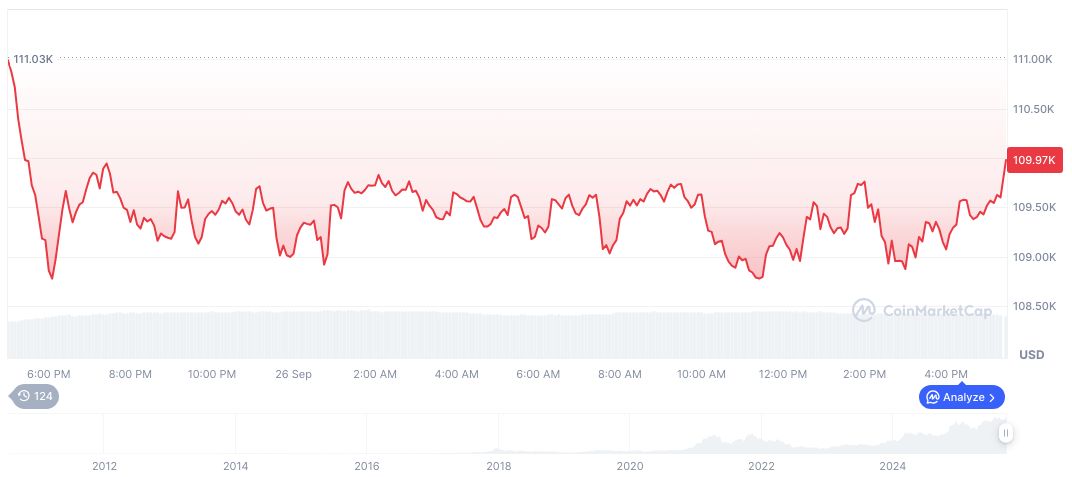

Bitcoin (BTC), as reported by CoinMarketCap, is currently priced at $110,277.33 with a market cap of $2.20 trillion and accounts for 57.81% market dominance. The cryptocurrency’s price is down 4.51% in the past week, highlighting ongoing market volatility since the shutdown threat emerged. Over the last three months, BTC prices have swung between -6.21% and up to 2.64%.

Did you know? Previous U.S. government shutdowns often sparked short-term market volatility, with economic sentiment and asset prices typically rebounding once resolutions were achieved.

“History suggests a compromise will likely restore stability and support a rebound in economic and market sentiment. While headlines may drive short-term volatility, long-term investors focused on fundamentals have typically been rewarded,” remarked a Northern Trust Analyst. Cryptocurrency market experts predict temporary liquidity shifts during shutdowns, notably affecting DeFi protocols and governance tokens. As the situation evolves, financial analysts underscore the importance of maintaining focus on economic fundamentals amid unfolding events.

Cryptocurrency Response and Historical Market Trends

Did you know? Previous U.S. government shutdowns often sparked short-term market volatility, with economic sentiment and asset prices typically rebounding once resolutions were achieved.

Bitcoin (BTC), as reported by CoinMarketCap, is currently priced at $110,277.33 with a market cap of $2.20 trillion and accounts for 57.81% market dominance. The cryptocurrency’s price is down 4.51% in the past week, highlighting ongoing market volatility since the shutdown threat emerged. Over the last three months, BTC prices have swung between -6.21% and up to 2.64%.

“History suggests a compromise will likely restore stability and support a rebound in economic and market sentiment. While headlines may drive short-term volatility, long-term investors focused on fundamentals have typically been rewarded,” remarked a Northern Trust Analyst. Cryptocurrency market experts predict temporary liquidity shifts during shutdowns, notably affecting DeFi protocols and governance tokens. As the situation evolves, financial analysts underscore the importance of maintaining focus on economic fundamentals amid unfolding events.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/us-shutdown-employment-report-delay/