- Federal Reserve Governors advocate for rate cuts due to weak labor market data.

- Revised payroll numbers from previous months highlight economic concerns.

- Cryptocurrency market anticipates gains from dovish monetary policies.

On August 1, 2025, U.S. Federal Reserve governors Michelle Bowman and Christopher Waller opposed maintaining interest rates, highlighting labor market weakness, which impacted U.S. Treasury yields and the dollar.

Their dissent and revised nonfarm payroll data suggest potential rate cuts, historically influencing cryptocurrency markets by increasing dollar liquidity and impacting BTC and ETH prices.

Cryptocurrency Market Eyes Fed’s Dovish Stance for Gains

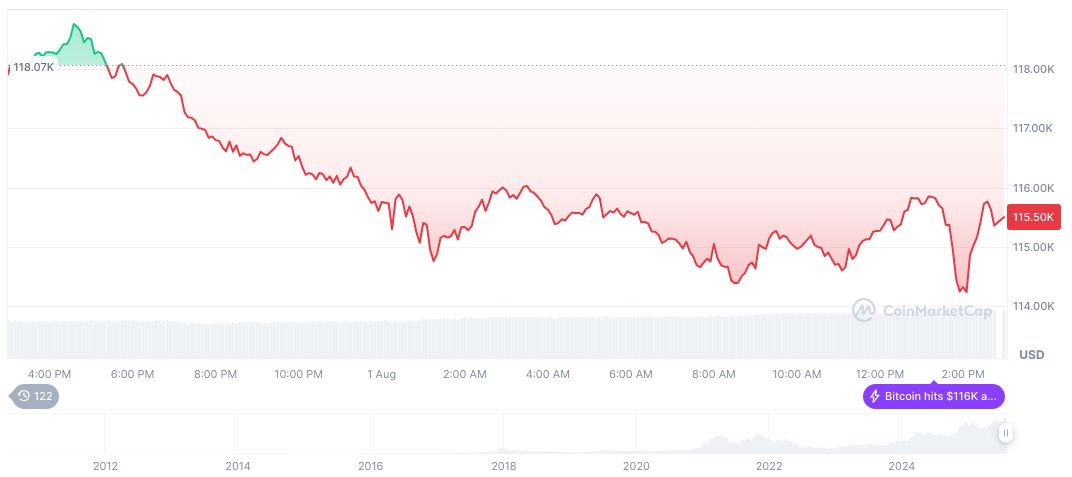

Bitcoin (BTC) stood at $115,570.24, with a market cap of $2.30 trillion, dominating 61.08% of the cryptocurrency market. Trading volumes reached $90.41 billion, marking a 29.19% change.

After a 1.98% decline in the past 24 hours, BTC had gained 0.52% over 7 days and 19.88% over 90 days, according to CoinMarketCap. Coincu research provides insights into potential outcomes, highlighting the historical BTC price trends associated with more accommodative policy stances from central banks. Looser monetary policies have historically driven investor interest in digital assets, resulting in positive price actions amidst evolving economic narratives.

Community reactions have been mixed, with some analysts expressing optimism about the potential for growth in the cryptocurrency market, while others caution against the volatility that can accompany such policy shifts.

Market Insights and Future Predictions

Did you know? Historically, periods of low interest rates have led to significant increases in cryptocurrency investments as investors seek higher returns.

The current trading volume and market cap of Bitcoin suggest a robust interest in the asset, with analysts predicting continued volatility as the Fed’s policies evolve.

Experts suggest that the Fed’s dovish stance could lead to a bullish trend in cryptocurrencies, especially if labor market conditions do not improve in the near future.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/fed-rate-cuts-revised-labor-data/