- Main event, leadership changes, market impact, financial shifts, or expert insights.

- Geopolitical rumors influence crypto focus significantly.

- Potential U.S. action against Iran affects investor sentiment.

Information has emerged regarding possible U.S. military plans targeting Iran, specifically the Fordow nuclear facility, potentially this weekend. Speculation arises about how this might influence market dynamics.

Market participants assess possible ramifications on cryptocurrencies’ volatility, driven by rumors of U.S.-Iran tension. The situation also coincides with the upcoming “Crypto 2025” event.

Potential U.S. Action Against Iran Spurs Crypto Volatility

Reports indicate the United States may target Iran’s Fordow nuclear facility this weekend, according to Jin10 data and several foreign media. This information prompted reactions considering potential geopolitical impacts. Analysts and the crypto community are speculating on the consequences for market volatility.

Join OKX and explore cryptocurrency trading opportunities include heightened volatility in cryptocurrencies, particularly in assets like Bitcoin and Ethereum. Investors often turn to these as hedges during geopolitically charged scenarios. These developments may create broader discussions about potential regulatory or institutional impacts on global finance.

Market participants and community channels anticipate that the ChainCatcher ‘Crypto 2025’ event will shape perspectives on regulation and scalability, but no major GitHub activity or developer communications have been publicly linked to either the conference or broader market shocks.

Cryptocurrency and Regulatory Insights Amid Geopolitical Uncertainty

Did you know? Historical geopolitical tensions have sometimes triggered increased interest in Bitcoin, often viewed as a “digital gold” hedge amidst uncertainty.

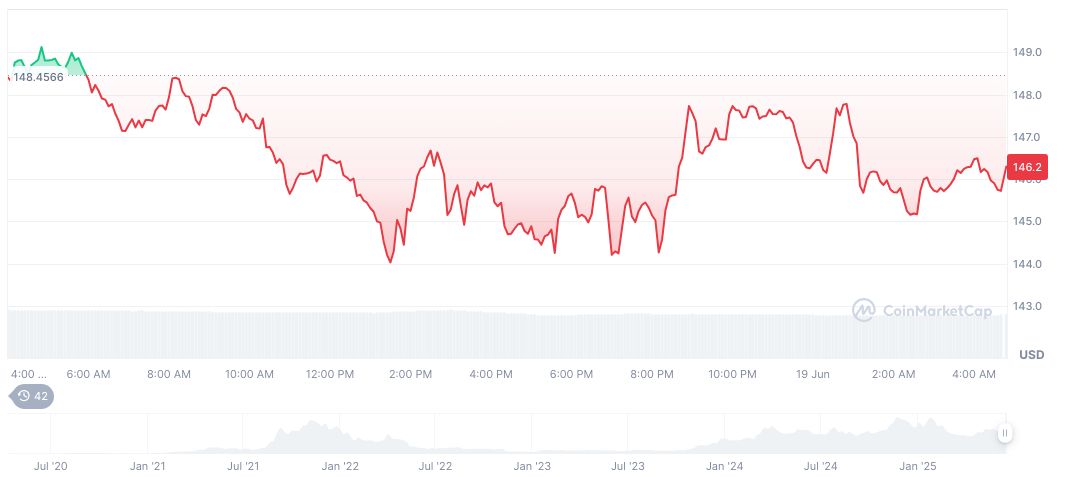

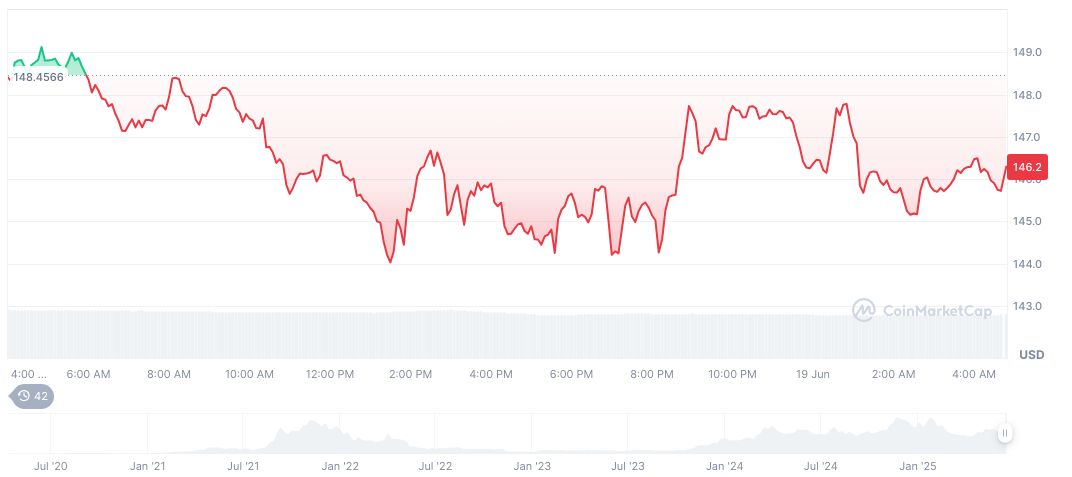

As of June 19, 2025, Solana (SOL) is trading at $145.31 with a market cap of $76.72 billion. Current market dominance is 2.36%, based on data from CoinMarketCap. Recent trends show a 1.88% decrease over 24 hours, while overall performance shows fluctuations, including a 13.37% rise over the last 90 days.

Insights from the Coincu research team suggest that investors should watch regulatory developments closely. Long-term, the potential collaboration and dialogues at events like ChainCatcher’s “Crypto 2025” event may influence regulatory clarity and investor strategies. The team’s analysis underscores the mix of ongoing speculative sentiment and strategic industry plans amid geopolitical uncertainties.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/344217-us-iran-defense-crypto-impact/