- U.S. weighs extending tariff suspension amid global trade talks.

- Short-term relief expected in financial markets.

- No immediate crypto disruptions linked to tariff news.

Treasury Secretary Besent announced on June 12 that the U.S. may extend the 90-day tariff suspension for partners negotiating in good faith, stated in a hearing before the House Ways and Means Committee in Washington.

This potential extension aims to reduce trade uncertainty and stabilize markets. Market response has been calm, with no direct crypto impact reported.

U.S. Evaluates Extending Tariff Suspension Amid Key Trade Talks

U.S. Treasury Secretary Besent stated that the Trump administration might lengthen the tariff suspension, initially set for 90 days, beyond the July 9 deadline. The decision depends on whether major U.S. trade partners negotiate in good faith. The announcement came during a hearing at the House Ways and Means Committee, signaling an open stance amid complex global negotiations.

This development offers temporary market relief by reducing trade uncertainties. Analysts suggest such market-friendly gestures help stabilize trading conditions, supporting broader economic dynamics. The potential extension aims to facilitate continued dialogue with the 18 key trading partners mentioned by Besent, promoting ongoing negotiations without immediate financial disruption.

Market participants reacted cautiously. While stablecoin assets like USDT and USDC remain intricately tied to U.S. Treasury markets, the news did not trigger notable volatility. Analysts like Michaël van de Poppe view the broader economic climate positively, reflecting a bullish sentiment for digital assets given current stable macro conditions. As van de Poppe noted, “Bitcoin’s recent breakout above the $106,500 resistance level triggered a swift move to $108,000, followed by a rapid retest that was aggressively bought up… confirming upward momentum in the current Bitcoin trend.”

Market Stability Despite Tariff Policy Speculation

Did you know? Previous tariff suspensions often led to interim periods of market calm, only to be followed by pronounced volatility upon deadline expiration or negotiation breakdowns, showing markets’ sensitivity to policy timelines.

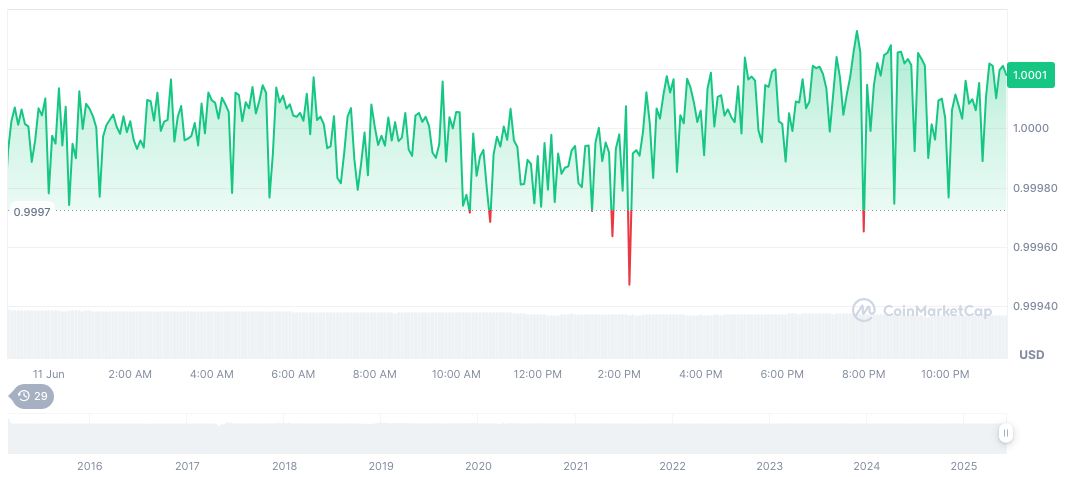

Tether USDt (USDT) holds a market cap of $155.20 billion and shows price stability with unchanged value at $1.00, reflecting a 0.00% price change over 24 hours (CoinMarketCap). The 24-hour trading volume decreased by 9.50%, aligning with maintained market stability amid current macroeconomic trends.

Coincu research indicates that while crypto markets remain stable, future regulatory or financial shifts linked to tariff policies could affect crypto liquidity.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/342770-us-tariff-suspension-extension/