- China and the U.S. reach trade agreement de-escalating tensions.

- U.S. stock indexes rally; S&P 500 gains momentum.

- Market awaits impact of Moody’s potential downgrade.

China and the United States recently agreed on a trade deal effective May 12, 2025, temporarily reducing tariffs and easing trade tensions. The agreement aims to enhance market stability and investor confidence, although it remains a short-term measure with a 90-day tariff reduction.

The U.S.-China trade agreement includes a 115% tariff reduction on goods from both countries. Officials are closely monitoring the changes, with discussions focused on sustaining economic connections. Modification of reciprocal tariff rates with China discussed. The temporary nature of the deal calls for further negotiations as the 90-day period progresses. Markets responded favorably, with the S&P 500 rising positively and other major indexes following suit. Wall Street sentiment benefited from the agreement’s announcement, although concerns about the Moody’s U.S. credit rating downgrade persist.

U.S.-China Deal Slashes Tariffs by 115%

President Donald J. Trump, President of the United States, stated, “This trade agreement is a significant step towards rebuilding the trust and cooperation that our two countries need,” – Source: White House Briefing Statement

Bitcoin Trading and Market Expert Opinions

Did you know? The U.S.-China trade deal resulted in a notable 90-day tariff reduction, similar to past short-lived agreements. These often boost markets temporarily but need extensive follow-ups to sustain long-term benefits.

Bitcoin Trading and Market Expert Opinions

Did you know? The U.S.-China trade deal resulted in a notable 90-day tariff reduction, similar to past short-lived agreements. These often boost markets temporarily but need extensive follow-ups to sustain long-term benefits.

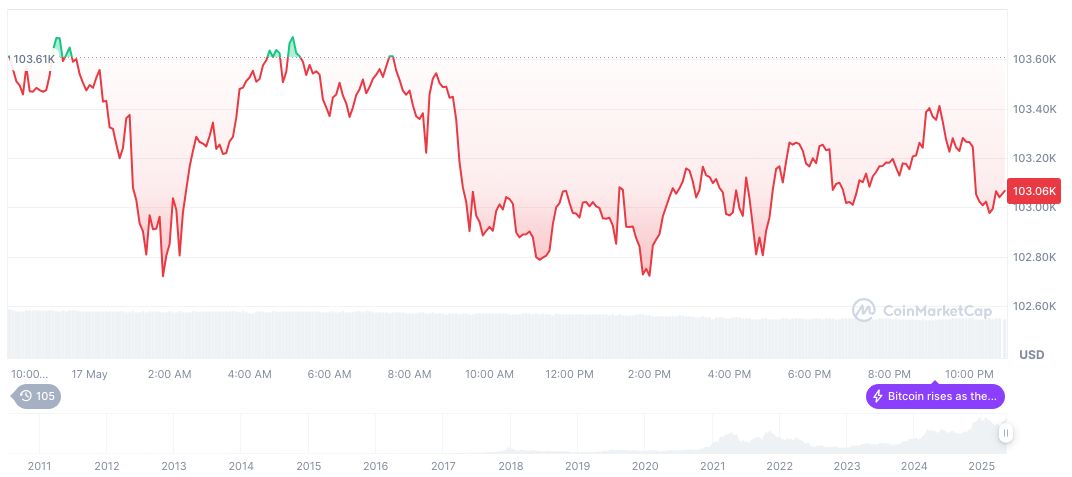

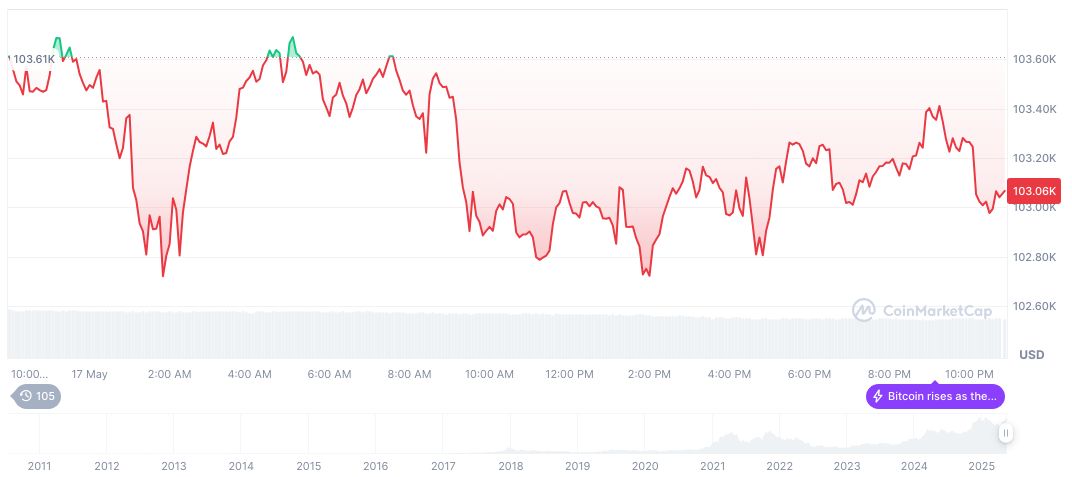

Bitcoin (BTC) is trading at $103,905.31 with a market cap of $2.06 trillion, down 0.53% over the last week. According to CoinMarketCap, its circulation nears 19.87 million with a max supply of 21 million. Recent gains include a 24-hour price change of +1.07%.

The Coincu research team indicates the trade deal may positively influence both financial and regulatory landscapes. However, experts recommend cautious optimism, stressing that ongoing U.S.-China discussions are vital for stability.

Source: https://coincu.com/338262-us-china-trade-market-gains/